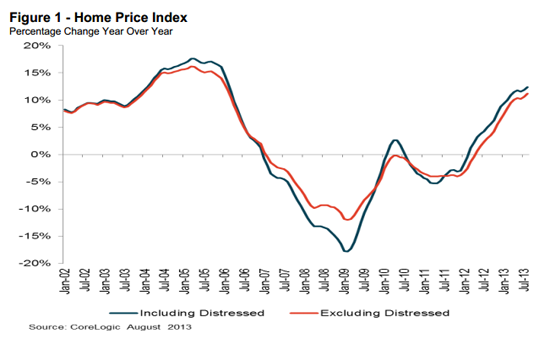

Home prices continued to increase in August, but the breakneck pace of earlier months moderated a bit CoreLogic said today. Its Home Price Index (HPI), including distressed sales, rose 0.9 percent from July to August and was 12.4 percent above the HPI in August 2012. CoreLogic said this was the 18th consecutive month in which prices were higher than in the same month the year before. When distressed sales are excluded the annual increase was 11.2 percent and the monthly increase was 1 percent.

Every state posted an increase in its HPI both whether distressed sales were included or not. The annual rate of increase including distressed sales was highest in Nevada (+25.9 percent), California (+23.1 percent), Arizona (+16.4 percent), Wyoming (+15 percent) and Georgia (+14.8 percent). When distressed sales were excluded Nevada, California, and Wyoming still lead with increases of 23.4 percent, 19.8 percent, and 14 percent respectively. Utah (+13.7 percent) and Florida (+13.5 percent) rounded out the top five.

The Pending HPI including distressed sales is projected to rise from August to September by 0.2 percent and the annual increase will be 12.7 percent. When distressed sales are excluded those increases will be 0.7 percent and 12.2 percent. The CoreLogic Pending HPI is a proprietary metric based on Multiple Listing Service (MLS) data that measure price changes for the most recent month.

"Home price gains were negligible month over month in August-an expected decrease in the pace of appreciation as housing enters the off-season," said Dr. Mark Fleming, chief economist for CoreLogic. "While prices increased more than 12 percent on a year-over-year basis, the month-to-month change is more telling of this year's late summer trend."

"After a strong run, the rate of home price appreciation slowed in August. In addition to normal seasonality, the recent sharp rise in mortgage rates off their historic lows was a clear driver behind the slowdown," said Anand Nallathambi, president and CEO of CoreLogic. "We anticipate moderate gains in home prices over the balance of this year, supported by the recent downward trend in rates and continued tight supplies of homes in many markets."

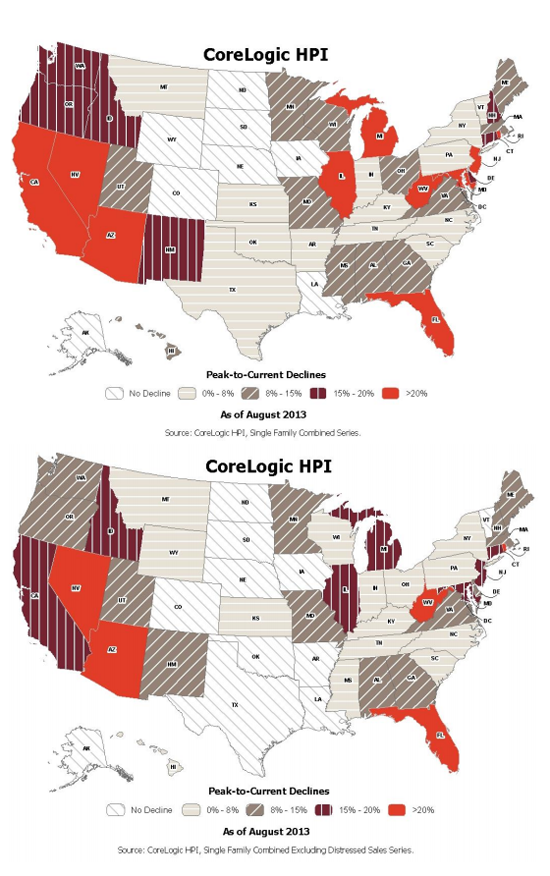

The five states with the largest peak-to-current declines in home prices including distressed transactions, were Nevada (-41.9 percent), Florida (-37.2 percent), Arizona (-32 percent), Rhode Island (-29.1 percent) and Michigan (-25.7 percent).