Eric Rosengren, president of the Federal Reserve Bank of Boston, told attendees at a Federal Reserve sponsored conference on REO and Vacant Property Strategies for Neighborhood Stabilization last Thursday that there may not be a single solution for the housing market as the effects of financial crisis depend on the characteristics of each individual community.

Framing the problem affects the solutions you propose, he said.

If we assume we are trying solve a problem of foreclosures and REO rooted in the housing bubble, the solutions will tend to emphasize mitigating foreclosures, accelerating the disposition of REO, or advocating for reconsideration of the legal systems approach to personal bankruptcy and foreclosure.

If the problem is viewed as being primarily about housing demand, then the focus might be on solutions that result in sustainable home ownership such as establishing a minimum down payment or new financing approaches or financial education. The availability of affordable rental housing might also be a focus.

If the problem is seen through the lens of community, however, foreclosure may be viewed as a symptom of broader problems affecting neighborhoods - such as high concentrations of unemployment, elevated crime rates, and poor code enforcement. "Let me be clear, Rosengren said, "I am not saying that 'the community is the problem,' but rather that, in this view, different communities will experience problems differently because of their different characteristics, and often requiring different solutions. The public policy solution for this problem may be to have more general revenues available for non-profits and local governments to address the problem in a more holistic fashion."

He said that clearly the current crisis has all three elements but the solutions will be different depending on how the problem is framed. "So, we should ask, do we have the right balance as we think about the best way to address a serious - and I would argue multifaceted - public policy problem? My own view is that too little focus has been on community problems because the focus has been more targeted to housing and foreclosures."

Focusing on his home region of New England, Rosengren asked whether the current foreclosure and housing problem affects all communities similarly or if it is better understood as a crisis that is reflected differently in each community.

On a map of the three states in the Fed's New England Region, Rosengren showed the REO per square mile by zip code and compared that with changes in the median housing price from 2005 to 2008. There was little correlation between REO and changes in price at the lower levels of REO, but as the concentration rose, there was a much stronger correlation with price drops. Rosenberg admitted that not all questions of causality had been answered in this relationship and that more work is being down to control for factors such as population density.

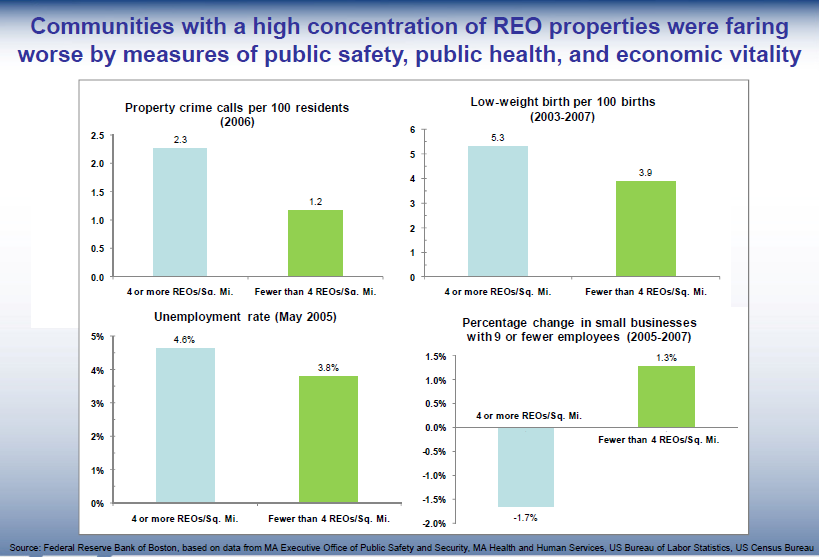

But, where concentrations of REO were high - four or more houses per square mile, there were also higher concentrations of property crimes, higher rates of low birth-weight babies, higher unemployment, and weaker activity among small businesses. Information for these charts actually predates the foreclosure crisis so these communities were already challenged.

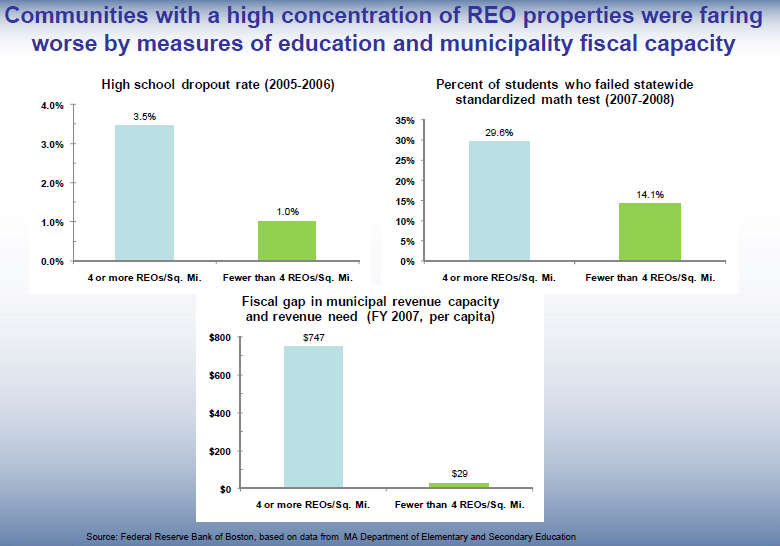

He said that it is easy to ignore children in the current crisis but many studies show that school difficulties are strongly correlated with moving and "foreclosures mean moving; to a shelter, to a relative's home, to the back seat of a car" and we can see that children in these communities were being impacted even before the dramatic increase in foreclosures. Those communities with four or more REO per square had higher high school drop-out rates and higher failures in statewide math tests. Since foreclosure is also often related to unemployment, martial stress or physical ailments, a foreclosure can make it difficult for even the most determined student to excel.

The chart also illustrates the large gap in these communities between their municipal service needs and their ability to raise revenues to pay for those needs (the "fiscal gap").

The patterns in these data imply a need for more holistic approaches to the problem. This is not a one-size-fits-all foreclosure or housing problem; these are community problems. He stressed that he was using examples from New England and the Fed needs to examine how similar or dissimilar the patterns are in other regions.

It seems, in sum, Rosengren said, that communities with some of these challenging attributes are likely to experience higher rates of foreclosure and REO. And the same communities experience greater hardships when those foreclosures and REO begin to rise. Thus, rather than treating the symptom, high REO, "we need to better understand how to resolve the more general problems in communities that lead to higher concentrations of REOs and exacerbate the effects of high REOs. However, the challenge of finding holistic solutions is significant, and longstanding."

Rosengren said that while more research needs to be done on the communities, and on which solutions work, we should also reflect on how we are spending our public policy dollars. Are they appropriately balanced to address the problems of housing deman, foreclosure, and individual communities?

As an example, he pointed to a recent Boston Fed finding that non-school revenue sharing in Massachusetts is not well aligned with communities' fiscal gaps and changes in revenue sharing are critical to helping those communities address their problems. He suggested that potentially, a federal revenue sharing program at the national level that focuses on these communities could help. These funds could be provided in a flexible way so they could target those areas of most importance - since local governments may be in a better position to determine if the funds should be directed to more teachers, more code enforcement, more police, or more assistance to non-profit organizations that are making a difference in their communities.

If a more holistic approach is needed, states and the federal government may need to examine the most effective and efficient way to address the broader problems in these communities, including potentially looking at revenue sharing that provides a flexible way to address the fiscal gap faced by many of our hard-pressed communities.

HERE is the full text of his prepared remarks and presentation slides