As profit margins have continued to shrink, mortgage lenders have been seeking to utilize technology to reduce their production expenses which involve in part transmitting large volumes of data among several interconnected parties such as consumers, investors, service provider, and others. In an article in the Fannie Mae Perspectives blog the company's Vice President for Digital Products, Prabhakar Bhogaraju, writes that "Businesses are increasingly leveraging digital technologies to reduce errors and costs, transact faster, and drive a richer and better customer experience. Over the past few years, technological advancements such as artificial intelligence, APIs, and document digitization have gained traction, enabling digital transformation."

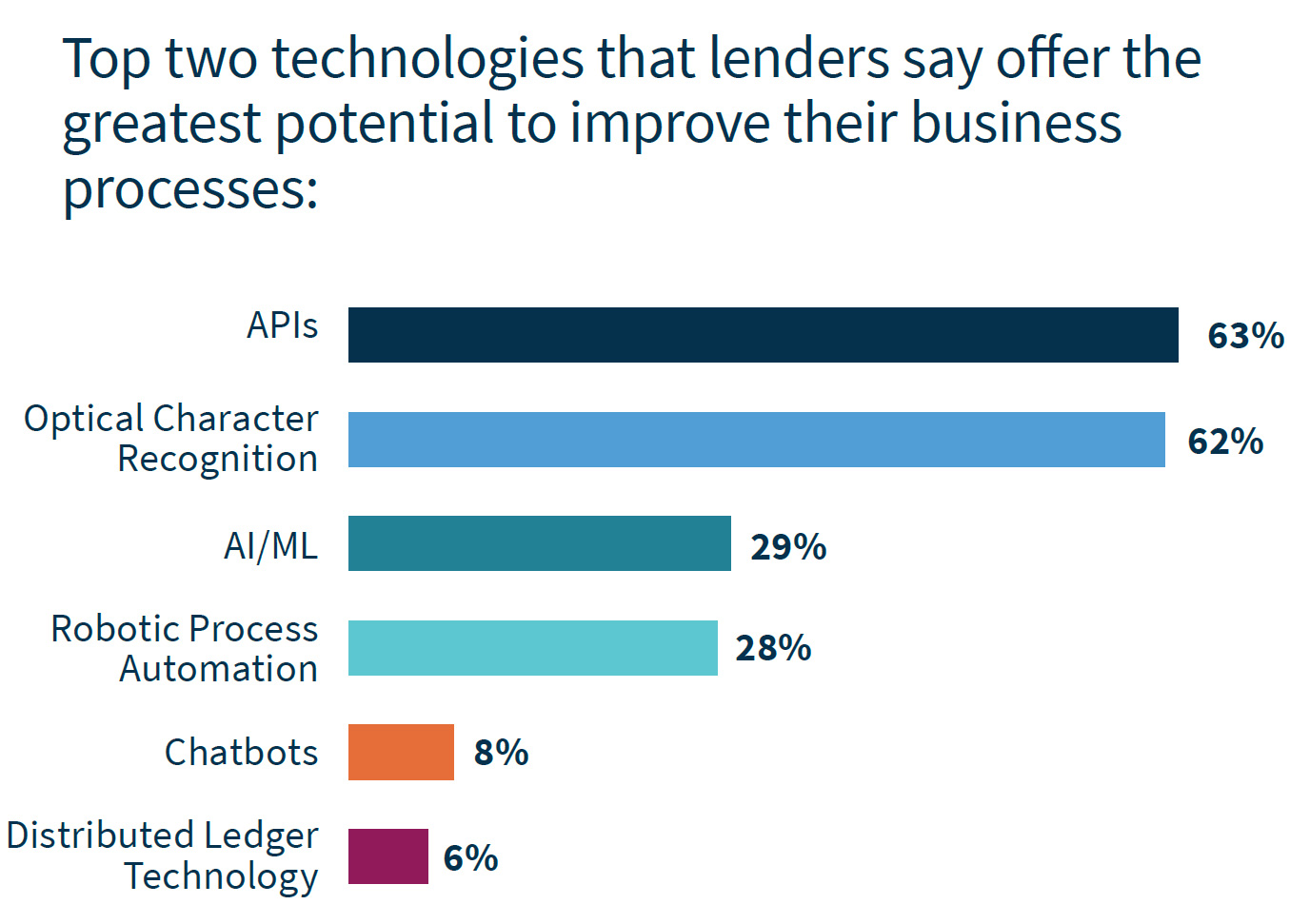

Fannie Mae's Q1 2019 Mortgage Lender Sentiment Survey (MLSS) asked respondents about this transition and identified two pieces of technology lenders saw as having the greatest potential to help improve or streamline mortgage processes. These were optical character recognition (OCR) which is fairly self-explanatory, and Application Programming Interface (API), which to our non-technical mind, is not. API is a software intermediary that allows two applications to talk to each other. If you click on a link to Facebook or check the stock market on your phone, you are using an API. Some companies have developed their own software to perform this function, others rely on those of third-party vendors.

Fannie Mae asked lenders about their criteria for adopting a third-party API and how strong their interest is in various API ideas. Nearly two-thirds of lenders selected APIs and OCR as the two technologies of greatest interest. They were also the technologies reported to be most likely to be rolled out more broadly by lenders in the next two years.

Ease of technology integration was cited by 47 percent of lenders as the most important criterion in deciding whether to adopt a third-party API. To this end, lenders indicated that the GSEs, Fannie Mae and Freddie Mac could help set clear industry standards, provide guidance on best practices, and create user-friendly environments.

The second most important criterion in choosing whether to adopt a third-party API was whether it would make the lender more competitive. For example, be a way for a lender to a differentiated customer experience and a competitive advantage. Forty-one percent of lenders thought this was important.

Among the various API ideas suggested to lenders, an API to verify borrower qualification was the most appealing to lenders, followed by an API to obtain appraisers' property appraisal value and comparables.

While lenders think APIs and OCR have the potential to help reduce costs and improve customer experience, Bhogaraju says previous research has shown that difficulties with integration and the cost of the investment are barriers to adoption. "Identifying the benefits that justify technology investments may not be easy since the impacts are often multi-layered and include a mix of direct and indirect benefits. For example, the better customer experience achieved through APIs and OCR may lead to increased referrals or subsequent refinance or purchase loan business, which may save on costs and create brand preference," he writes.

Use of the two technologies may also yield fewer mistakes, less rework, and an ability to translate fixed labor costs into variable costs, allowing a business to scale capacity up or down as the market expands or contracts. The author says in order to properly justify investments in technology lenders should consider the indirect benefits, including time savings and customer goodwill, in addition to the more direct cost savings.