The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending June 11, 2010.

The Mortgage Bankers Association application survey covers over 50% of all US residential mortgage loan applications taken by mortgage bankers, commercial banks, and thrifts. The data gives economists a look into consumer demand for mortgage loans. In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payment which can increase disposable income and consumer spending (or give consumers a chance to pay down other debts like credit cards). A falling trend of purchase applications indicates a decline in home buying interest, a negative for the housing industry and the economy as a whole.

Excerpts taken from the release...

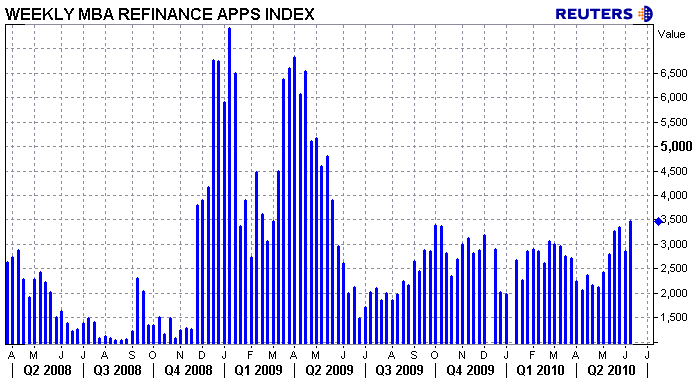

The Market Composite Index, a measure of mortgage loan application volume, increased 17.7 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index increased 29.7 percent compared with the previous week, which was a shortened week due to the Memorial Day holiday. The four week moving average for the seasonally adjusted Market Index is

up 3.8 percent.

The Refinance Index increased 21.1 percent from the previous week. This is the highest Refinance Index recorded in the survey since May 2009. The four week moving average is up 5.5 percent for the

Refinance Index. The refinance share of mortgage activity increased to 74.8 percent of

total applications from 72.2 percent the previous week, which is the

highest refinance share observed in the survey since the week ending

December 18, 2009.

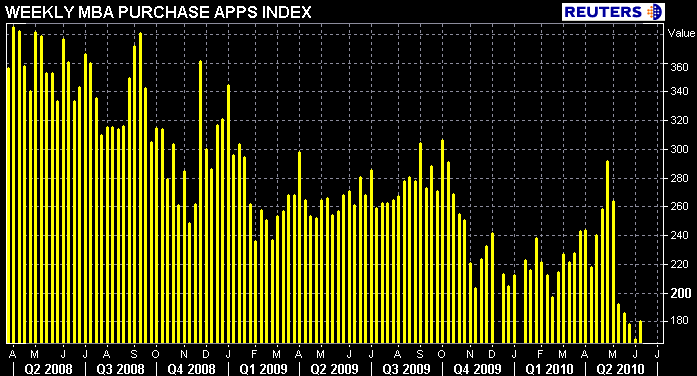

The seasonally adjusted Purchase Index increased 7.3 percent from one week earlier, which is the first increase in six weeks. The unadjusted Purchase Index increased 17.4 percent compared with the previous week and was 31.3 percent lower than the same week one year ago. The four week moving average is down 1.7 percent for the seasonally adjusted Purchase Index.

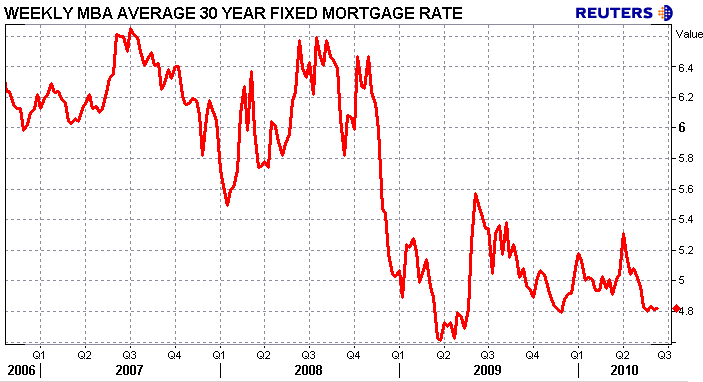

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.82 percent from 4.81 percent, with points decreasing to 0.89 from 1.02 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. However, due to the decrease in points, the effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages decreased to 4.23 percent from 4.26 percent, with points decreasing to 0.83 from 0.95 (including the origination fee) for 80 percent LTV loans. The effective rate also decreased from last week.

The average contract interest rate for one-year ARMs increased to 7.07 percent from 6.94 percent, with points decreasing to 0.27 from 0.30 (including the origination fee) for 80 percent LTV loans.

The adjustable-rate mortgage (ARM) share of activity increased to 5.2

percent from 5.1 percent of total applications from the previous week.

Last week I speculated that the refinance index might rebound because the par 30 year fixed mortgage rate had fallen to its most aggressive levels since the record lows offered last spring. I was however not totally sold on an uptick in refinance demand because while the par 30 year fixed mortgage rate was being quoted at lower levels by lenders, total consumer borrowing costs hadn't really improved all that much. This observation is more obvious today as the MBA says the average 30 year fixed mortgage rate actually rose 1bp to 4.82%. But if you look closer you'll notice that points charged declined from 1.02% to 0.89% of the loan amount.

What happened?

Rates stayed the same but closing costs got cheaper.

The following explanation is from THIS POST, written last Wednesday when mortgage rates were at their best levels of the week.

One thing I am noticing is even though loan pricing has greatly improved over the last four sessions, total consumer borrowing costs haven't really moved lower. Most deals are still getting done at 4.75-5.00% rates, depending on loan characteristics.

WHY?

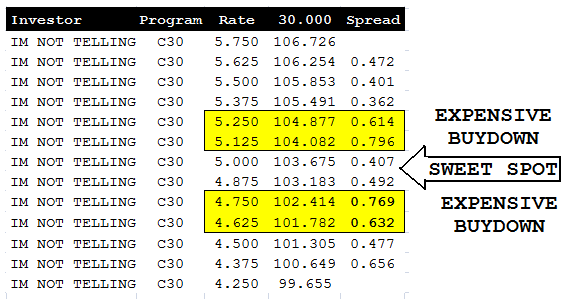

Take a look at rate sheets. As par (100.000) mortgage rates fall below 4.875%, the spread between note rates gets larger and larger. Permanently "buying down the rate" is EXPENSIVE. The pricing grid below is an example. This is what one lender was offering on C30 product.

(note: this pricing does not include loan level price adjustments, which are based on the borrower's unique credit and collateral profile)

Plain and Simple: loan pricing improved but not enough to quote lower mortgage rates. Instead of offering a lower note rate, lenders applied better loan pricing toward closing cost credits. This was a function of expensive interest rate buydowns.

To quantify "expensive" I ran a breakeven analysis on a $200,000 loan.

P&I @ 4.875% = $1,058.42

P&I @ 4.75% = $ 1,043.29

MONTHLY PAYMENT DIFFERENCE: $15.13

COST TO BUYDOWN RATE FROM 4.875% TO 4.75%: 0.769% of $200,000 = $1,538

MONTHS TO RECOVER UPFRONT DISCOUNT FEE: 101.65 or 8.5 years

Let's see how expensive it is to buy down your rate to 4.625%...

P&I @ 4.750% = $1,043.29

P&I @ 4.625% = $ 1,028.28

MONTHLY PAYMENT DIFFERENCE: $15.01

COST TO BUYDOWN RATE FROM 4.750% TO 4.625%: 0.632% of $200,000 = $1,264

MONTHS TO RECOVER UPFRONT DISCOUNT FEE: 84.2 or 7.0 years

That is a long time to recover those funds! Borrowers should consider front loading this cost if they plan to stay in their home for longer than the time it takes to recover the upfront fee they paid to buydown their note rate.

What appears to have happened is...

- Either a bunch of fence sitting INDEX+MARGIN paying ARM borrowers got wind of the news that mortgage rates were just above record lows and felt like it was a good time to refinance into a fixed rate loan (LIBOR higher because of Euro crisis). Or....

- Borrowers who had already locked their refinance with one lender were offered the same rate but lower closing costs by another lender, or a lower rate with the same closing costs, and they re-applied at a new lender. I doubt there was much purchase application fallout, but if the uptick in purchase apps was a factor of fallout, I hope those borrowers jumped ship to a lender who underwrites and closes in house. If they didn't, they better pray for an extension of the June 30 homebuyer tax credit closing deadline

Michael Fratantoni, MBA's Vice President of Research and Economics says:

"Mortgage applications for home purchases increased last week, the first increase in over a month. Refinance applications also picked up significantly over the week....While it is clear that purchase applications in May dropped sharply as a result of the tax credit induced increase in applications in April, it is unclear whether we are seeing the beginnings of a rebound now."