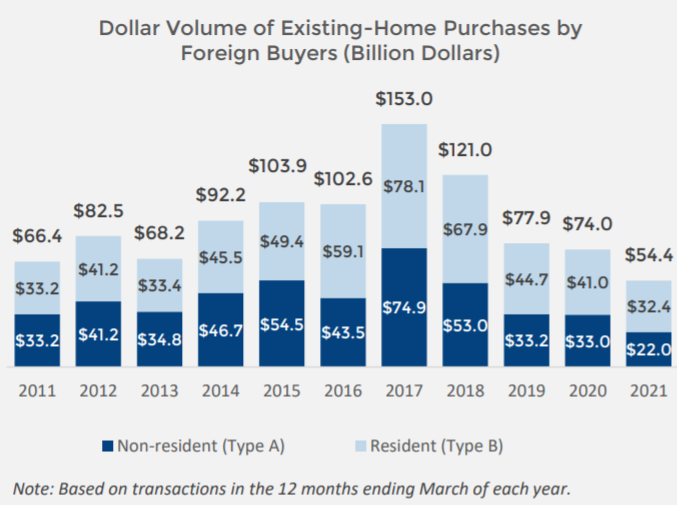

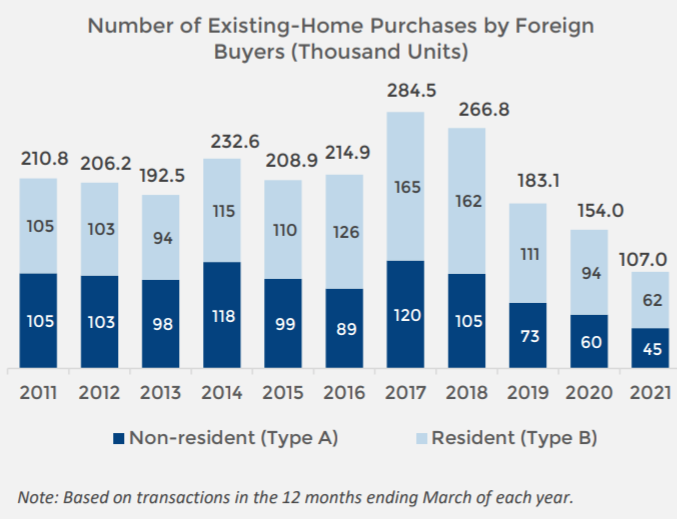

The National Association of Realtors® (NAR) reports that there was a fourth consecutive year-over-year decline in the rate of investment in U.S. real estate by international buyers. In the 12 month period that ended on March 31 those buyers purchased 107,000 residential properties for a total of $54.4 billion. This was down 31 percent and 27 percent respectively from the prior 12 month period in which foreign investors spent $72 billion to buy 154,000 units, and the lowest set of numbers since 2011.

NAR's 2021 Profile of International Transactions in U.S. Residential Real Estate is based on a survey of its members about transactions with international clients who purchased and sold U.S. residential property from April 2020 through March 2021.

NAR divided buyers into two categories; Type A, non-U.S. citizens with permanent residences outside the U.S., and Type B, non-U.S. citizens who are recent immigrants (less than two years at the time of the transaction) or non-immigrant visa holders who reside in the U.S. for more than six months for professional, educational, or other reasons. Type B buyers purchased $32.4 billion worth of U.S. existing homes, 60 percent of the tot volume of foreign purchases and a 21 percent decrease from the prior year. Type A buyers purchased $22 billion in existing homes, accounting for the remaining 40 percent and down by one-third from the previous period. In total, international buyers accounted for 2.8 percent of the $5.8 trillion in existing-home sales during that period.

"The big decline in foreign purchases of homes in the U.S. in the past year is no surprise, given the pandemic-induced lockdowns and international travel restrictions," said NAR Chief Economist Lawrence Yun. "Yet, even with the absence of foreign buyers, the U.S. housing market strengthened solidly."

While it doesn't explain the four-year slowdown in investment which peaked in 2017 at $153 billion, the global impact of the pandemic obviously effected the most recent numbers. NAR said, while the U.S. economy contracted by 3.5 percent during the period, Canada was down 5.4 percent, the Euro area fell 6.6 percent, India by 8.0 percent and Latin America and the Caribbean by 7.0 percent. China did post economic growth, but at 2.3 percent it was about a third its pre-pandemic rate.

China and Canada were the largest investors in U.S. residential sales dollar volume at $4.5 billion and $4.2 billion, respectively. These two countries have been in first and second place since 2013. India was the third largest at $3.1 billion, followed by Mexico ($2.9 billion). The UK moved into fifth position, displacing Colombia, and becoming the only country in the top five to see an increase. Its dollar volume of investment grew by $1.3 billion to $2.7 billion.

"As travel restrictions loosen and foreign students return to U.S. colleges in the upcoming year, there is likely to be some growth in foreign buying of U.S. real estate," Yun added. "High home prices and the ongoing lack of inventory could, however, pose a challenge for buyers."

The median existing-home sales price among international buyers was $351,800, 15 percent higher than the median price for all existing homes sold in the U.S. That difference primarily reflects the locations and type of properties desired by foreign buyers. At $476,500, Chinese buyers had the highest median purchase price, and more than a third - 34 percent - purchased property in California.

Florida was the top destination for foreign buyers for the 13th straight year, accounting for 21 percent of all international purchases. California ranked second at 16 percent, followed by Texas (9 percent) and Arizona (5 percent). New Jersey and New York tied at 4 percent each.

Thirty-nine percent of international transactions were all-cash, 61 percent of non-resident (Type A) purchasers paying cash compared to 24 percent of those residing in the U.S. The percentage of cash purchases varied by nationality, from 80 percent of transactions made by UK citizens to only 8 percent of those by citizens of India.

Nearly half of international buyers purchased a home in the suburbs and 28 percent bought in an urban area, a figure that's held steady over the last six years. Seven percent bought in a resort area, a 10 point decline since 2012.