Excerpts From the Release...

The U.S. Department of Housing and Urban Development (HUD) and the U.S. Department of the Treasury today introduced a monthly scorecard on the nation's housing market.

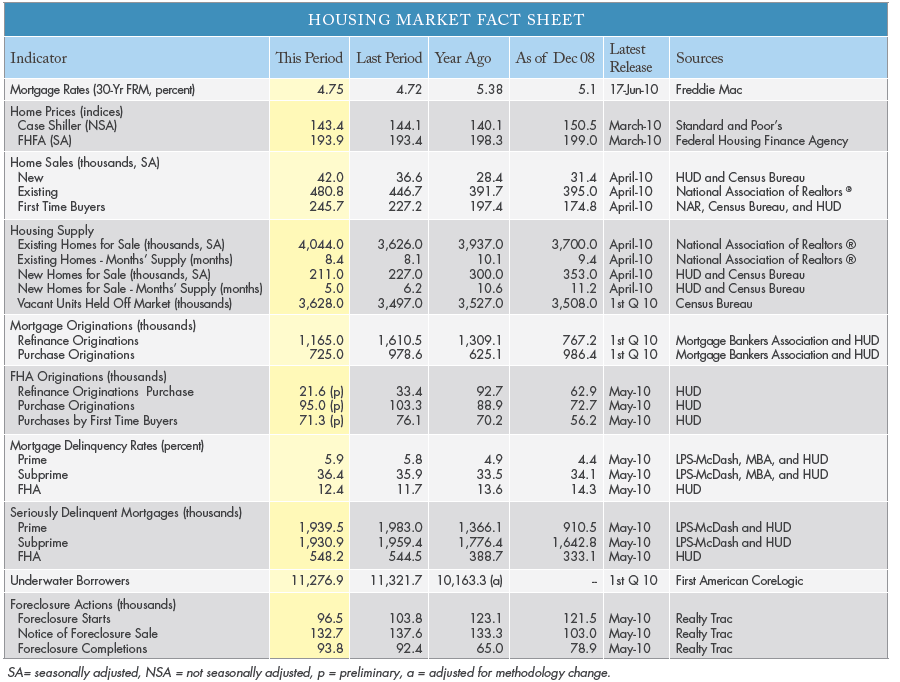

Each month, the scorecard will incorporate key housing market indicators and highlight the impact of the Administration's unprecedented housing recovery efforts, including assistance to homeowners through the Federal Housing Administration (FHA) and the Home Affordable Modification Program (HAMP).

This scorecard contains key data on the health of the housing market including...

- Mortgage Rates

- Home Prices

- Home Sales

- Housing Supply

- Mortgage Originations

- Delinquency Rates

- Foreclosure Actions

- Underwater Borrowers

HUD Secretary Shaun Donovan says:

"We already know that due to the Obama Administration's efforts, the housing market is significantly better than anyone predicted a year ago...This scorecard will allow the American people to monitor the Administration's efforts to strengthen the housing market on a monthly basis and hold the government and industry accountable. Demonstrating the progress in the housing market due to the Administration's policies, this month's report provides a broad set of indicators showing encouraging signs of recovery."

The housing scorecard now incorporates the monthly Making Home Affordable Program Servicer Performance Report, including HAMP modification data that once again shows a month-over-month increase in permanent modifications, with average growth of roughly 50,000 permanent modifications per month over the last four months. Servicer data indicates close to half of the homeowners in HAMP trial modifications who were ultimately ineligible for a HAMP permanent modification were offered an alternative modification and less than 10 percent move to foreclosure sale.

HERE are some of the findings (see page 8)...

- After 30 straight months of decline and an expectation of continued nearly 14 percent decline, home prices leveled off in the past year and expectations have adjusted upward

- Mortgages are more affordable: due to historically low interest rates, more than 6 million homeowners have refinanced, saving an estimated $150 per month on average and more than $11 billion in total. And more than 2.5 million families have purchased a home using the First-Time Homebuyer Tax Credit.

- Servicers report that the number of homeowners receiving restructured mortgages since April 2009 has increased to 2.8 million. Additionally, nearly half of homeowners unable to enter a HAMP permanent modification enter an alternative modification with their servicer, and fewer than 10 percent of cancelled trials move to foreclosure sale.

- However, the foreclosure prevention initiatives are not intended to help all borrowers and the market will continue to adjust for some time. The supply of homes on and off market remains near all-time highs. It will take time to work though this large inventory.

- Since April 2009, the number of homeowners receiving restructured mortgages totals 2.8 million. This includes 1.2 million homeowners who have started HAMP trial modifications and nearly 400,000 who have received some form of mitigation from FHA.

- Of those

enrolled in HAMP trials, 346,000 have now received permanent

modifications, an

increase of 47,000 since the May report.

- New data indicates that nearly half of the homeowners who were unable to enter into a permanent HAMP modification have been able to receive an alternative modification from their mortgage servicer while fewer than 10 percent of borrowers whose trials were cancelled have ultimately been foreclosed.