Taking out a mortgage with an origination balance higher than whatever the conventional loan limit was at the time used to be an expensive proposition. Home buyers and refinancers had an incentive to do whatever they could - higher down payments, piggy back second mortgages - to get their loan under that conventional limit in order to reap the benefits of lower borrowing costs.

However, as Archana Prahan writes in the CoreLogic Insights Blog, since mid-2013 a jumbo loan has had lower borrower costs than a conforming loan, currently defined as one with a balance at or under $453,100. In the first quarter of 2018 that differential averaged 33 basis points (bps).

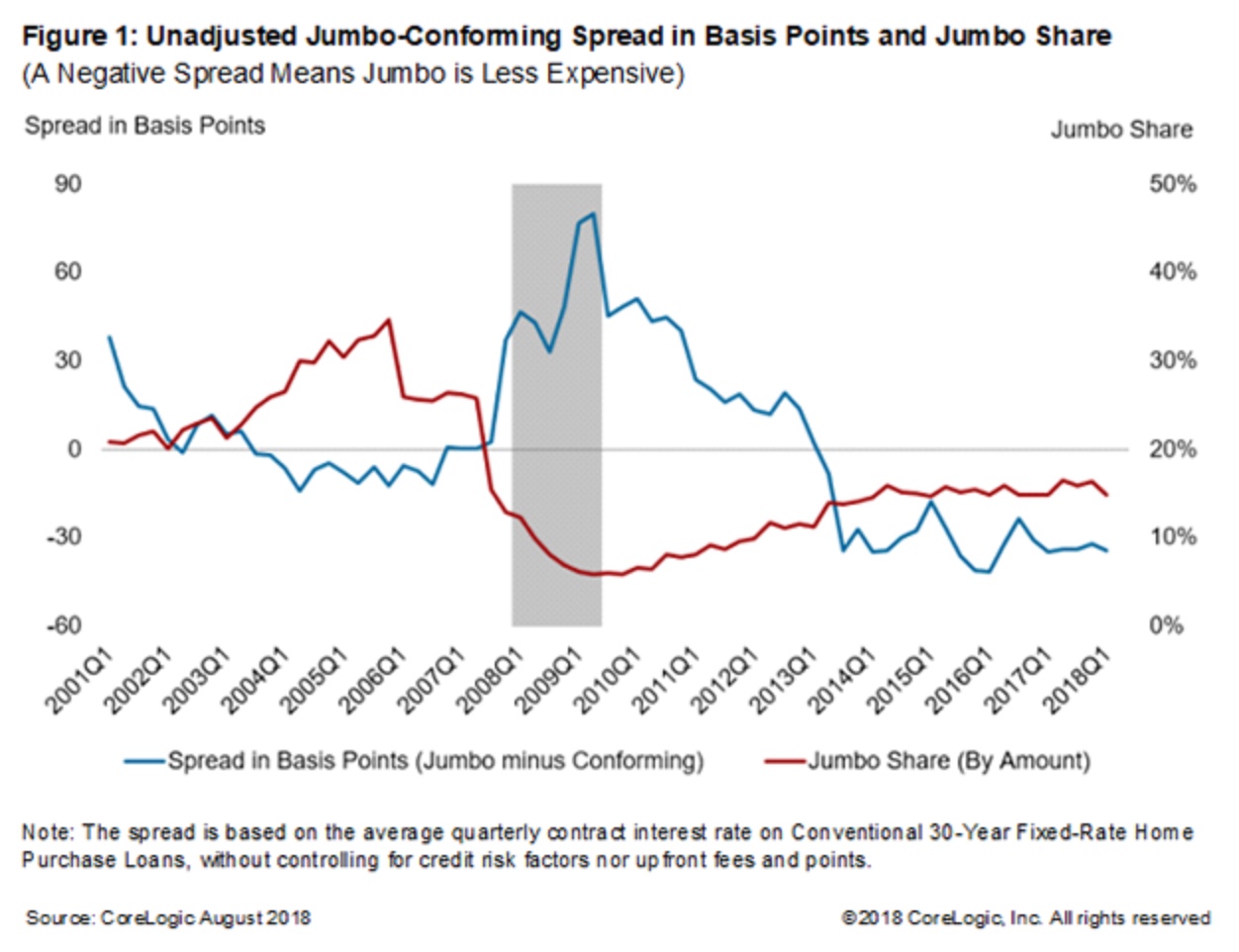

As Figure 1 shows, conforming loans were cheaper during the period from the second quarter of 2007 to the first quarter of 2013, (blue line), peaking in the second quarter of 2009 when they had an advantage of almost 80 basis points. That reversed in Q2 of 2013. The red line in Figure 1 shows that the share of jumbo loans plummeted as the spread widened and started to increase slowly as the spread narrowed in favor of jumbo loans, eventually turning negative. The share of jumbo loans has now reached its highest level since 2009, with the dollar volume of purchase originations at about 15 percent compared to 6 percent in 2009.

One of the reasons for the reversal of costs between jumbo and conforming loans as the recession was ending was the increase in guarantee fees (g-fees). This is a fee charged by the GSEs Fannie Mae and Freddie Mac, for guaranteeing loans and is reflected in the interest rates. This fee has almost tripled since 2010 from 22 bps to 57 in 2017. One purpose of this fee is to compensate for the credit risk associated with the conforming mortgage loans, however Congress imposed a 10 basis point fee in 2011 as a mechanism to pay for a temporary reduction in payroll taxes to stimulate the economy. That increase remains in effect.

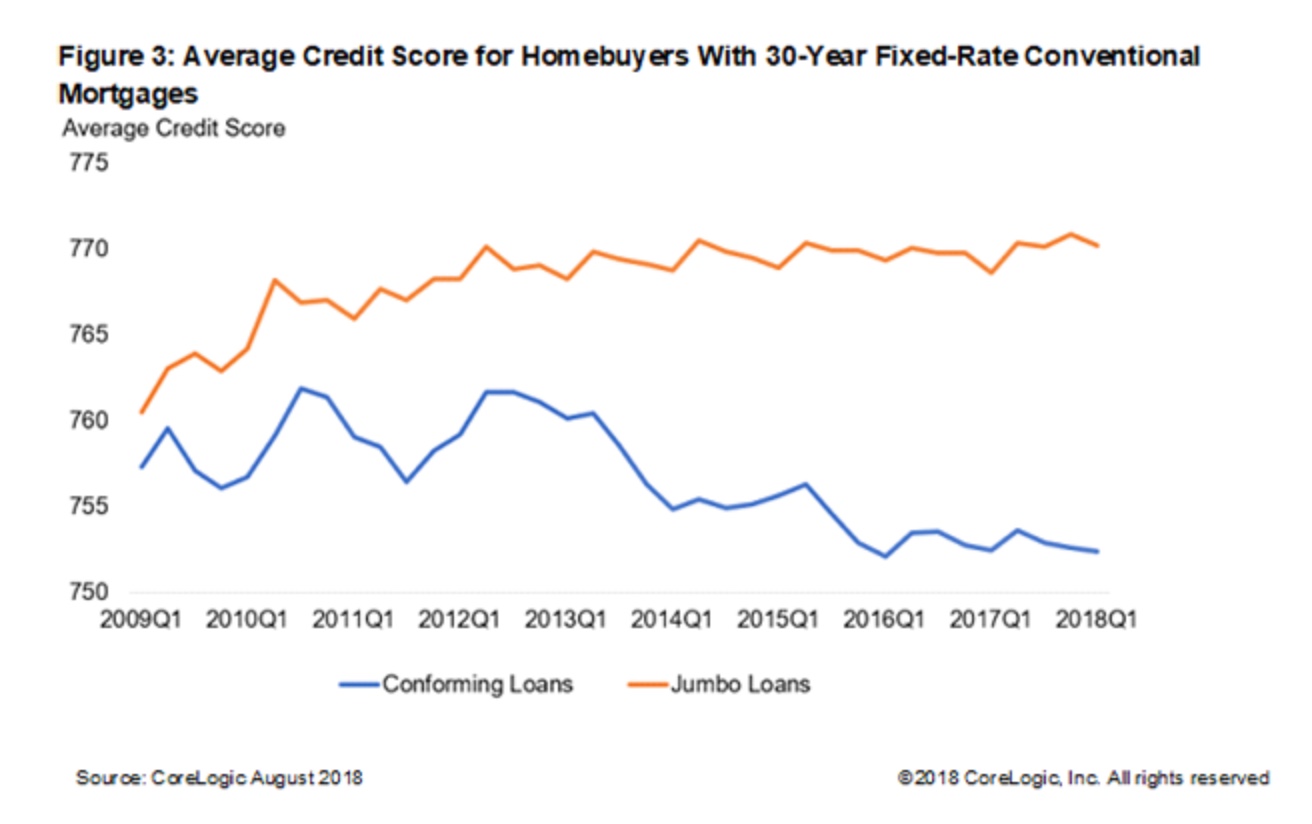

Since the GSEs cannot purchase jumbo loans, their pricing for risk and thus their g-fees affect only conforming loans. Banks do the pricing for risk for jumbo originations, and those loans have comparatively higher credit standards. These have evolved over time, but today nearly all of those large loans are made to prime borrowers and require full documentation. In the first quarter of this year the average credit score for jumbo loans was 18 points higher than for conforming loan borrowers. In 2009 the difference was only 4 points. Thus, the author says, the jumbo-conforming spread may also have been influenced by the higher-standard of jumbo loans and risk-based pricing, the process through which lenders tend to charge premiums for higher-risk mortgages and lower rates for lower-risk loans.

Prahan will look further at the risk aspects of the spread in a subsequent analysis in which she controls for loan characteristics such as credit score, loan-to-value ratio, and debt-to-income ratio.