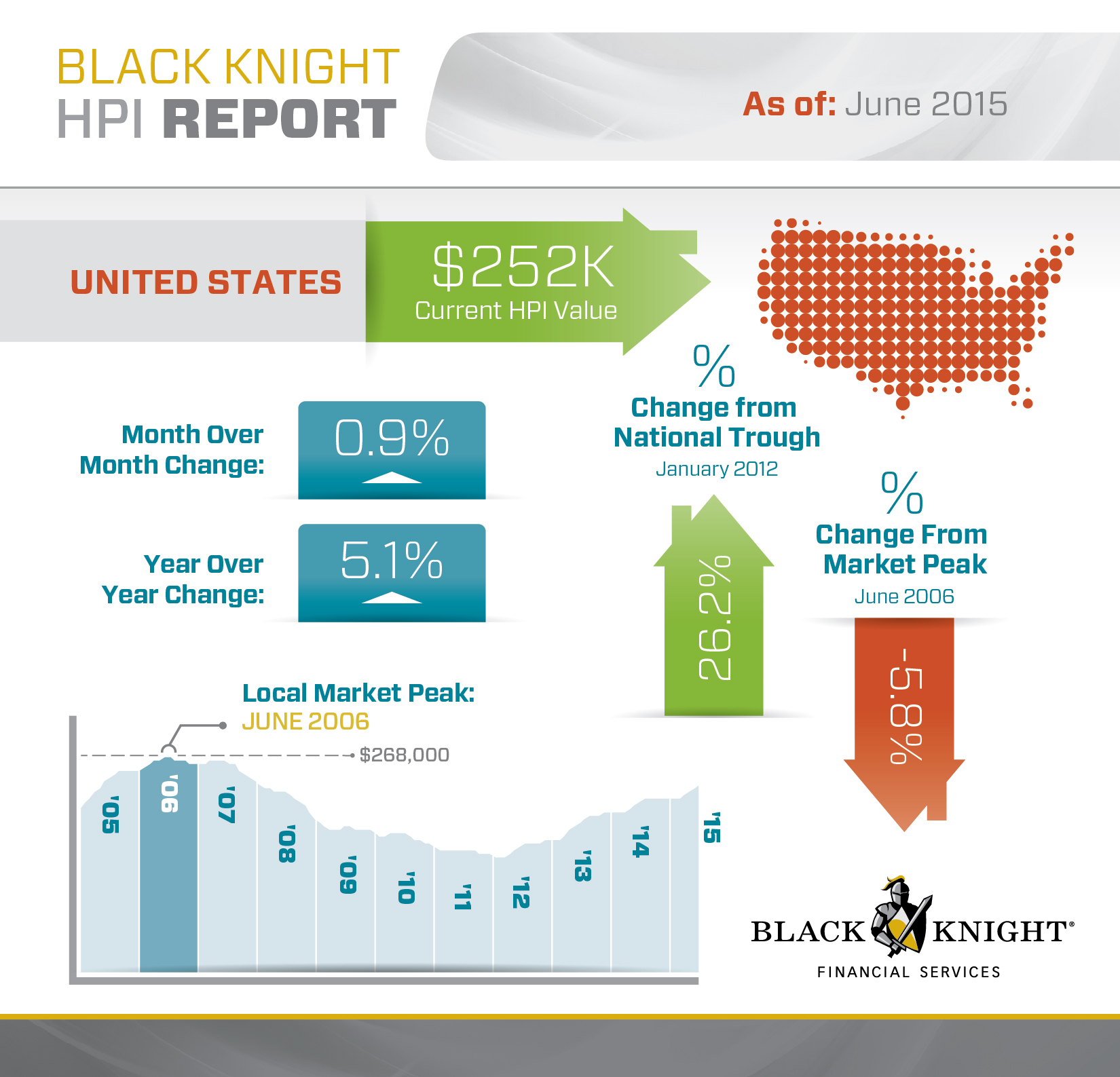

Black Knight Financial Services said on Monday that as of the end of June home prices nationally had returned to within 5.8 percent of their peak exactly nine years earlier. The company's Home Price Index (HPI) Report said that the HPI in June was $252,000 compared to $268,000 at the June 2006 peak and has regained 26 percent in value since the market bottom of $200,000 in January 2012.

The national HPI increased by 0.9 percent from May to June and is now up 5.1 percent year-over-year. The largest gain among the states was in Michigan which shot up 1.9 percent followed by Colorado at 1.4 percent and Nevada, Alaska, and Vermont, each at 1.3 percent. Among metropolitan areas Reno made the greatest monthly gain at 2.6 percent followed by Janesville, Wisconsin at 2.4 percent, Detroit and Carson City (2.2 percent) and Yakima, Washington (2.0 percent).

There were no states posting month-over-month losses but West Virginia's HPI remained unchanged. Other states with minimal increases included Virginia at 0.1 percent and Missouri, Arkansas, Maine, Mississippi, and Alabama, all at 0.2 percent. Sierra Vista, Arizona had the only loss reported, down 0.1 percent in home price value. HPIs in four West Virginia metro areas, Wheeling, Beckley, Morgantown, and Parkersburg each had 0.0 percent change.

Most states have recovered substantially from the financial downturn. Home prices in California have risen more than 50 percent since the national price trough and, with an HPI of $445,000 are now within 14.6 percent of the state's peak price of $521,000. Las Vegas home prices have risen by nearly 60 percent from the national trough but still remain almost 40 percent below the state's own peak. A similar situation exists in Arizona which, along with Nevada, topped foreclosure charts for years. Its home prices have recovered by 39 percent but remain 27 percent below pre-crash levels.

Indiana, New York Tennessee, and Texas all established new price peaks in June and Massachusetts and Pennsylvania are both within 3 percent of their respective highs. Of the nation's 20 largest metros, 13 hit new peaks in June.

The Black Knight HPI combines the company's property and loan-level databases to produce a repeat sales analysis of home prices as of their transaction dates every month for each of more than 18,500 U.S. ZIP codes. The Black Knight HPI represents the price of non-distressed sales by taking into account price discounts for REO and short sales.