Low interest rates continue to expand the pool of refinancible mortgages and bolster mortgage prepayment rates according to Black Knight's Mortgage Monitor. The company, noting that Freddie Mac's 30-year fixed rate mortgages dropped 9 basis points last week to 3.49 percent, said its measure of the refinanceable population of homeowners is "the largest it has ever been" and July's prepayments were the highest in three years.

More than half of homeowners with a 30-year mortgage now have an interest rate 0.75 percent above the prevailing rate. At 24.5 million, this is the largest the pool has been since early 2013. Of those, 11.7 million are considered capable of being approved for a new loan with a credit score of 720 or more, at least 20 percent equity in their homes, and being current on their mortgage payment. This is the largest number of "high quality" refi candidates since Black Knight began tracking the data point in 2000.

The pool is also being fueled by the temporary increase in rates in 2018, rising home prices, and the quality of home loan underwriting in recent years. During the several quarters last year when rates rose, some 5 million mortgages were originated with rates above 4.5 percent, and those borrowers represent 10 percent of all borrowers and 17 percent of all refinanceable candidates. Add to this those homeowners who have not refinanced their pre-2004 vintage mortgages. They are almost all in a position to save 1.75 percent or more if they refinance and Black Knight suggests it might be worthwhile for lenders to launch campaigns soliciting these borrowers to refinance into 10-year loans.

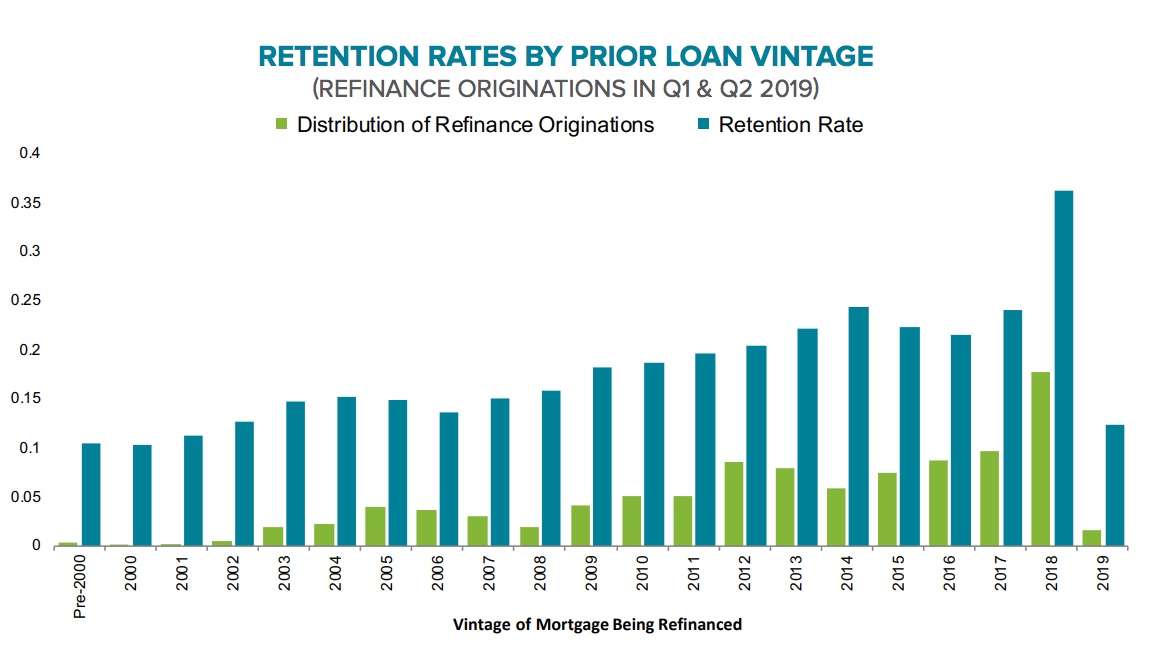

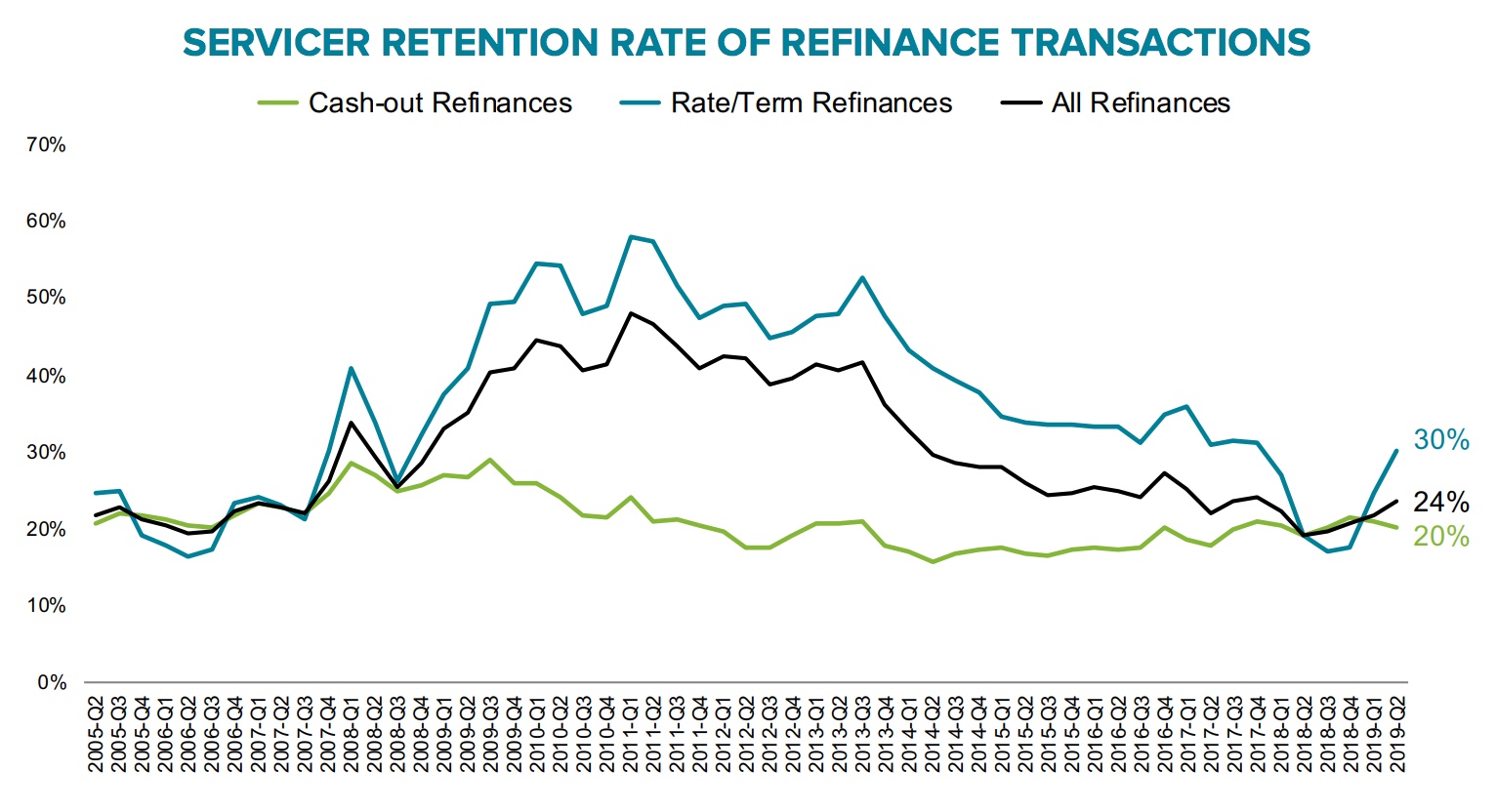

The Mortgage Monitor, in fact, stresses the importance to servicers of retaining their borrowers in what could be a wave of refinance originations, and says, to a certain extent, servicers have been successful in doing so. Last year retention rates fell to multi-year lows but in the second quarter of this year their easy access to refinance candidates allowed servicers to push retention rates up significantly, retaining a quarter of their refinancing borrowers, the highest rate in two years.

Rate/term refinance business is typically an easier mark for retention than cash-out or housing turnover prepayments and falling interest rates have promoted exactly that kind of business. Servicers managed to hold on to 30 percent of the rate/term refinancing in Quarter Two and they did even better with their customers who took out loans in 2018 and who have accounted for about 20 percent of all refinances in the first half of this year. The retention rate there has been 35 percent. With the huge part of the refinance pool the 2018 vintage represents, Black Knight suggests servicers make them another focus of retention efforts.

However, any efforts lenders have made to retain cash-out refinancers is not yielding as much return. Black Knight Data & Analytics President Ben Graboske explained, "The not-so-good news is that - in an environment of record-high levels of tappable equity and low interest rates that makes cash-out refinances an affordable option for accessing that equity - servicers are retaining just one in five cash-out borrowers. Even though rate-term refis are surging right now, cash-outs still made up some 62 percent of all refinances in the second quarter. Add to that the fact that borrowers refinancing out of 2012-2017 vintage loans account for nearly half of all refis so far in 2019, nearly 80 percent were cash-out transactions. Savvy lenders and servicers need to go beyond the low- hanging fruit of 2018 vintage loans in order to retain this business - and capture additional market share where others are missing out. The key to success is being able to identify and target these customers through an informed, data-driven growth and retention strategy."

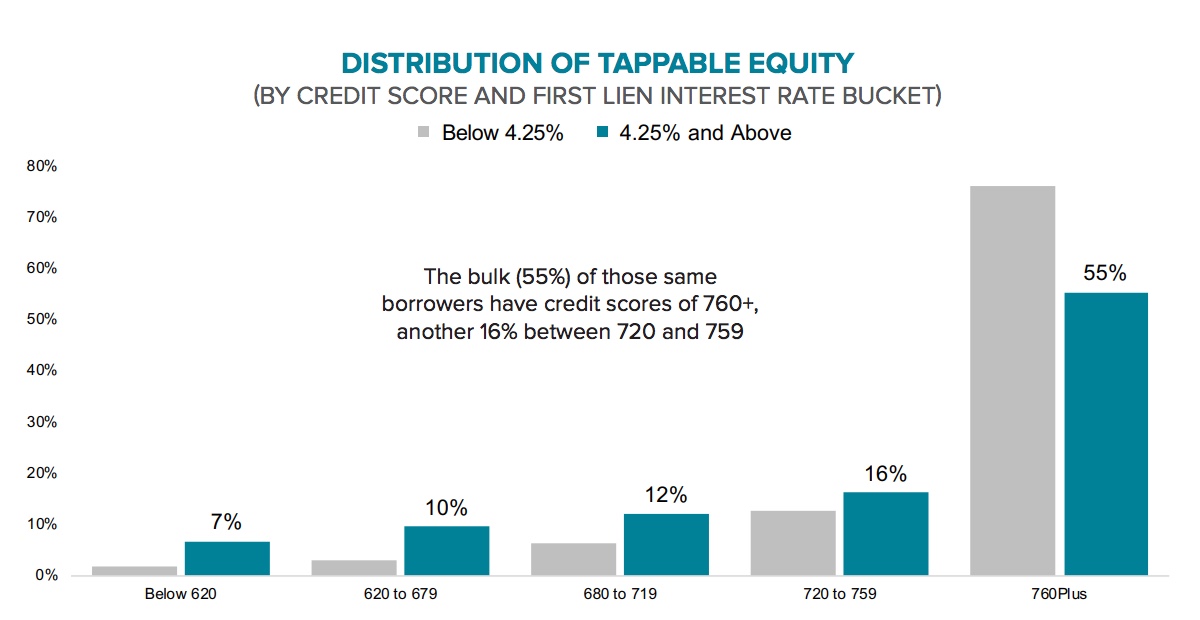

That cash out market is likely to survive the end of the current rate/term refinancing boom as tappable equity continues to rise. This month's analysis of that equity, which Black Knight defines as the amount of equity available to homeowners with mortgages before reaching a maximum combined loan-to-value (LTV) ratio of 80 percent - rose for the second consecutive quarter. Gaining $335 billion in Q2 2019, tappable equity is now at an all-time high of $6.3 trillion.

Approximately 45 million homeowners with mortgages have an average of $140,000 in tappable equity available to them. The falling rates have diminished the appeal of HELOCs as a way for homeowners to tap equity and opened up 30-year cash-outs to a relatively low-risk pool of potential borrowers. Nearly half of tappable equity holders have current first lien rates of 4.25 percent while more than three-quarters have rates of 3.75 or higher, meaning they could potentially tap into home equity with little change to their existing 30-year rate, or perhaps even experience a slight improvement. More than half of this population has credit scores of 760 or above, making for a relatively low-risk market segment; another 16 percent have credit scores between 720-759.

The size of that tappable pool seems bound to grow, at least in the short term, as price gains reaccelerated in June. Black Knight said in a previous news release that the rate of increase in its Home Price Index (HPI) rose that month for the first time since February 2018. Over that 16-month period the annual rate of appreciation had fallen from 6.75 percent to 3.7 percent. In July the rate rose to 3.9 percent. Home prices have now increased for 87 consecutive months.

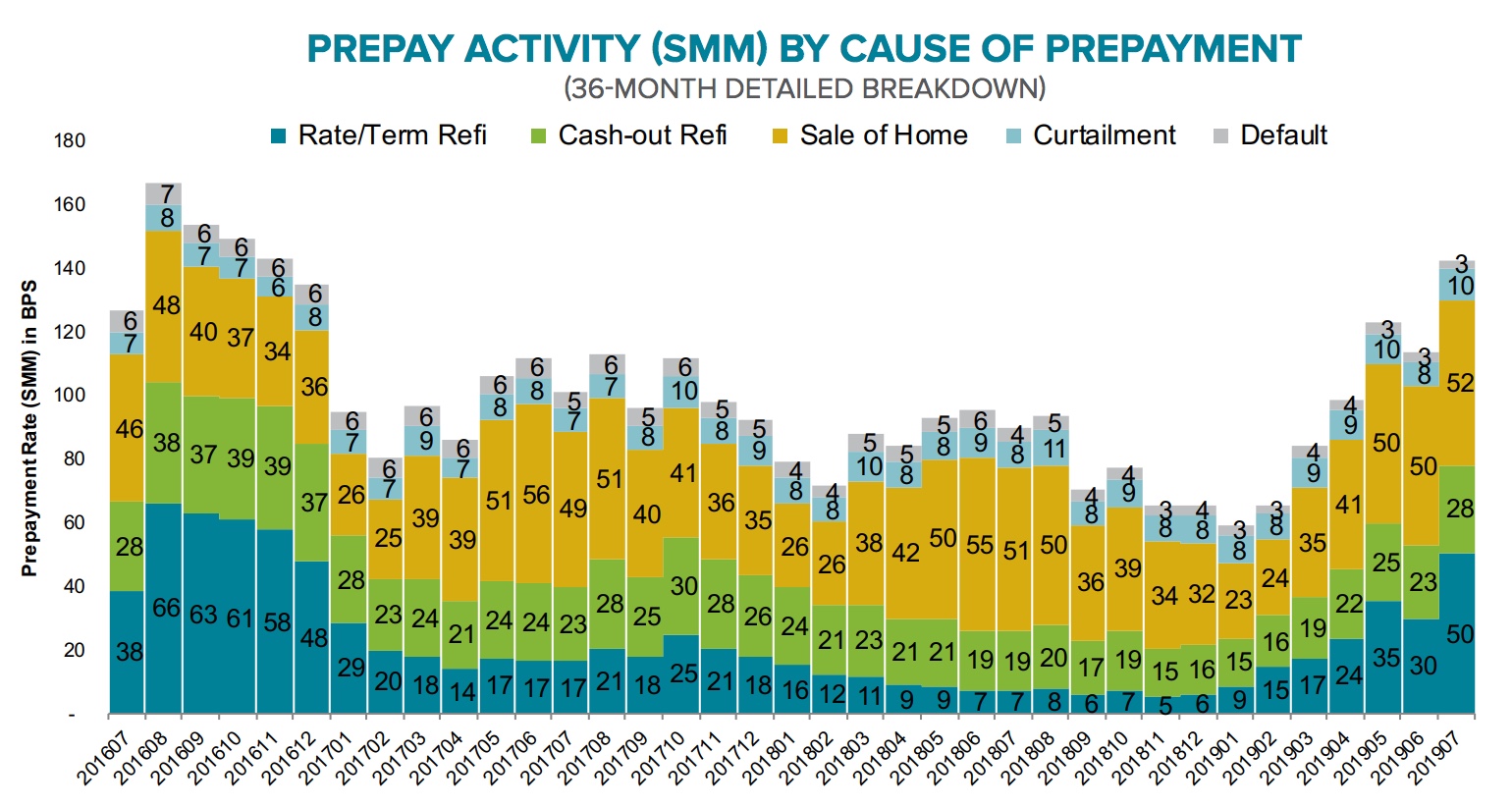

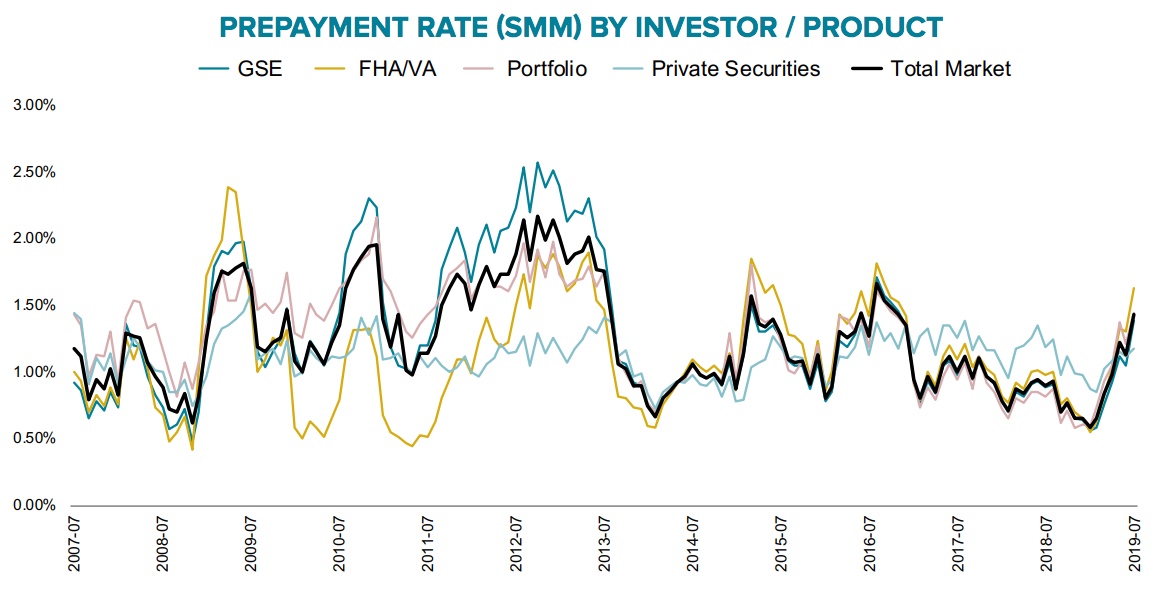

The prepayment or Single Month Mortality (SMM) rate also grew again in July, up 26 percent after a June lull. There was a 70 percent June to July increase in rate/term refinance driven prepayments and a 47 percent gain in those where cash-out refinances were the purpose. Refinances in total were behind 78 basis points of the SMM rate, three times what they were last November when interest rates were approaching 5 percent. Home Sales accounted for 52 basis points in July.

The SMM rate has grown the most over the last six months for FHA and VA loans. Prepayments on those loans are up nearly 200 percent from their January trough

Black Knight notes that rates fell to 3.6 percent and below after the beginning of August so the full impact on refinance and prepayment activity may not be known until September or October when loan originations are recorded. They predict that we could see 25 basis points of SMM "headwinds" even as home sales cool seasonally.