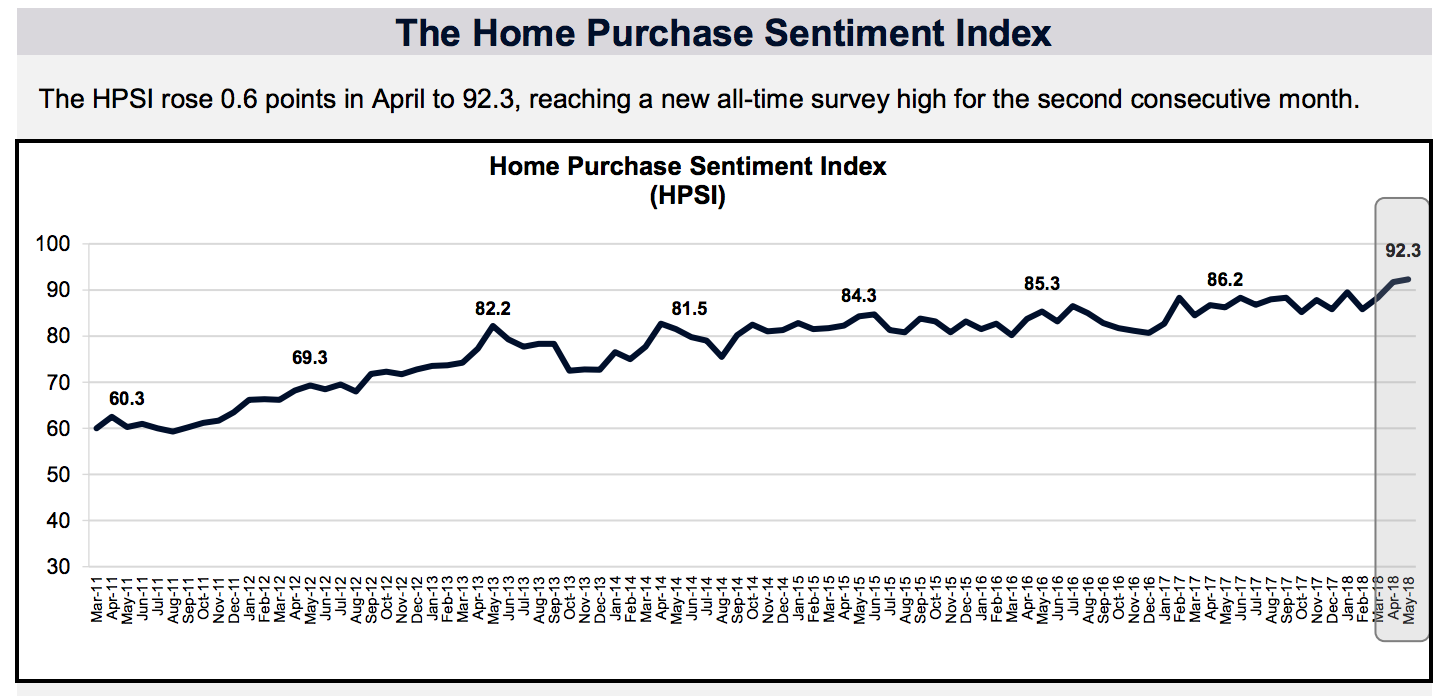

Despite declining consumer confidence about buying a home, Fannie Mae's Home Purchase Sentiment Index® (HPSI) hit a second consecutive survey high in May. The Index, which distills some of the responses from the National Housing Survey, rose 0.6 points to 92.3. In May 2017 the Index stood at 86.2.

However, the company says consumer attitudes about buying and selling a home have continued to diverge as home prices have increased. While the net share of respondents who reported that now is a good time to sell a home increased to 46 percent in May, and is now up 14 percentage points year over year, the net share who said now is a good time to buy a home decreased to 28 percent, showing little improvement year over year.

Three of the six elements of the HPSI increased from April and all were higher than a year earlier. In addition to the increase in consumers who say it is a good time to sell a home, more Americans reported they were confident about keeping their job, up 2 percentage points for the month and 7 points year-over-year, and that their household income had increased, a gain of 3 points on both a monthly and an annual basis.

The net share of consumers who said home prices will go up in the next 12 months remained unchanged at 49 percent, while the net share who expect mortgage rates to go down over the next 12 months fell 1 percentage point to a net negative of 49 percent.

While not among the responses that are included in the Index, the National Housing Survey® results also showed that the share of consumers who expect their personal financial situation to improve within the next year fell 6 percentage points to 48 percent, and those who expect it to stay the same rose 6 percentage points to 40 percent.

"The HPSI edged up to another survey high in May, bolstered in part by a fresh record high in the net share of consumers who say it's a good time to sell a home. However, the perception of high home prices that underlies this optimism cuts both ways, boosting not only the good-time-to-sell sentiment but also the view that it's a bad time to buy, and presenting a potential dilemma for repeat buyers," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "For the survey's renter respondents, who are unable to reap benefits from selling a home, the HPSI has been essentially flat in the first quarter, during which home sales were also lackluster. According to our latest Mortgage Lender Sentiment Survey®, which we expect to release on Tuesday, lenders expect mortgage demand to soften in the near term."

The Home Purchase Sentiment Index (HPSI) converts information about consumers' home purchase sentiment from six NHS questions into a single number. The HPSI reflects consumers' current views and forward-looking expectations of housing market conditions and complements existing data sources to inform housing-related analysis and decision making.

The NHS is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. Respondents are asked more than 100 questions to track attitudinal shifts. The May survey was conducted between May 1 and May 22, 2018.