The Mortgage Bankers Association (MBA) today released its Weekly Mortgage Applications Survey for the week ending September 3, 2010.

The MBA's loan application survey covers over 50% of all U.S. residential mortgage loan applications taken by retail mortgage bankers, commercial banks, and thrifts. The data gives economists a snapshot view of consumer demand for mortgage loans.

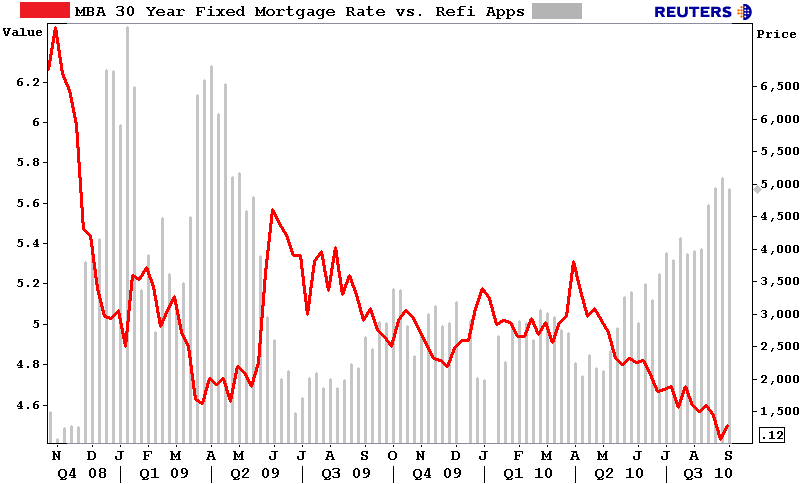

In a low mortgage rate environment, a trend of increasing refinance applications implies consumers are seeking out a lower monthly payment. If consumers are able to reduce their monthly mortgage payment and increase disposable income through refinancing, it can be a positive for the economy as a whole (creates more consumer spending or allows debtors to pay down personal liabilities like credit cards). A falling trend of purchase applications indicates a decline in home buying demand, a negative for the housing industry and the economy as a whole.

Excerpts from the Release...

The Market Composite Index, a measure of mortgage loan application volume, decreased 1.5 percent on a seasonally adjusted basis from one week earlier. On an unadjusted basis, the Index decreased 1.9 percent compared with the previous week. The four week moving average for the seasonally adjusted Market Index is up 4.4 percent.

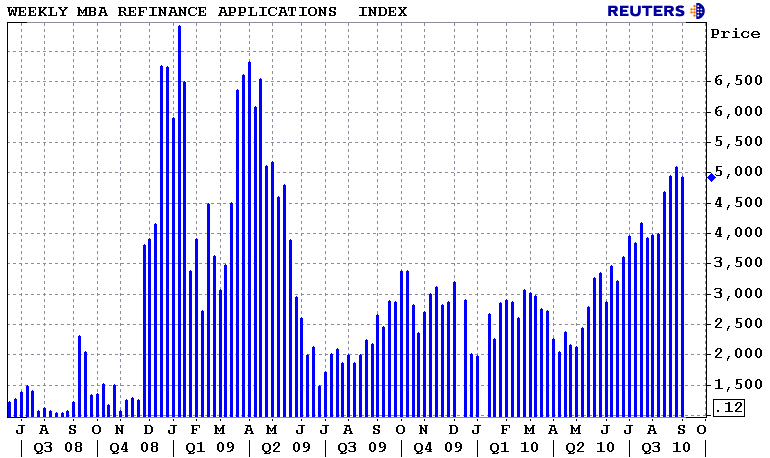

The Refinance Index decreased 3.1 percent from the previous week. The four week moving average is up 5.0 percent for the

Refinance Index. The refinance share of mortgage activity decreased to 81.9 percent of total applications from 82.9 percent the previous week.

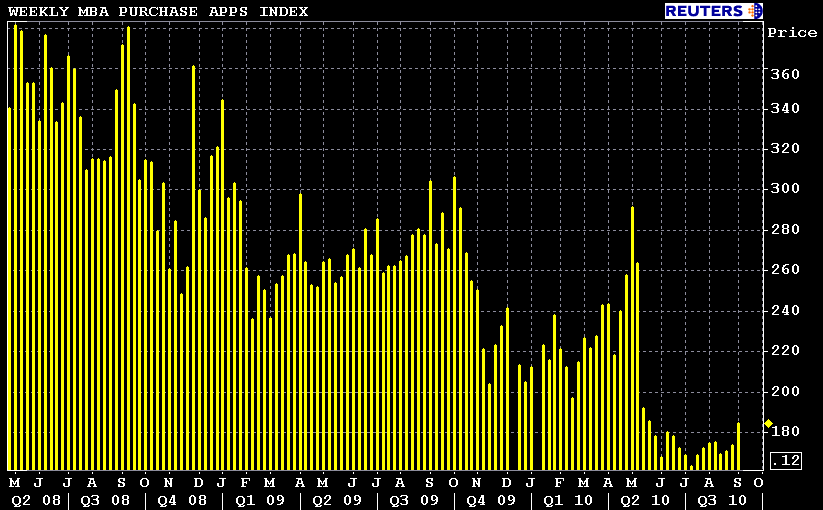

The seasonally adjusted Purchase Index increased 6.3 percent from one week earlier. The unadjusted Purchase Index increased 4.0 percent compared with the previous week and was 38.8 percent lower than the same week one year ago. The four week moving average is up 1.3 percent for the seasonally adjusted Purchase Index.

The average contract interest rate for 30-year fixed-rate mortgages increased to 4.50 percent from 4.43 percent, with points decreasing to 0.96 from 1.34 (including the origination fee) for 80 percent loan-to-value (LTV) ratio loans. The effective rate decreased from last week.

The average contract interest rate for 15-year fixed-rate mortgages increased to 4.00 percent from 3.88 percent, with points decreasing to 0.87 from 1.45 (including the origination fee) for 80 percent LTV loans. The effective rate decreased from last week.

The average contract interest rate for one-year ARMs increased to 7.00 percent from 6.95 percent, with points decreasing to 0.21 from 0.23 (including the origination fee) for 80 percent LTV loans.

The adjustable-rate mortgage (ARM) share of activity remained unchanged

at 6.1 percent of total applications from the previous week.

Michael Fratantoni, MBA's Vice President of Research and Economics says...

"Purchase applications increased last week, reaching the highest level since the end of May. However, purchase activity remains well below levels seen prior to the expiration of the homebuyer tax credit, and is almost 40 percent below the level recorded one year ago...On the other hand, refinance volume dropped last week for the first time in six weeks, but the level of applications to refinance remains close to recent highs, as historically low mortgage rates continue to draw borrowers into the market."