It's baaaack.

The condo market that is. At least according to CoreLogic which says condo construction completions are up 90 percent to 2,100 buildings in the fourth quarter of 2013 from the trough of 1,100 condo buildings in hit in the second quarter of 2012. Of course the comeback trumpeted, at least in the construction area, is relative; there were 20,000 completions in the first quarter of 2008.

However there are other measures besides construction that lead to the rosy picture CoreLogic's Sam Khater paints in the company's Housing Trends blog. The strengthening is also evident in the market's ability to more quickly absorb new condos - indicating an increase in demand to match the increased new condo supply. In 2013, condo absorption rates, defined as the percentage of units which sell within three months of completion, reached 82 percent - over twice the 36-percent low at the height of the financial in mid-2008.

Khater says that the absorption rate has increased in part because condo prices have normalized in two important ways, both of which will draw more condo buyers back into the market and encourage more construction.

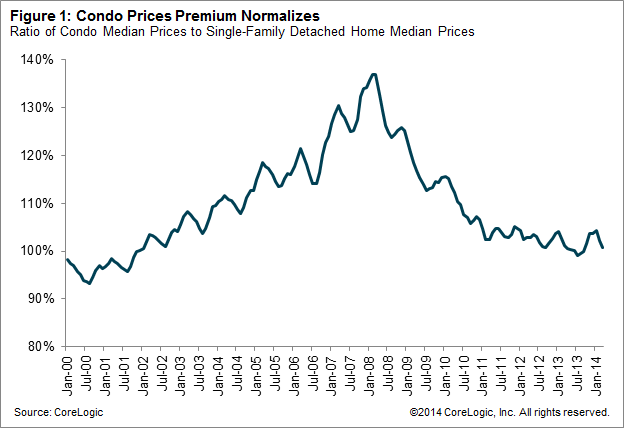

First, the price of condos relative to single family detached home values has declined over the last few years and is back to levels of the early 2000s. At that time both condo and single family median prices were around $138,000 but as the market began to overheat condo prices rose much faster than single family home prices. By March 2008 the median condo price was 37 percent above the median single family detached home price. Once the market started to cool condo prices fell fast and by July 2013 the median condo price was 1 percent below that of single family homes. This relative relationship has continued thus far in 2014.

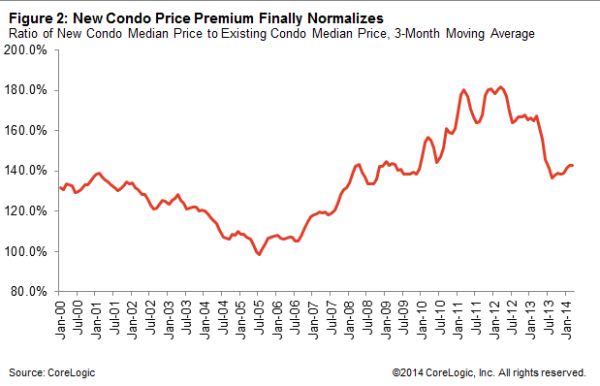

The normalizing of new condo price premiums relative to existing condo prices has taken longer than that between condos and single family houses. Khater said this is particularly important because of its influence on the demand for new condos, a demand that was lacking until 18 months ago. From 2000 to 2003 new condo prices sold at a 29-percent premium over existing consos but the housing boom then pushed up existing prices much faster and reduced the new price premium to 5 percent by 2005.

Once the market crashed most condo prices declined rapidly but not new condo prices. By late 2011 the price premium had been pushed to 80 percent. Since then existing prices have surged while new condo prices "have moved sideways" and the premium ceclined to 43 percent by this year. Khater says that while this is still modestly above the levels of the early 2000s, "Given more recent improvements in the amenities and locations of new condos, it is reasonable to expect the new premium to be even higher than in prior "normal" times."