The Administration's Housing Scorecard for April claims progress on both home sales and mortgage delinquencies "but continued fragility overall." Delinquencies have now declined for four straight months and sales of existing homes in the first quarter of the year were 5.3 percent higher than in the same period in 2011.

The Scorecard is essentially a summary of data on housing and housing finance released by public and private sources over the previous month and/or quarter. Most of the data such as new and existing home sales, permits and starts, mortgage originations, and various house price evaluations have been previously covered by MND.

The Housing Scorecard incorporates by reference the monthly report of the Home Affordable Modification Program (HAMP) and related remediation programs. Through March HAMP has facilitated 990,000 permanent first lien modifications since it began in April 2009. These modifications have saved homeowners an estimated $12.2 billion in monthly mortgage modifications - an average of $535 per month.

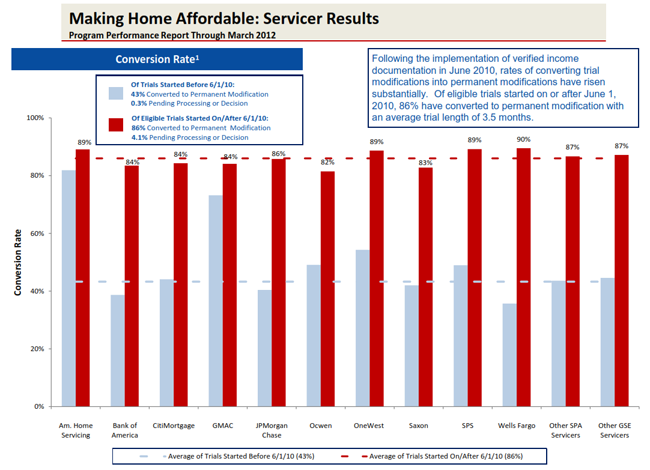

During March there were 20,940 trial modifications started and 19,940 trials converted to permanent status. Since the program began there have been over 2 million trial modification offers extended to borrowers and 1,830,000 homeowners who entered into trials. There are 68,630 active trials and the average trial length is now 3.5 months compared to trials nearly three times that length earlier in the program.

Eight of the 12 largest servicers participating in the HAMP program have now reached the goal of an 85 percent trial to permanent modification conversion rate. The four which have not are still above an 80 percent rate.

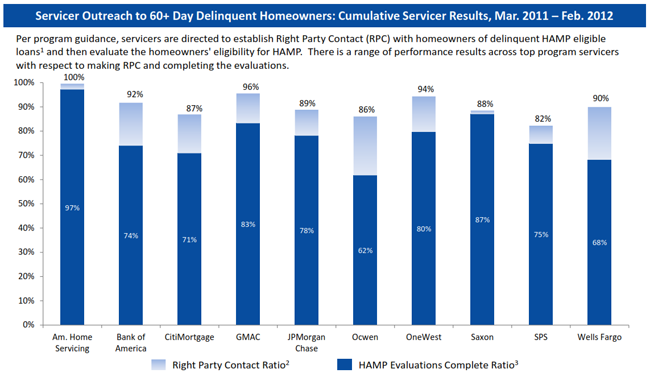

Servicers also continue to improve in the manner in which they contact delinquent borrowers and complete initial HAMP evaluations. All servicers are now above an 85 percent success rate in making contact with the right party according to program guidelines and most have at least a 75 percent success rate in completing the evaluations

There are a variety of other foreclosure prevention programs run under the HAMP mantle. Here is the most recent data on several of them.

The Principal Reduction Alternative (PRA) program run under HAMP has been at the center of considerable controversy in recent weeks as the Federal Housing Finance Agency, one of two sponsors of HAMP, refuses to allow Freddie Mac and Fannie Mae (the GSEs) to participate in principal reductions despite considerable pressure from Congress and the other HAMP sponsor, the Treasury Department. Even without the availability of GSE loans to the program there have now been 77,640 PRA trial modifications started, 52,243 of which have been converted to permanent modifications. The median principal reduction is $69,083, a median of 31.4 percent of the outstanding principal balance before modification.

The Second Lien Modification Program (2MP) has started modifications on 76,218 junior liens. There have been 16,599 second liens fully extinguished and 57,097 modified. The median lien amount of extinguished loans is $61,355 and the median modification is $7,027.

Another program run under the auspices of HAMP is the Home Affordable Foreclosure Alternatives or HAFA which facilitates short sales and deeds-in-lieu of foreclosure as alternatives to foreclosure. To date there have been 40,252 HAFA transactions completed, almost all short sales. HAFA completions were largely accomplished with privately held loans (26,660); portfolio loans accounted for 10,994 HAFA transactions and GSEs loans for 2,600.

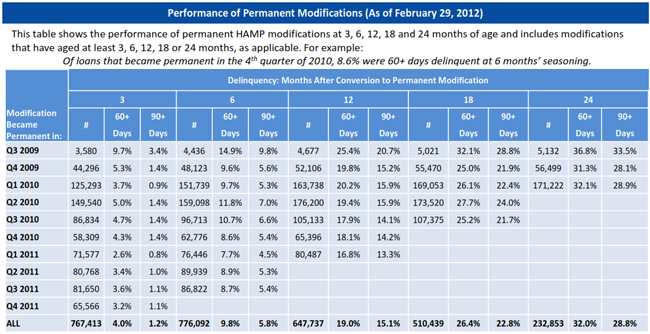

Modified loans are still performing better than is usually the case. Even among the oldest of the modifications the serious delinquency rate is 33.5 percent after two full years. The performance of the modifications has improved over time as can be seen in the table below.