Last week the Mortgage Bankers Association said that independent mortgage bankers had reported negative production revenue in the first quarter of this year. This week Fannie Mae reminded us that lenders have long expected it to happen.

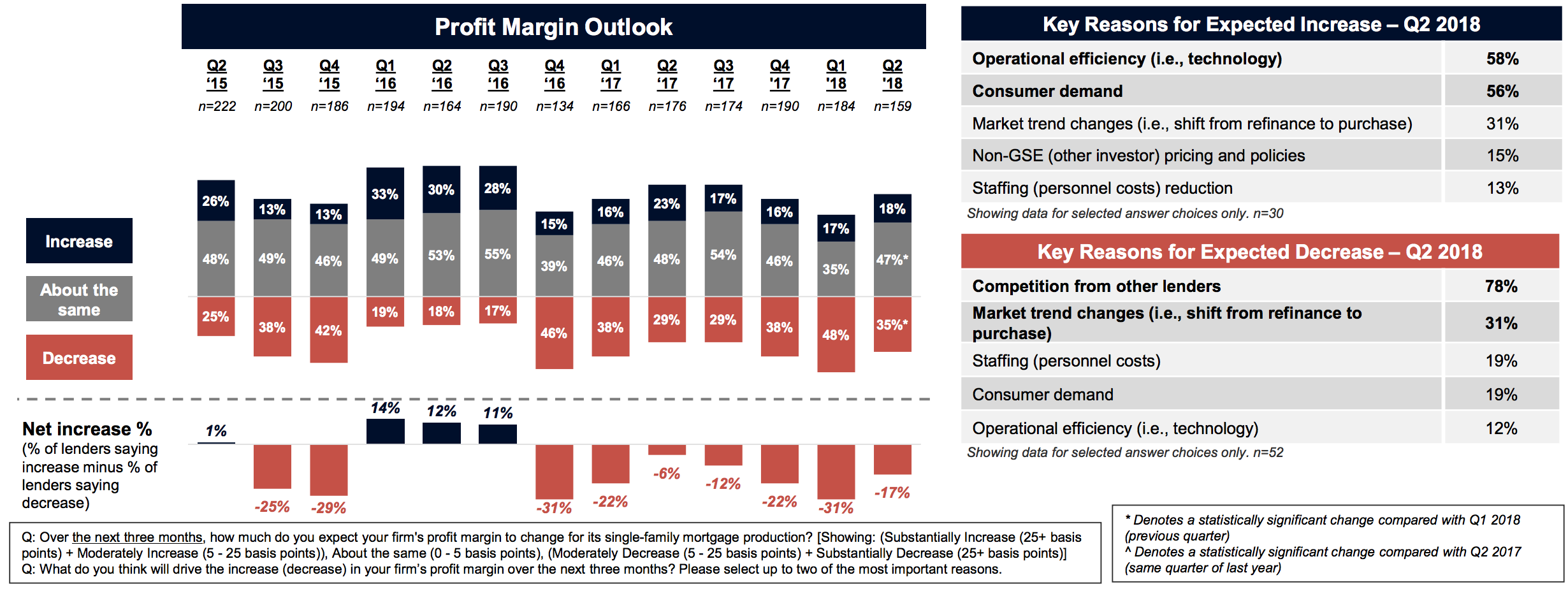

The company's Mortgage Lender Sentiment Survey for the second quarter, which gathered responses from 87 senior executives representing 170 lending institutions, found more than a third (35 percent) expect their net profit margin to decline over the next quarter while 47 percent expect it will stay the same. Over the last four quarters less than 20 percent of respondents have expected profits to improve.

Fannie Mae said it was the seventh consecutive quarter that the lender profit outlook has been negative, although responses to the second quarter survey were less downbeat than in the first quarter when nearly half of the lenders expected a decrease. Expectations were substantially more negative that in the same quarter last year when nearly a quarter of lenders were looking for higher margins.

Respondents cited competition from other lenders as the primary reason for their lower expectations. It was the sixth consecutive quarter for that sentiment to take first place and it tied with the first quarter as the survey high with a net of 78 percent. The second key reason given was "market trend changes" but it trailed at 31 percent. Among the few lenders who expect profits to increase, the most frequent justification was technological improvements.

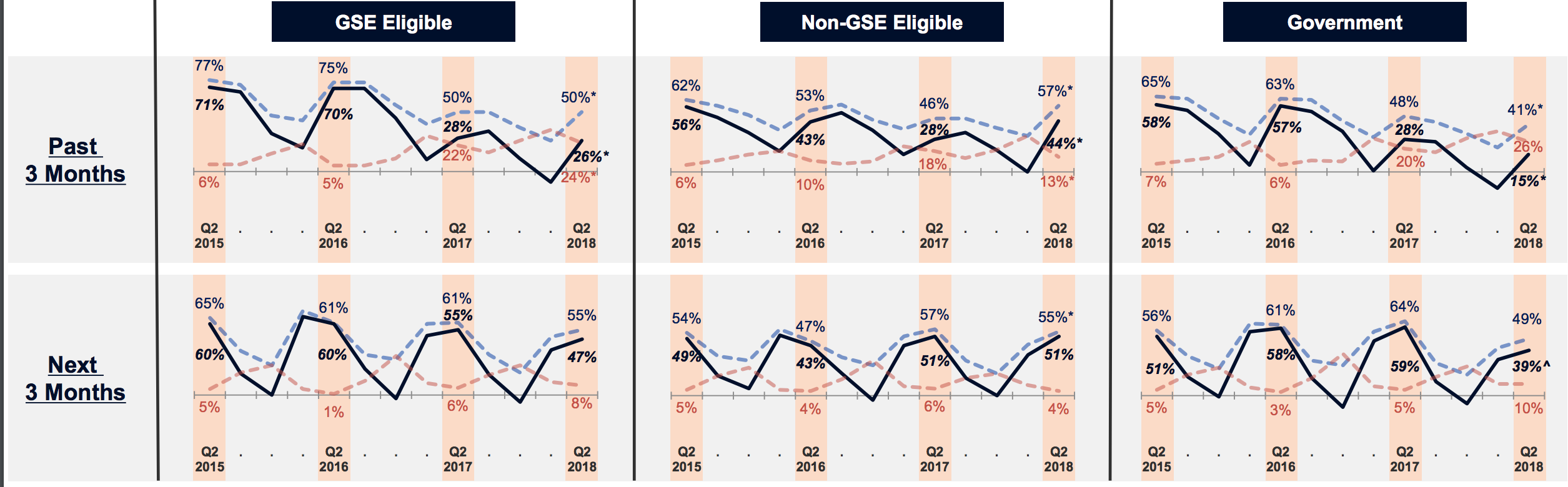

Competition will probably continue to be seen as a top factor as expectations for mortgage demand decline. The net share of lenders reporting they experienced growth in demand for purchase mortgages over the previous three months as well as the net share who expect growth over the next three months were both at the lowest level for any second quarter over the past three years. However, the net an increase in demand for non-GSE eligible loans over the previous period at 44 percent was the highest for a second quarter since 2015.

For refinance mortgages, on net, more lenders continued reporting declining demand over the prior three months, with responses for all three loan types a net negative, ranging from -67 percent for non-GSE eligible loans to -73 percent for both government and GSE eligible loans. The forward-looking responses were a little less gloomy, net positive responses about upcoming demand ranged from -46 to -54 percent. Both sets were the lowest since the second quarter of 2014.

"Lenders remain bearish this quarter as they continue to face headwinds from rising mortgage rates, tight supply, and strong home price appreciation, which have drastically reduced refinance activity and restrained home purchase affordability," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "These factors have combined to squeeze mortgage origination volumes and have increased competitive pressures. Increased competitiveness will likely persist as a top driver of lenders' mortgage business strategy. We expect this will prompt businesses to turn to cost-cutting as a means of managing their bottom lines, with payroll reduction likely to assume a more prominent role in future belt-tightening efforts."

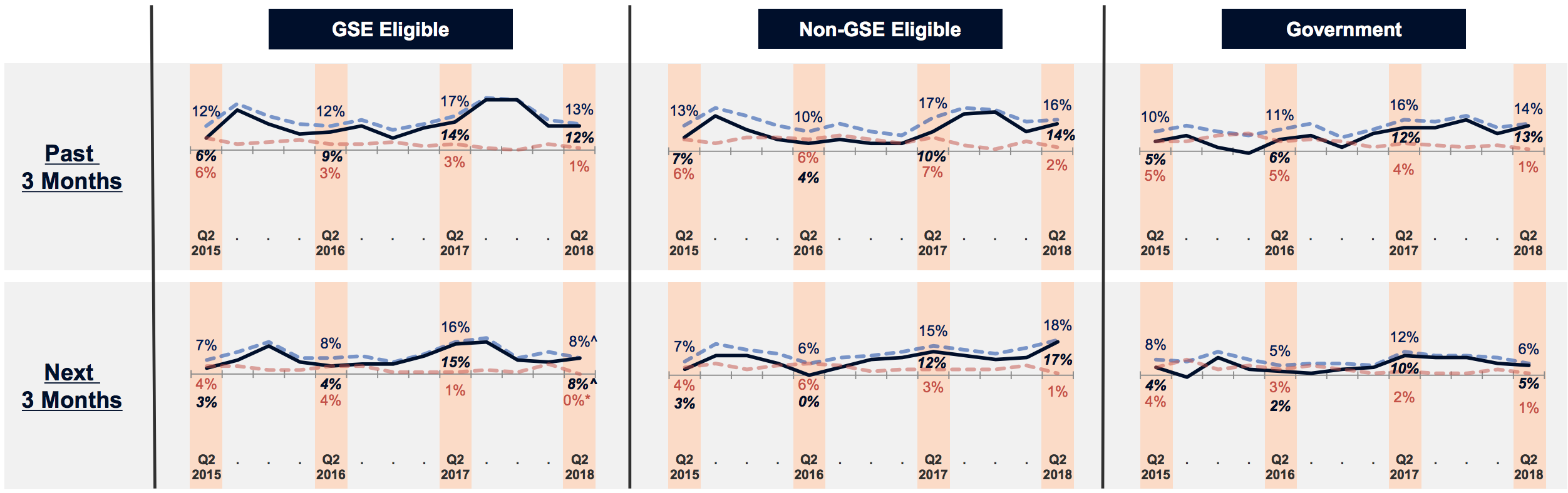

The net share of lenders reporting easing of credit standards over the prior three months as well as the net share of lenders reporting easing for the next three months remained stable overall. However, the net share reporting easing of credit standards for non-GSE eligible loans appeared to tick up from last quarter. In particular, the net easing share for non-GSE eligible loans for the next three months reached a survey high.

Of the 170 institutions represented in the second quarter survey, 67 were depository institutions, 56 were mortgage banks, and 30 as credit unions. More than half, 94 institutions, were among the bottom 65 percent of Fannie Mae lenders classified as small institutions, with loan origination volume of less than $400 million. Thirty-six were mid-sized, with volumes between $400 million and $1.18 billion. The remaining 40 represent the top 15 percent of lenders, those with loan volumes over $118 billion.

The second quarter Mortgage Lender Sentiment Survey was conducted between May 2 and May 14, 2018.