The S&P 500 has shed 63 points or 5.61% over the past month, including a 3.44% slide on Friday. As a new week gets underway, equity futures are basically flat.

One hour before the opening bell, Dow futures are up 1.00 point to 9,947 and S&P 500 futures are up 3.75 points to 1,069.75. The 2 year Treasury note is 2.4 basis points higher at 0.754% while the benchmark 10 year Treasury note yield is 2.7 basis points higher at 3.233%.

The July delivery NYMEX crude oil contract is up $0.02 to $71.53, and Gold futures are off $4.20 to $1,212.00

Meanwhile, the euro continues to weaken against the dollar. Overnight it fell to $1.1877, its lowest level since March 2006. Worse, the euro fell to 108.08 yen, the lowest since November 2001.

Markets on Friday sold off on a weak employment report. Prices worsened throughout the day on fears that Hungary ― which announced a larger-than-expected deficit ― is the next Greece.

Looking to the week ahead, some economists are anticipating the sell-off to continue.

“This week… look for more of the same, particularly as China is poised to release a truckload of economic indicators towards the end of the week for the month of May, which will roil markets far and wide if they indicate that activity, is slowing,” said economists at BMO Capital Markets.

“China has been implementing rather aggressive measures to cool growth, particularly in the property sector, so this should show up in the data,” they added. “Some reports suggest that officials have gone too far with their tightening measures. In any event, at this point in the recovery, slowing, even slightly, would be a bad thing.”

Key Events This Week:

Monday:

3:00 ― Consumer Credit is expected to expand by $1 billion in April. In March, credit increased by $2 billion, marking just the second monthly increase in the past 14 months. The expansion of credit is generally indicative of economic growth, suggesting that consumers are confident enough in the labor market to take on debt.

After last month’s report, economists at TD Securities emphasized that credit expansion remained too tight despite the most recent expansion.

“This underscores a major breach in the transmission of the stimulative monetary policy to the U.S. economy as the tighter credit conditions and weak demand continues to constraint the flow of credit, and if anything, it remains the Achilles’ heel for a sustained economic recovery in the U.S. On the whole, despite the improvement in the flow of credit in March, it appears that the deleveraging process in the U.S. private sector appears to be ongoing.”

Economists at Nomura Global Economics said they expect the latest increase to reverse in April, but the concede that the trend is improving.

“This report does not measure mortgage credit, however, which was the main factor behind the surge in credit growth before the recession and financial crisis,” they added.

Tuesday:

Treasury Auctions:

- 1:00 ― 3-Year Notes

Wednesday:

10:00 ― Wholesale Inventories in March rose for the third straight month with a 0.4% advance after the 0.6% gain in February. Wholesale sales have been also ticking up recently,rising by 2.4% in March and 1.2% in February. Both indicators point to broad economic momentum.

No consensus on economist’s forecasts were available, but analysts at Nomura predict a 0.6% gain in inventories.

“The ratio of inventories to sales in the wholesale sector is now quite low, and firms likely need to continue building stocks,” they wrote. “Moreover, wholesale inventories tend to move in line with factory-level inventories, and manufacturers built inventories during the month.”

10:00 ― Ben Bernanke, chairman of the Federal Reserve, will testify before the U.S. House Budget Committee about economic and financial conditions, and the federal budget.

2:00 ― The Federal Reserve’s Beige Book, an anecdotal summary of economic conditions released by each of the central bank’s 12 regional branches, is expected to continue in the vein of cautious optimism.

After the last report was issued mid-April, economists at BMO Capital Markets summarized it as: “Activity around the U.S. is improving, which is good news as it shows the recovery is spreading out. But the pace of recovery doesn't appear to be picking up much momentum and the same pockets of weakness remain.”

For this report, analysts at Nomura said the report should show overall expansion, albeit at a slow pace.

“We do not expect the report to use adjectives associated with accelerating or especially rapid growth,” they wrote. “We expect the report to say that the manufacturing sector continues to recover faster than other areas of the economy. Respondents are likely to indicate limited cost pressures, except for scattered increases in commodity prices.”

Treasury Note Auctions:

- 1:00 ― 10-Year Notes

Thursday:

8:30 ― The monthly deficit in the Trade Balance is expected to narrow ever so slightly in April. The average prediction among economists is a $40.0 billion gap, down from $40.4 billion in March; estimates range from $37.5 billion to $42 billion. In recent months, imports and exports have each been advancing, but imports have outpaced exports, in part due to petroleum prices, causing a wider deficit. That trend could change somewhat in April, as export volume is anticipated to be healthy, and import prices should be lower thanks the strength of the greenback.

“Aircraft exports were unusually low in March, while aircraft imports were unusually high, and we expect corrections this month that will help narrow the overall deficit,” said economists at IHS Global Insight. “In coming months, lower oil prices should help to bring the deficit down further, but in volume terms we think that import growth will be outpacing export growth as the swing in the U.S. inventory cycle sucks in imports, and that trade will be a drag on growth for the rest of the year.”

8:30 ― Initial Jobless Claims averaged 456k per week in May, lower than the 463k average in April but higher than the 448k average in March. For the first week of June, economists are predicting 453k new claims, or 53k above the level needed to indicate clear growth in the jobs market.

“The downtrend in initial jobless claims has stalled at around 450,000 ― a level historically consistent with large job losses,” said economists at Nomura Global Economics. “In today's labor market, however, we believe this level of claims is consistent with positive payroll growth. We expect the improvement in claims to remain very slow.”

2:00 ― The Treasury’s Budget Statement in May has averaged a deficit of $76.6 billion over the past 10 years and $100.3 billion over the past 5 years, according to Bloomberg News. For May 2010, economists predict a deficit of $140.0 billion, following a $82.7 billion gap in April.

Economists at Nomura predict an even worse budget deficit of $158 billion in the month, but note that even that is lower than May 2009’s $190 billion gap.

“Although outlays remain very high, daily tax receipt data from the Treasury suggest that revenues are improving,” they wrote. “Another cut in its debt issuance sizes for this week suggests the government is becoming increasingly confident about its ability to finance spending needs.”

Treasury Bond Auctions:

- 1:00 ― 30-Year Bonds

Friday:

Morning ― Narayana Kocherlakota, president of the Minneapolis Federal Reserve, speaks on entrepreneurship and the economy to the Metropolitan Economic Development Association in Minneapolis.

8:20 ― Charles Plosser, president of the Philadelphia Fed, discusses economic recovery and the role of the central bank before the Blair County Chamber of Commerce in Altoona, Penn.

8:30 ― The week’s top indicator, Retail Sales, could have mixed results for financial markets. The Street anticipates sales to advance by 0.4% in May, repeating the gain in April and following a 2.1% climb in March. Sales excluding autos, however, are expected to slow from +0.4% to +0.2%, indicating that the pick up isn’t so broad-based.

“A data release in line with our expectations would imply real consumer spending is tracking a +3.0 percent growth rate in Q2 2010 compared to +3.5 in the first quarter – assuming that weakness doesn’t permeate spending into June,” said Ellen Zentner from BTMU.

Analysts at IHS Global Insight added that motor vehicle sales probably advanced for a third consecutive month as unit sales of light vehicles increased from an annual rate of 11.2-million units to 11.6-million units.

For broader sales, however, they were more pessimistic.

“Excluding the automotive group, sales fell an estimated 0.4%, pulled down by a sharp drop in gasoline prices and a retreat in sales of building materials dealers. Sales at the latter channel surged 15.2% from February to April in response to federally funded, state-administered rebates on purchases of energy-efficient appliances. Since most of the rebate programs end when available funds are exhausted, their impact on appliance sales is expected to diminish in May and June.”

10:00 ― The first monthly look at Consumer Sentiment could show confidence in a bit of a rut. Economists at Nomura note that the Reuters / University of Michigan index “edged higher in late May despite renewed turmoil in financial markets,” but that in June the Eurozone crisis could have some negative impact.

Economists at IHS Global Insight added: “Weakening stock prices and doubts over the employment recovery should weigh down on sentiment. Low inflation, lower gasoline prices and lower mortgage rates should provide some offset.”

10:00 ― Business Inventories are anticipated to rise 0.5% in April following a 0.4% gain in March and a 0.5% advance in February. Inventories can play a major role in gross domestic product, so these continual and consistent advances bode well for the broader economy.

“Considering the very low level of inventories, stock building likely continued at all distribution levels,” said economists at Nomura.

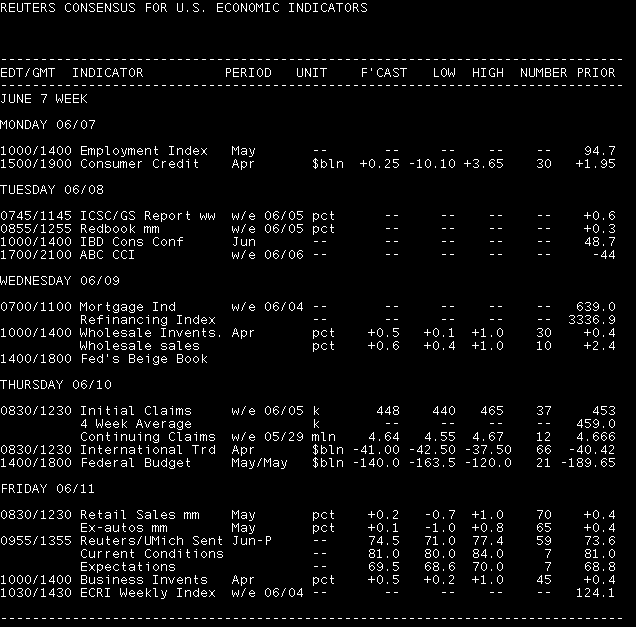

Below is a full recap of U.S. economic indicators and forecast ranges.