U.S. homeowners gained or regained more than $1 trillion in equity over the year that ended on June 30, 2014. According to Core-Logic's 2nd quarter 2014 analysis, 44 million homes in the country now have positive equity, a gain of 950,000 homes during the quarter.

The number homes which are still "upside-down" or "underwater," that is the owner owes more on the mortgage than the market value of the home, is now 5.3 million or 10 percent of all homes with a mortgage. In the preceding quarter (Q1) there was a negative equity share of 12.7 percent or 6.3 million homes and in the second quarter of 2013 there were 7.2 million homes or 14.9 percent that were underwater. This is a year-over-year decline of 1,962,435 or 4.2 percent.

The aggregate value of negative equity was $345.1 billion at the end of Q2 2014, down $38.1 billion from approximately $383.2 billion in the previous quarter. Year-over-year negative equity declined from $432.9 billion, a decrease of 20.3 percent in 12 months.

Nine million or 19 percent of the 44 million residential properties with positive equity are what Core-Logic calls "under-equitied," that is their owners have less than 20 percent equity in the home. Of these 1.3 million have less than 5 percent (referred to as near-negative equity). Under-equitied homeowners may have a more difficult time refinancing their existing homes or obtaining new financing to sell and buy another home due to underwriting constraints. Those with near-negative equity are considered at risk of slipping into negative equity if home prices decline. On the other hand, Core-Logic estimates that a price increase of as little as 5 percent would lift another 1 million homeowners into positive equity.

"The increase in borrower equity of $1 trillion from a year earlier is evidence that things are moving solidly in the right direction," said Sam Khater, deputy chief economist for CoreLogic. "Borrower equity is important because home equity constitutes borrowers' largest investment segment and, as a result, is driving forward the rise in wealth for the typical homeowner."

"Many homeowners across the country are seeing the equity value in their homes grow, which lifts the economy as a whole," said Anand Nallathambi, president and CEO of CoreLogic. "With more and more borrowers regaining equity, we expect homeownership to become an increasingly attractive option for many who have remained on the sidelines in the aftermath of the great recession. This should provide more opportunities for people to sell their homes, purchase a different home or refinance an existing mortgage."

Approximately 3.2 million underwater homes have only one lien while 2.1 million have both first mortgages and home equity loans. Homes with only first liens accounted for $180 billion in aggregate negative equity and the average homeowner was underwater by $57,000 with a mortgage balance of $227,000. Homes with two mortgages account for $165 billion in negative equity with an average negative balance of $77,000 on a $297,000 mortgage.

The bulk of home equity for mortgaged properties is concentrated at the high end of the housing market. For example, 94 percent of homes valued at greater than $200,000 have equity compared with 84 percent of homes valued at less than $200,000.

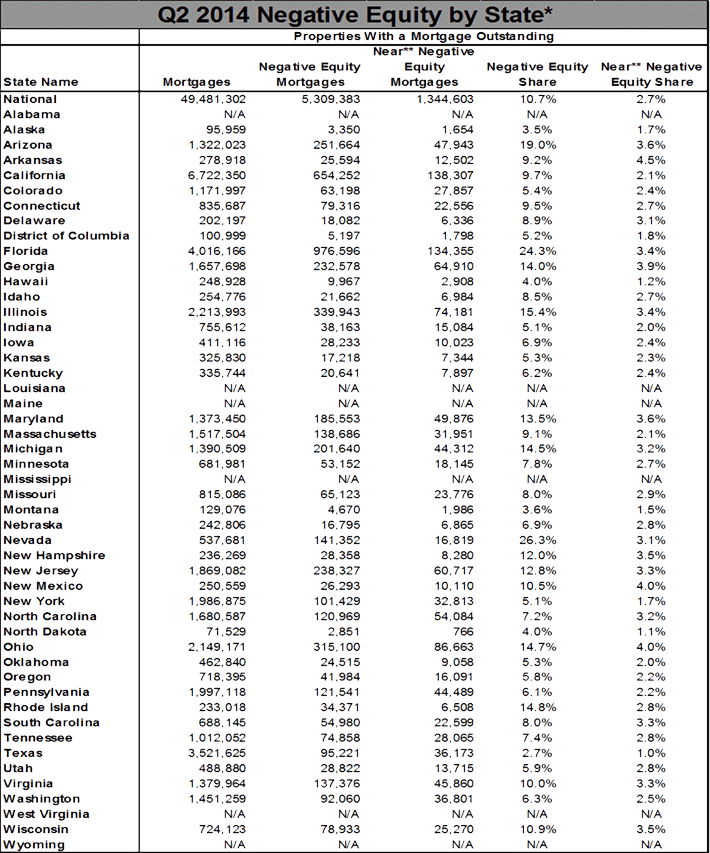

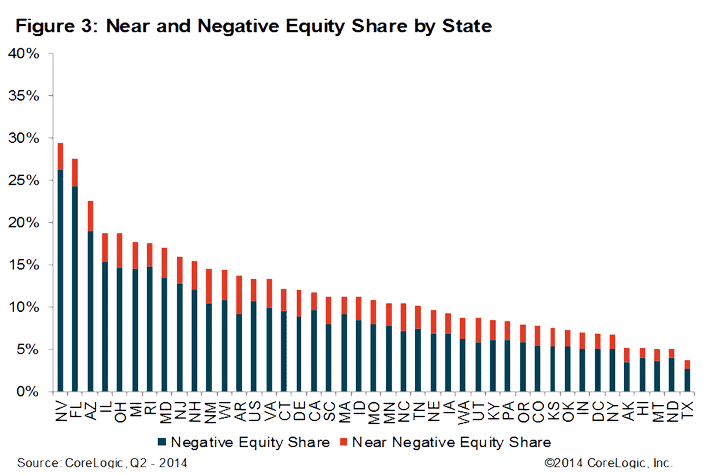

Nevada continues to have the highest percentage of properties in negative territory at 26.3 percent, followed by Florida (24.3 percent), Arizona (19.0 percent), Illinois (15.4 percent) and Rhode Island (14.8). These top five states combined account for 32.8 percent of all negative equity in the nation.

There are five states in which more than 96 percent of homeowners have positive equity. In descending order from Texas at 97.3 percent they are Alaska, Montana, North Dakota, and Hawaii.