Freddie Mac's total mortgage portfolio shrunk by $7.53 billion or 4.0 percent during the month of May, resuming the decline that began in January.

Despite a 3 percent upward blip in April, the portfolio has dropped 2.9 percent since the first of the year and now has a total balance of $2.22 trillion. The total portfolio, however, is still 18.2 percent larger than it was in May 2009. The annualized liquidation rate in May was 17.8 percent compared to 19.2 percent in April.

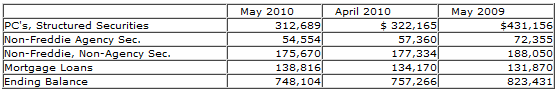

The refinance-loan purchase and guarantee volume in the Mortgage-Related Investments Portfolio was 17.1 billion, down from 18.4 billion in May. The Investments Portfolio declined in value to 748.1 billion, a decrease of $9.2 billion or 14.5 percent from April and 2.3 percent since May 2009. The breakdown of that portfolio in May compared to April 2010 and May 2009, expressed in $millions, was:

The delinquency rate among single family based mortgages was unchanged from April at 4.06 percent. This is the third month in a row there has been no increase in the total delinquency rate, however delinquencies are still running much higher than one year ago when the rate was 2.73 percent. Delinquencies represented 3.15 percent of the non-credit enhanced portfolio, also unchanged from last month, while the rate in the credit-enhanced portion of the portfolio ticked up one basis point to 8.69 percent. Multi-family delinquencies increased from 0.25 percent in April to 0.32 percent.

The measure of Freddie Mac's exposure to changes in portfolio market value averaged $455 million in May with a duration gap that averaged 0 months. These measures include the impact of purchases and sales of derivative instruments used to limit exposure to changes in interest rates.