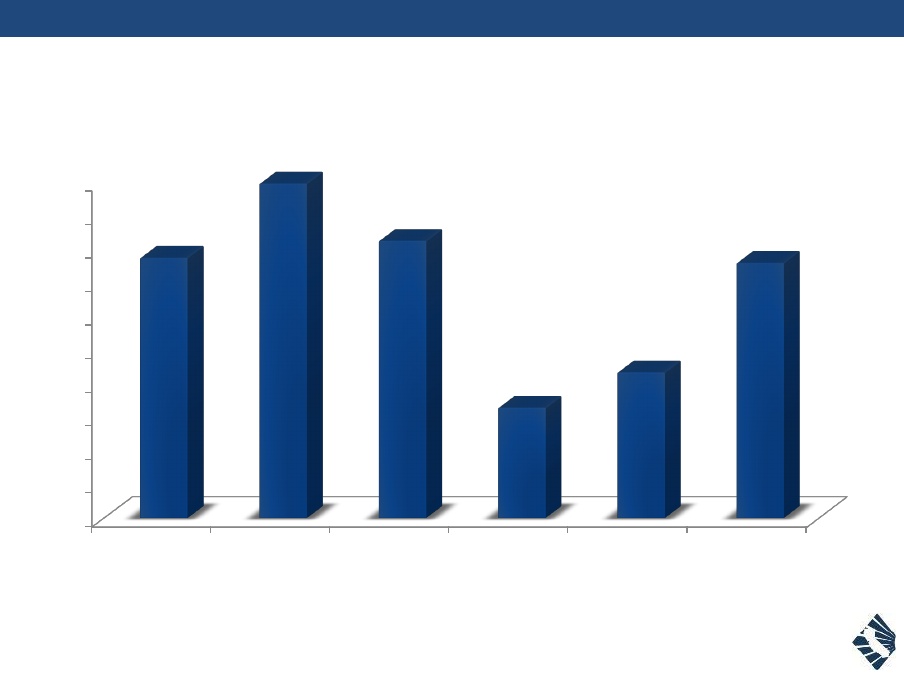

Realtors responding to a recent survey by the California Association of Realtors® (C.A.R.) reported that investors and investor sales are a shrinking part of their business. Investor transactions made up an average of 32 percent of sales Realtors reported in the survey, conducted in May of this year, down from 39 percent in the 2013 survey. Most respondents reported that they have one to three clients who are investors. Only 20 percent said they were doing business with six or more. The average number of investor clients dropped from 7 in the 2013 survey to 5.2 this year. More than half of respondents reported they had three or fewer investor sales over the previous 12 months.

While Realtors reported that the percentage of sellers they represented in investor transactions grew by 7 percentage points to 30 percent compared to the 2013 survey, buyers still make up by far the largest share of clients, 70 percent, in investors transactions. Realtors reported that 80 percent of investor transactions were single family sales compared to 73 percent in the previous survey and the average number of units per transaction dropped from 3.8 to 3.5.

With the number of distressed homes on the market diminishing, investors are moving away from the more popular urban areas and buying homes in more rural areas where better deals can be found. Forty-five percent said they had purchased properties in such counties as Sacramento, Fresno, Kern, and Tulare, up from 27 percent in 2013. Further reflecting the recovering housing market, the majority of investment properties purchased (70 percent) were equity sales, while 18 percent were short sales, and 12 percent were foreclosures.

Seventy-seven percent of investor transactions involved property listed for under $500,000. The median sales price of an investment property in 2014 was $320,000, up 9.6 percent from $292,000 in 2013, reflecting increasing home prices and fewer available distressed properties over the past year.

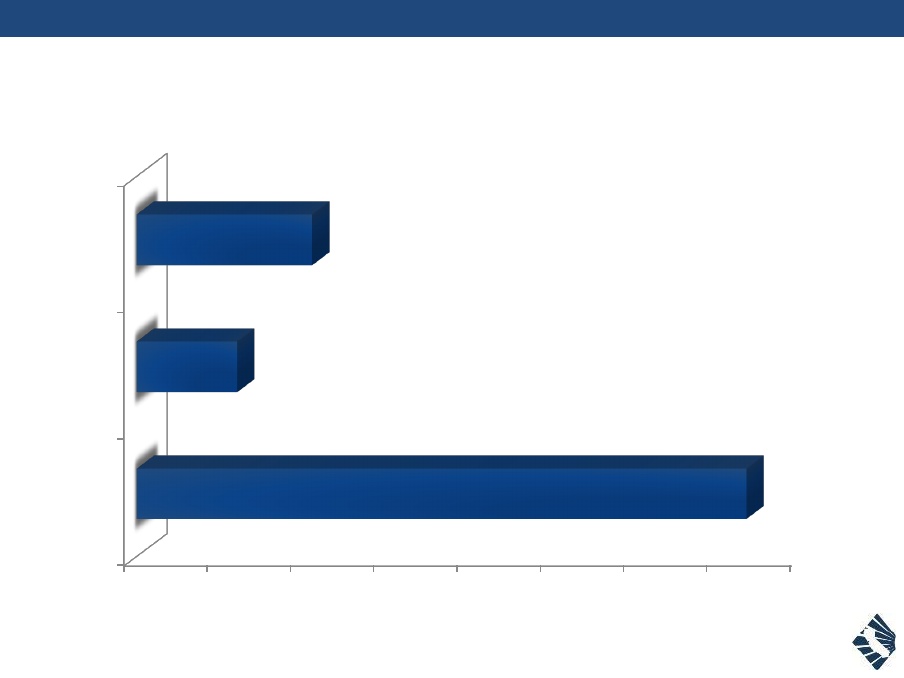

Almost half of investors spent less than $10,000 in transactions costs to purchase their investments but the median transaction cost increased from $9,000 in 2013 to $12,000. The median transaction cost relative to the cost of the property was significantly higher for properties selling for over $500,000 than for those under that price.

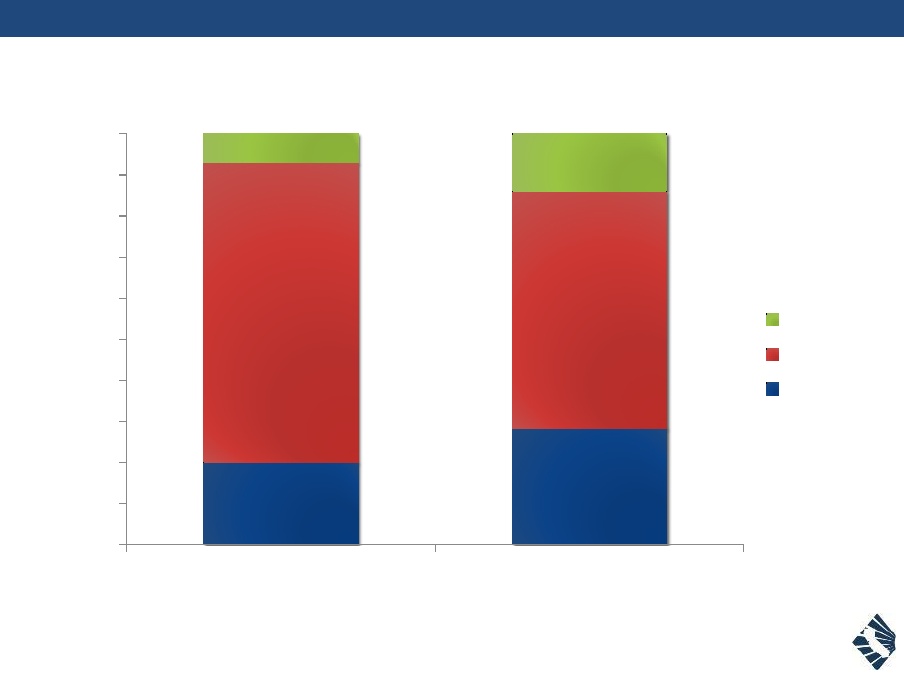

With home prices on the rise, more investors are flipping properties instead of renting them. In 2014, 28 percent of investors flipped the property, up from 20 percent last year. Thus fewer of the investment properties were rented; that percentage dropped from 73 percent in 2013 to 58 percent in the recent survey. More than half of investors (55 percent) intend to keep the property they purchased for less than six years. More than two-thirds of owners manage their properties themselves, essentially unchanged between 2013 and 2014.

More than two-thirds (67 percent) of investors paid cash for the properties and most made either no repairs or minor ones. The percentage of those who did do major remodeling went from 9 percent in 2013 to 17 percent and those investors spent more, a median of $15,000 compared to $10,000 in 2013.

Of those who financed their purchases 86 percent did so with a bank loan. The average down payment was down from 30 to 24 percent and Realtors said that only a small number of their clients had any difficulty financing.

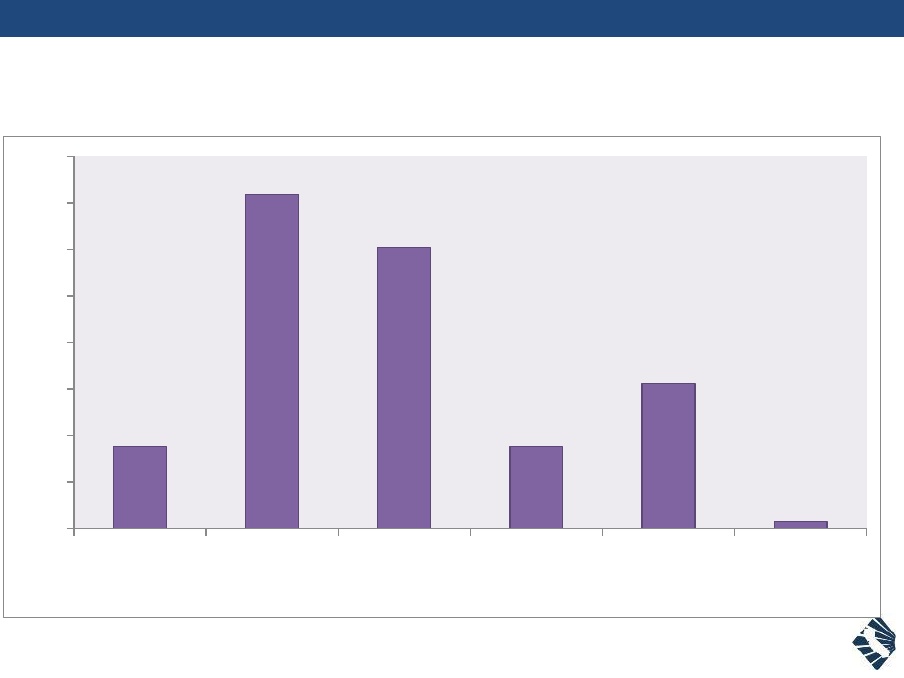

More than eight out of 10 investors (83 percent) own other investment properties, with 7 percent owning more than 10 properties, 17 percent owning 6-10 properties, 47 percent owning 2-5 properties, and 12 percent owning one other property. The average number of properties owned increased from 6.5 in 2013 to 8.3 this year.

Realtors reported that the majority of their investor-buyers found a property within eight weeks with an average of 6.8 weeks, more than three weeks more quickly than in the last survey. On average an investor looked at 6.9 properties, down from over 11.

About 75 percent of investors were individuals, 75 percent were male and 75 percent were married. The average age was up three years from the previous survey to 51. One-third of investors were from foreign countries with China, Mexico, Taiwan, and India being the top countries of origin.

The C.A.R. survey was emailed to a random sample of REALTORS® throughout California who had worked with investors within the 12 months prior to May 2014.