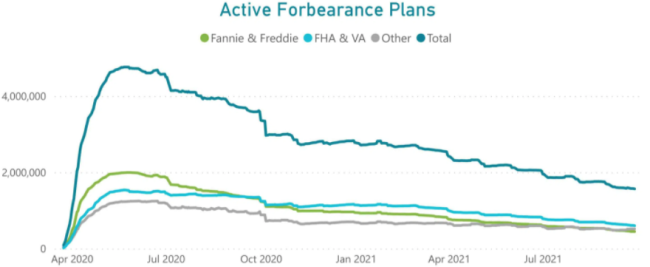

The number of loans in forbearance declined by 18,000 during the week ended September 21 and by another 11,000 during the week ended September 28. The declines over the two weeks brought the total number of loans remaining in plans to 1.567 million, 3 percent of the nation's 53 million active mortgages.

Black Knight says the number of loans remaining in forbearance has declined by 192,000 since the same point in August. The 11 percent reduction over that period is the fastest since July as early entrants into the program begin to reach their final expiration dates.

As of September 28, there were 448,000 GSE (Fannie Mae and Freddie Mac) loans remaining in forbearance, 1.6 percent of those portfolios, and 602,000 FHA and VA loans (5.0 percent.) Forborne loans serviced for bank portfolios or private label security (PLS) investors totaled 518,000 or 4.0 percent of those loans. The unpaid principal balance of forborne loans was $300 billion.

Black Knight says, "Given the sheer number of expirations, attention now turns to forbearance volumes over the next two weeks and again in early November. More than 300K active plans are still up for review for extension/removal in September, the majority of which are facing final expirations based on current agency guidelines. Another 480K plans are up for review for extension/removal in October."