The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending April 30, 2010.

Michael Fratantoni, MBA's Vice President of Research and Economics says:

"Purchase application activity continued to increase in the last week of the homebuyer tax credit program...Purchase applications were up 13 percent over the previous week and almost 24 percent over the last month, driven by significant increases in both conventional and government purchase applications. We also saw the Government share of applications for purchasing a home increase to over 50 percent of all purchase applications last week, which is the highest in two decades."

The survey covers over 50 percent of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. This data gives economists a look into consumer demand for mortgage loans. A rising trend of purchase mortgage applications indicates an increase in home buying interest, a positive for the housing industry and the economy as a whole.

From the Release....

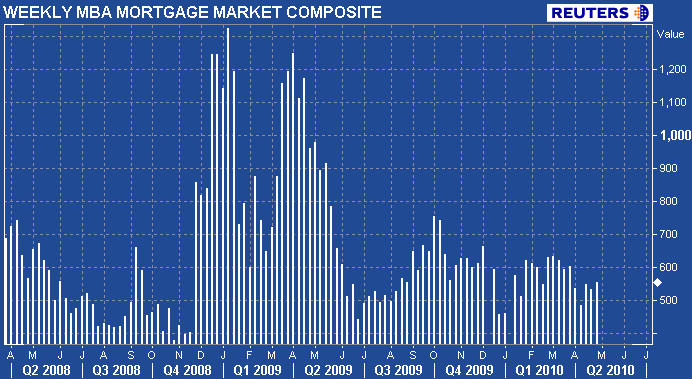

The Market Composite Index, a measure of mortgage loan application volume, increased 4.0 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 5.1 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is up 0.9 percent.

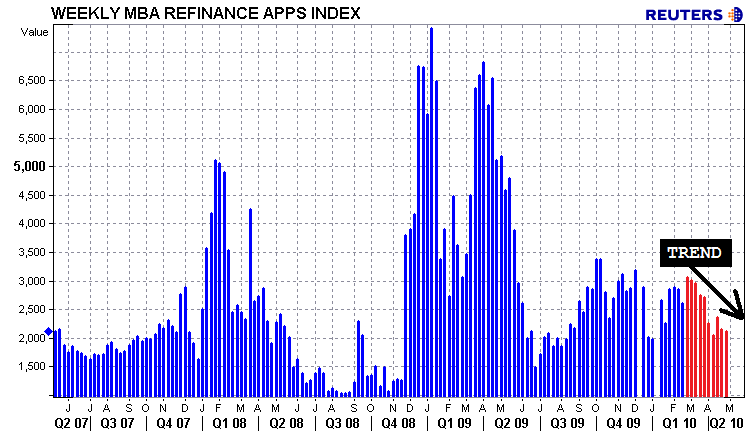

The Refinance Index decreased 2.1 percent from the previous week. The four week moving average is down 1.5 percent. The refinance share of mortgage activity decreased to 51.9 percent of total applications from 55.7 percent the previous week. This is the lowest refinance share observed in the survey since the week ending July 3, 2009.

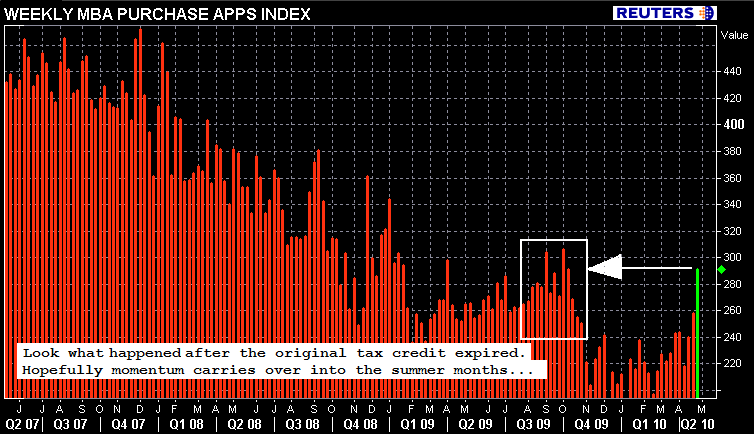

The seasonally adjusted Purchase Index increased 13.0 percent from one week earlier. The four week moving average is up 5.0 percent for the seasonally adjusted Purchase Index. This is the third consecutive weekly increase in purchase applications and the highest Purchase Index recorded in the survey since the week ending October 2, 2009.

The Conventional Purchase Index increased 9.4 percent from the

previous week while the Government Purchase Index increased 16.7

percent. The unadjusted Purchase Index increased 14.1 percent

compared

with the previous week and was 10.3 percent higher than the same period

one year ago.

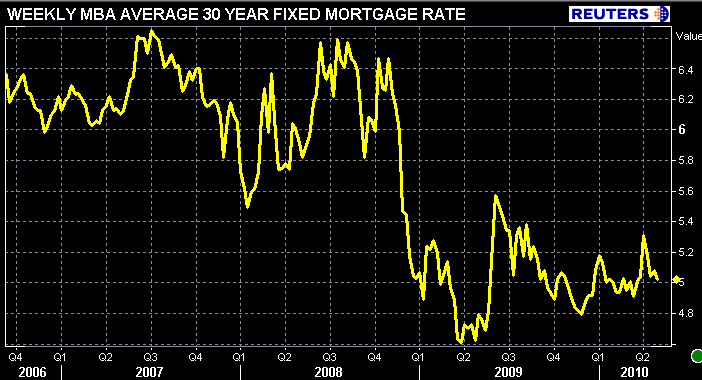

The average contract interest rate

for 30-year fixed-rate mortgages decreased to 5.02 percent from 5.08

percent, with points increasing to 0.92 from 0.91 (including the

origination fee) for 80 percent loan-to-value (LTV) ratio loans. The

effective rate decreased five basis points from last week.

The

average contract interest rate for 15-year fixed-rate mortgages

decreased to 4.34 percent from 4.38 percent, with points decreasing

to

0.80 from 0.93 (including the origination fee) for 80 percent LTV

loans. The effective rate decreased six basis points from last week.

The

average contract interest rate for one-year ARMs remained unchanged at

7.03 percent, with points decreasing to 0.28 from 0.30 (including the

origination fee) for 80 percent LTV loans. The adjustable-rate mortgage

(ARM) share of activity increased to 6.3

percent from 6.0 percent of total applications from the previous week.

The homebuyer tax credit officially expired on April 30, pending buyers have until the end of June to close on their contract. While most of these borrowers should have already submitted a loan app, there is the chance mortgage applications run higher in the weeks ahead as last minute buyers flip lenders, rate shop, and attempt to qualify elsewhere after an Approve/Ineligible or the dreaded Refer with Caution/IV. Plus there is the potential that "Shadow Buyers" boost demand. READ MORE ABOUT SHADOW BUYERS

Lawrence Yun, NAR chief economist at the NAR is cautiously optimistic...

“Clearly the home buyer tax credit has helped stabilize the market.

In the months immediately following the expiration of the tax credit, we

expect measurably lower sales,”

“Later in the second half of

the year, and into 2011, home sales will likely become self-sustaining

if the economy can add jobs at a respectable pace, and from a return of

buyer demand as they see home values stabilizing.”

THE TRUE TEST OF HOUSING's STABILIZATION WILL COME THIS SUMMER AND NEXT FALL

To play their part, mortgage professionals need good product (more 95% MI) and aggressive pricing aimed at creditworthy borrowers (reduction in certain LLPAs). Don't get your hopes too high for jumbo product though, the broad based resurgence of the non-agency mortgage market is still a ways off. Let's get the GSEs back on track first.

Consumers must pay close attention to their local market (realtor help) and start the loan application process early to avoid the potential for hangups in the underwriting process. READ MORE

The ducks are on the pond...now we gotta bring 'em home.