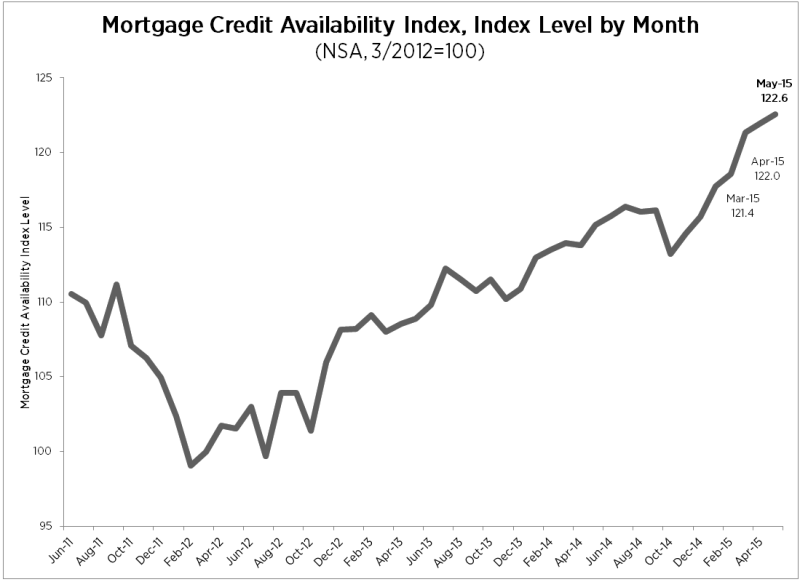

The availability of mortgage credit continued to rise in May the Mortgage Bankers Association (MBA) said today. Its Mortgage Credit Availability Index (MCAI) rose 0.5 percent from April to May and stands at 122.6. The index has increased by 4.8 points since the beginning of the year.

An increase in the index is an indication that credit is loosening while a decline means a tightening of lending standards. MBA bases its index, benchmarked to 100 in March 2012, on information from its lender members and data from Ellie Mae's AllRegs® Market Clarity® business information tool.

"Credit availability eased somewhat in May, largely as a result of increased availability of cash out refinance loans and greater availability of FHA 203K home improvement loans," said Mike Fratantoni, MBA's Chief Economist.

Of the four component indices, the Conventional MCAI and Conforming MCAI saw the greatest easing with both up 1.2 percent over the month. The Government MCAI, which includes FHA, VA, and USDA loan programs increased by 0.1 percent and the Jumbo MCAI decreased over the month (down 0.1 percent).