The National Association of Realtors released the Pending Home Sales Index today.

NAR's Pending Home Sales Index measures the number of home purchase contracts that were signed in the monthly reporting period. Once "pending" sales contracts are closed, they are considered an existing home sale. Because the Pending Home Sales index tells us how many contracts were signed, it is consider a forward indicator of existing home sales. A signed contract is not counted as an existing home sale until the transaction actually closes. In developing the model for the index, it was demonstrated that the level of monthly pending home sales parallels the level of closed existing-home sales in the following two months.

Excerpts from the Release...

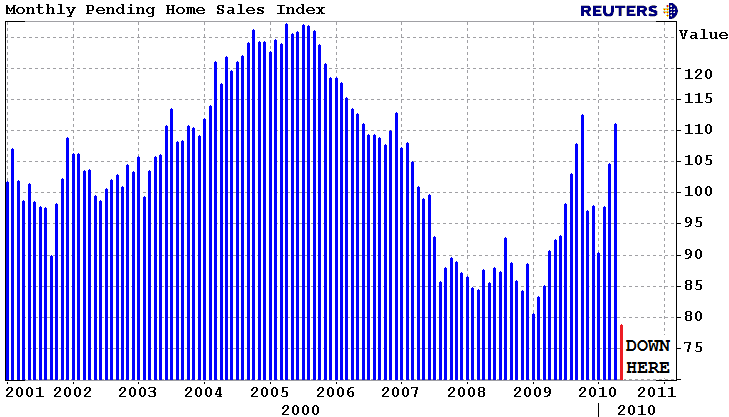

The Pending Home Sales Index, a forward-looking indicator, dropped 30.0 percent to 77.6 based on contracts signed in May from a reading of 110.9 in April, and is 15.9 percent below May 2009 when it was 92.3. The falloff comes on the heels of three strong monthly gains as home buyers rushed to take advantage of the tax credit.

The data reflects contracts and not closings, which normally occur with a lag time of one or two months. However, many closings have been delayed recently from a rush of buyers into the system and slow processing of short sales, in addition to the heavy volume and a more thorough loan underwriting process. As many as 180,000 buyers who signed contracts by April 30 may have missed the June 30 closing deadline for the tax credit. However, Congress passed legislation yesterday to extend the deadline for delayed contracts and President Obama is expected to sign. READ MORE

Congress also reauthorized the National Flood Insurance Program. Many lenders were hesitant to approve mortgages on homes needing flood insurance without congressional action and numerous sales have been on hold. The action is retroactive to a temporary authorization that expired May 31, and also is expected to be signed by the president.

The month over month drop-off was huge....

....but not a huge surprise given the fact that purchase applications fell to a 13-year low just two weeks after the tax credit expired.What's scary is purchase applications have fallen further since then!

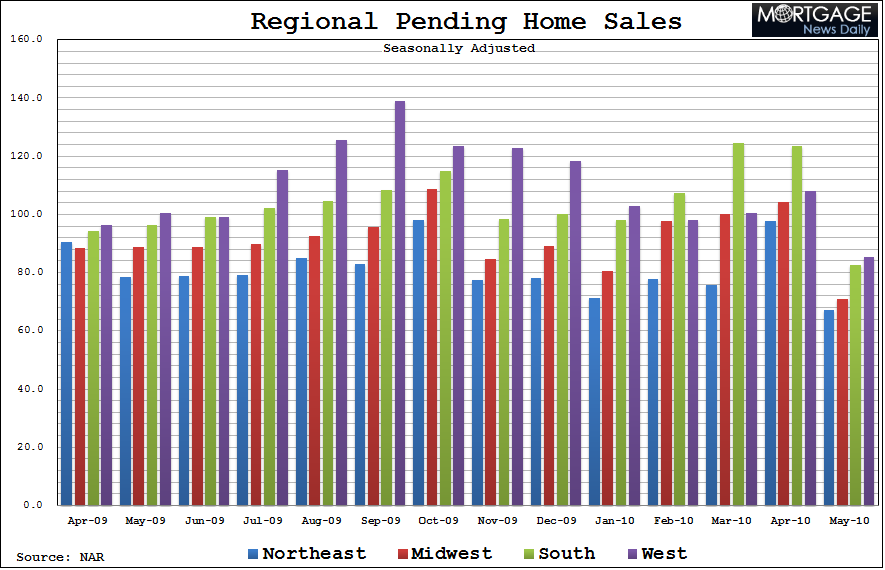

Pending Home Sales weakness was widespread across all regions....

Northeast: -31.6 percent to 67.0 in May and 14.8 percent lower than May 2009.

Midwest: -32.1 percent to 70.8 and 20.2 percent lower than May 2009.

South: -33.3 percent to 82.5 and 14.4 percent lower than May 2009.

West: -20.9 percent to 85.3 and 15.1 percent below May 2009.

NAR chief economist Lawrence Yun had much to say about this report...

“Consumers are rational and they rushed to meet the tax credit eligibility deadline in April. The sharp decline in contract signings in May is a natural result with similar low levels of sales activity anticipated in June...Surprisingly, though, some local markets such as Portland, Maine, and Jacksonville, Fla., actually experienced an increase in contract signings from a year ago without the tax credit."

“Existing-home sales that close in June will remain elevated, but we’ll then see a notable decline for July and August.”

“Without the tax credit, there will be more aggressive price negotiations between buyers and sellers. The key test on whether the housing market can stand on its own without stimulus medicine will depend critically on private sector job creation in the second half of the year. We’ll also keep a close eye on market conditions on the Gulf Coast.”

“If jobs come back as expected, the pace of home sales should pick up later this year and reach a sustainable level of activity given very favorable affordability conditions,”

“In most areas of the country there will be no sharp snap back in home prices in the upcoming years, although some local markets have experienced double-digit gains this year,”

“One factor that could lead to price acceleration in upcoming years for some markets is if the very low levels of new home construction were to persist for another year or two,”

Even the NAR is starting to sound a little less optimistic these days..