There has been a lot of hand-wringing for going on two years or so about the incredible shrinking inventory of homes for sale. This week CoreLogic analyst Molly Boesel joins the chorus with another analysis of the problem.

Boesel says the inventory of existing homes is at its lowest level in more than 18 years and continues to decrease (although the National Association of Realtors now reports two consecutive months of increasing listings,) and new home construction isn't helping. This has resulted in an inventory shortage "at a time when demographic and economic indicators are moving upward for the housing market."

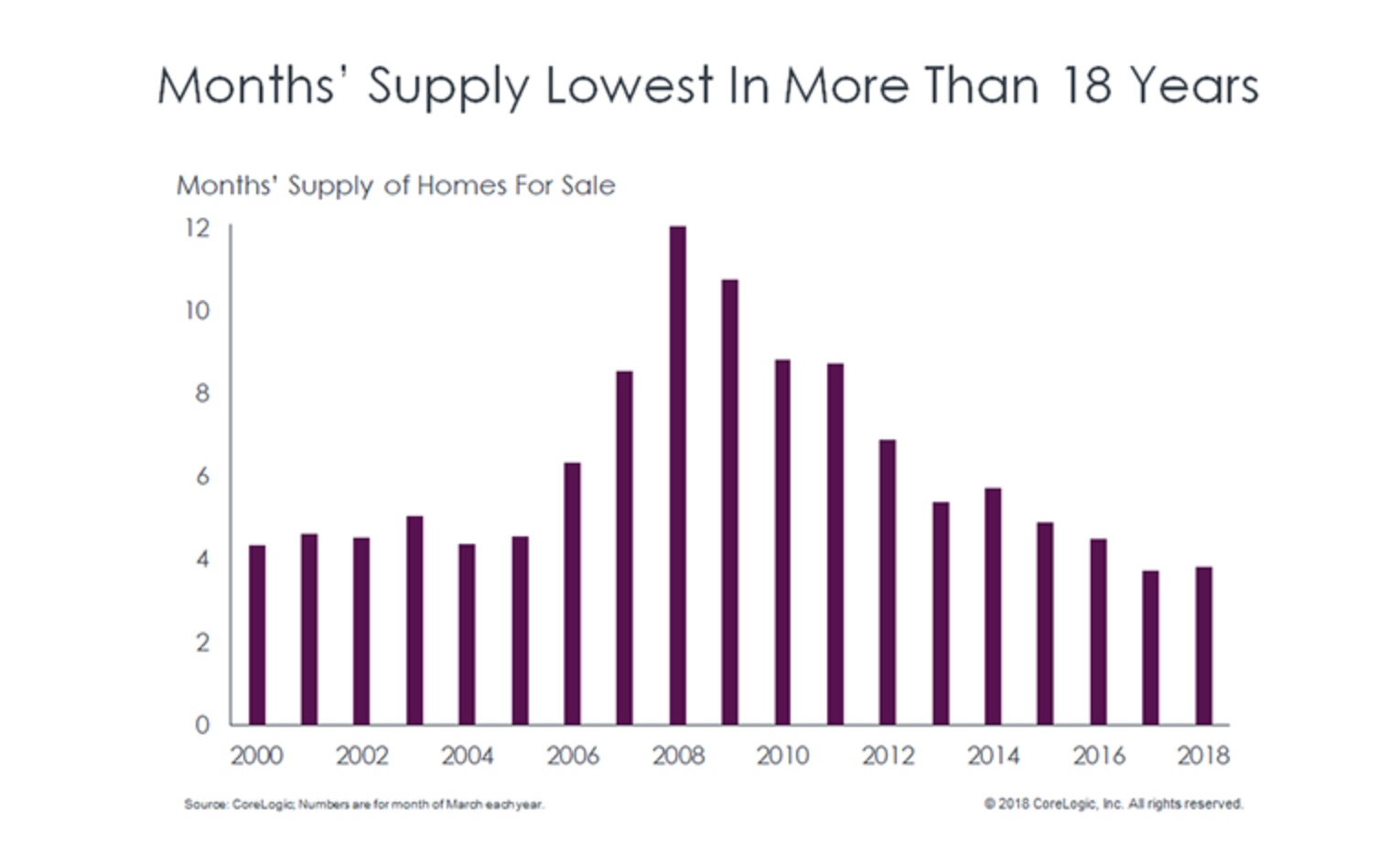

A "month's supply" measure is used in most inventory reports. This indicates how many months it would take to sell the available inventory at the current sales pace and if no other homes came on the market. Boesel says this scenario, while unlikely, is a good way to measure market health and confirms the 18-year inventory low.

Since the housing market is seasonal one, comparisons must be made among data collected at the same point in time each year. The author chose March and this year that supply was approximately 3.8 months nationwide. This was about the same level as in March 2017, but well below where it was during the Great Recession, and tighter than before the housing boom.

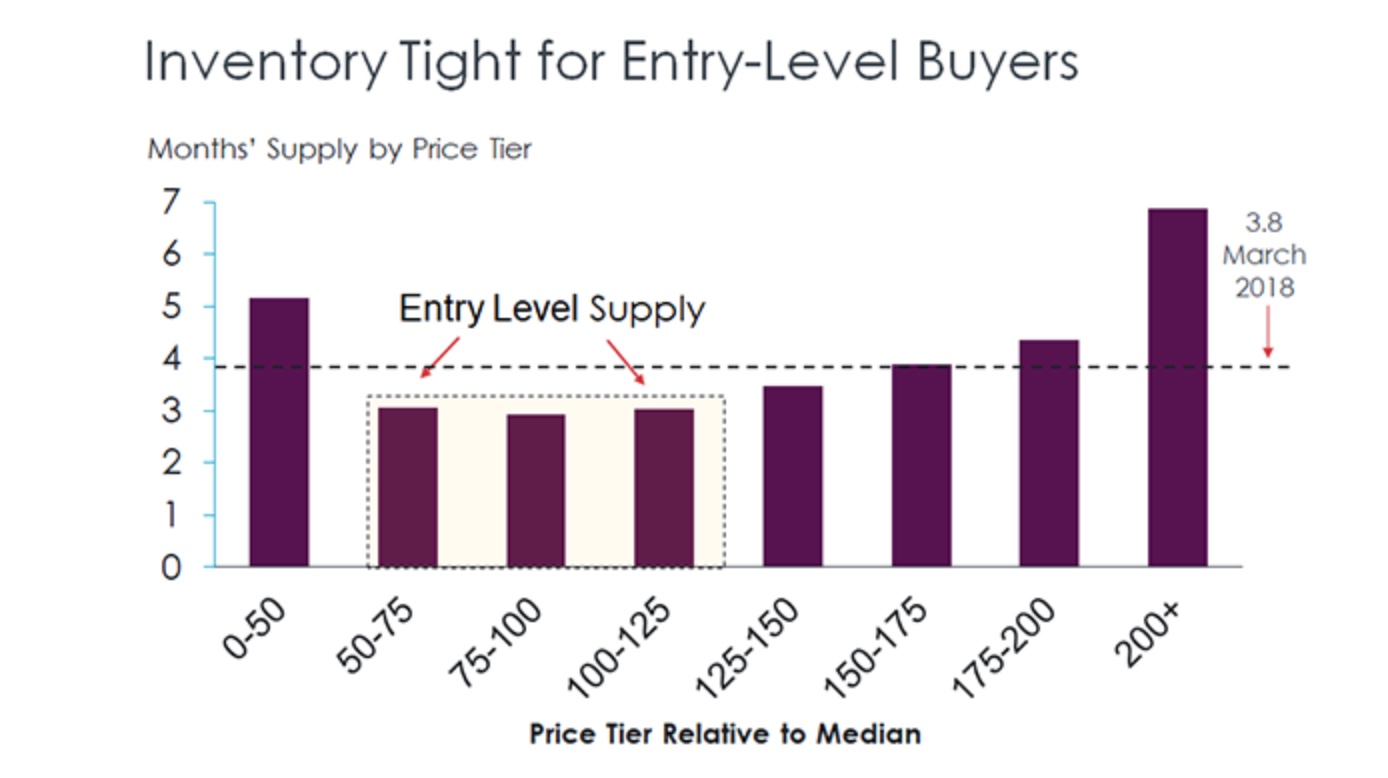

But being the tightest market in 18 years is the bright spot in her analysis. She also looked at the inventory at different price levels and at the entry-level, (homes priced from 50 percent of the median sales price to 25 percent above it) there was only a 3-month supply available in March. Moving higher in the price tiers the inventory improves, with close to a 7-month supply for homes listed at more than double the median price.

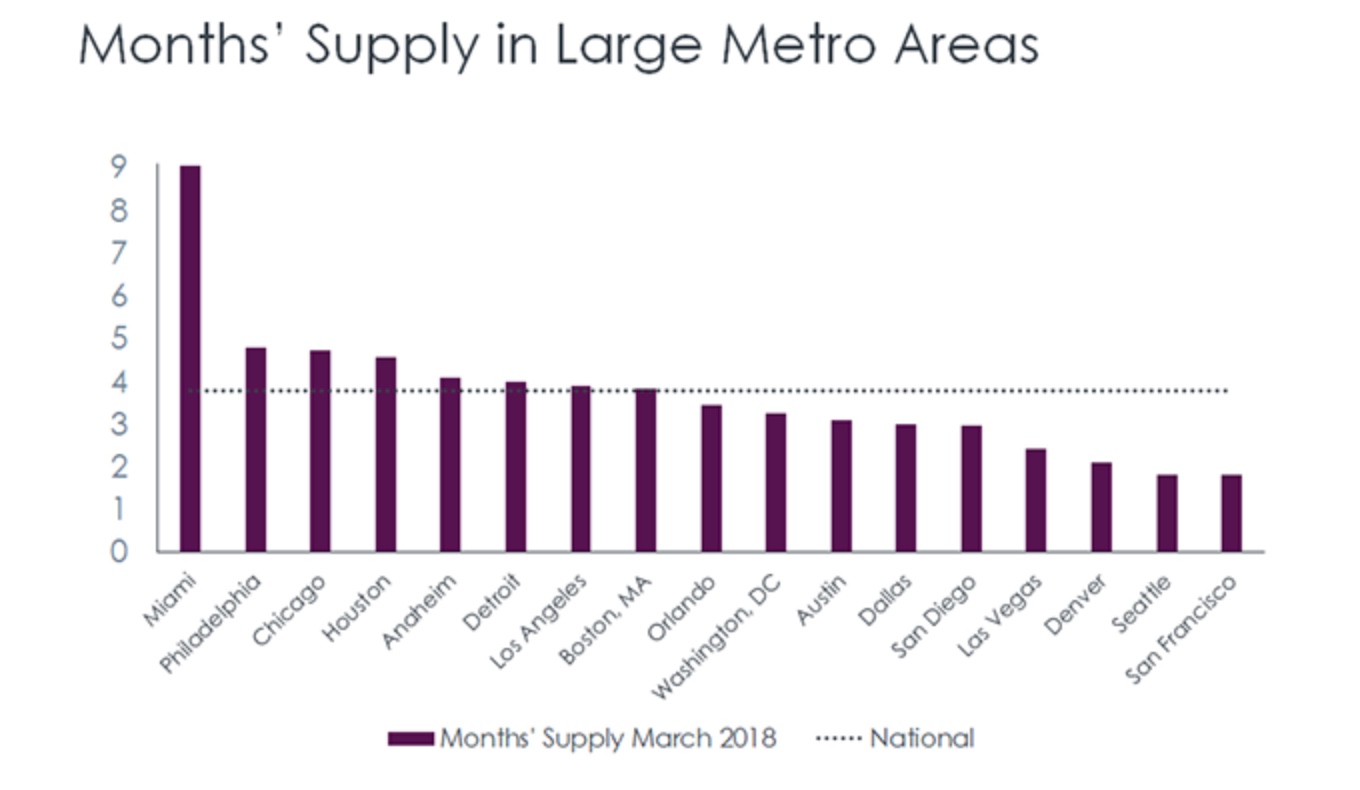

Prices aside, those localities with strong job growth also look worse than national averages would imply. Denver, Seattle, and San Francisco have about 2 months of supply, making each of those cities a sellers' market. Miami, with a supply made up mostly of condos, has almost a glut among the large metros, a 9-month supply.

Boesel says the tight inventory on the low-end means higher prices for first-time buyers. The CoreLogic Home Price Index shows prices for lower-end homes increased by almost 10 percent year-over-year in March against a gain for higher-priced homes of only 6 percent. This could mean pricing entry-level buyers out of the housing market and keeping a lid on overall home sales.