Mortgage application fraud declined in the second quarter of this year. CoreLogic's report on the incidence says that one out of every 123 mortgage applications submitted during the quarter (0.81 percent) had a fraudulent component compared to one in 109 (0.92 percent) in the second quarter of 2018. This is a decline of 11.4 percent. The company said it was the first decrease in the index since the third quarter of 2016 and attributed it to the strong spike in lower risk refinance originations.

New York, Florida, and New Jersey remain the top states for fraud, with New Jersey moving from second to third place. Occasions of fraud were up 8 percent on an annual basis in New York and 9 percent in Mississippi. The remaining top ten states had stable or decreasing risk.

Risk increased the most in Idaho, Alabama, New York and Delaware. States seeing the largest decreases were Kansas, Missouri, Massachusetts, Illinois, and New Mexico.

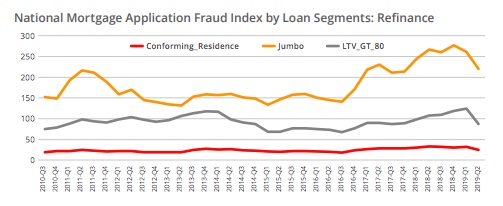

Risk declined for almost all mortgage segments except jumbo purchase loans. That risk ticked up 3.8 percent. The most notable declines were among conforming purchase and conforming refinance segments which each were down more than 25 percent. Jumbo refinance risk also fell, down 17.4 percent, and had a greater volume increase than any other segment.

CoreLogic looks at fraud risk across various types. Undisclosed real estate debt, which declined 12.8 percent in the current report, occurs when a borrower fails to disclose past real estate debt or foreclosures. Despite the decline, CoreLogic says it remains one of the most common offenses.

A second type is property fraud risk, when information about the property or its value is intentionally misrepresented. That type of application fraud was also down, falling 9.9 percent.

Income fraud decreased 7.7 percent, transaction fraud (undisclosed agreements among parties, falsified down payments) was down 3.8 percent, identity fraud was 2.9 percent lower, and occupancy fraud declined by 2.0 percent.

In its 2018 annual report CoreLogic noted an increased risk and increased frequency of applications from out-of-state investors (OOSI). They found that markets with high numbers of OOSI had higher 90-day delinquencies and foreclosures and that mortgage fraud for investment properties was 88 percent higher than the baseline and 140 percent higher when owners were OOSI. The current report finds that this activity is still trending higher. When full year 2018 data was analyzed, the company found OOSI activity increased from 20 percent in 2017 to 22 percent last year and was up 37.5 percent from 2013 to 2018.

The report also updates earlier findings about schemes to use fake employers to validate income data. Some of these "phantom employers" appear legitimate with valid phone numbers, addresses, and web sites; others may not even have a real address. The most consistent red flag is that the applications featuring them almost always have current employment of less than one year. This short tenure prevents income verification through IRS tax transcripts.

There is also a new phenomenon referred to as iBuyers. While flipping has always been a red flag for potential fraud, it has become more common and less concerning as more large and small investors are buying and renovating housing for resale. In the last two years a growing number of flips are being done by iBuyers who offer sellers instant cash sales. Their activity is up 18-fold since 2017 and they accounted for 1 percent of sales last year. The price markups for these transactions are modest and they have lower fraud risk because of their high level of transparency and because prices are rising.

CoreLogic, however, warns that these sales need to be watched. The risk could change if smaller companies try to compete and home prices fall. If speculators cannot sell properties fast enough and at an acceptable profit they could quickly drain operating capital. This could lead to schemes where the property is sold to a straw buyer and at an inflated price.