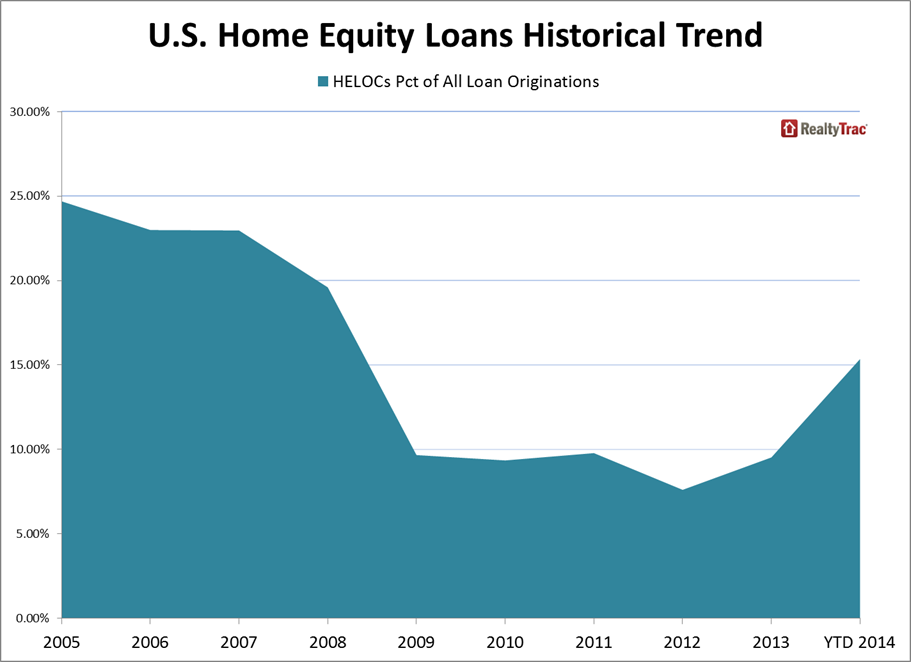

Home equity lines of credit or HELOCs accounted for over 15 percent of all 2014 home loan originations through the end of August. RealtyTrac, which released its first U.S. Home Equity Line of Credit Trends Report on Thursday said that this is the highest market share for these loans since 2008.

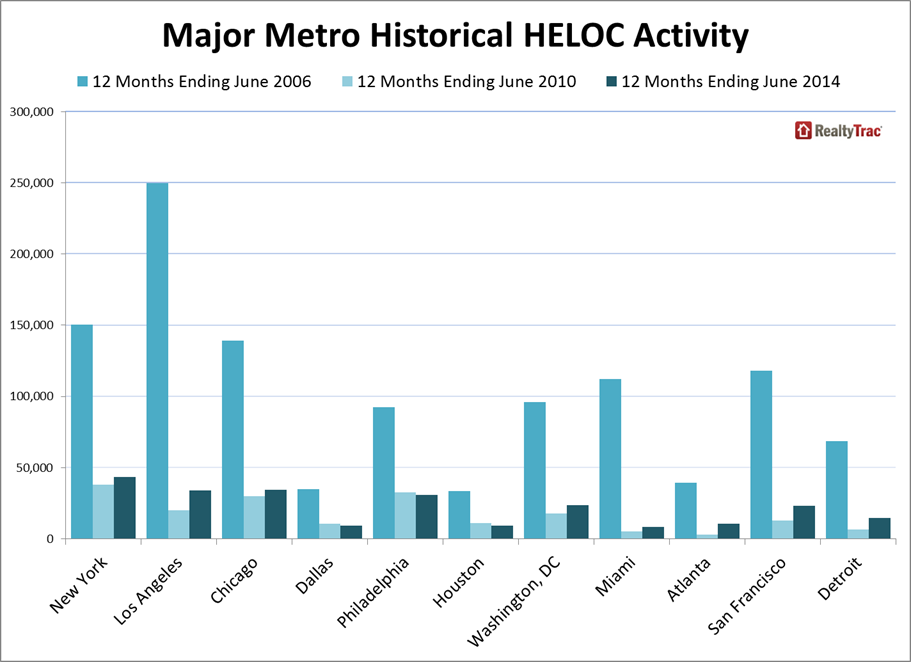

Lending for these loans increased nationwide by 20.8 percent for the 12 months ended in June 2014 compared to the 12 months that ended in June 2013. Despite the increase, HELOC originations in most areas were well below their peaks from the previous housing boom. Nationwide, the 797,865 HELOC originations in the 12 months ending in June 2014 were 76 percent below the previous peak of 3,299,007 in the 12 months ending June 2006. The 15.4 percent share of HELOCs year-to-date nationwide was also below the 24.7 percent share in 2005

"This recent rise in HELOC originations indicates that an increasing number of homeowners are gaining confidence in the strength of the housing recovery and, more importantly, have regained much of their home equity lost during the housing crisis," said Daren Blomquist. "Nearly 10 million homeowners nationwide, representing 19 percent of all homeowners with a mortgage, now have at least 50 percent equity in their homes, according to RealtyTrac data. Meanwhile the percentage of homeowners with severe negative equity has decreased from 29 percent in the second quarter of 2012 to 17 percent in the second quarter of this year.

"The rise in HELOCs also reflects a natural evolution for a lending industry looking for products they can offer to homeowners who have already refinanced their first position loan into a low fixed rate," Blomquist added. "A HELOC enables homeowners to leverage additional equity they may have gained since refinancing while still preserving the rock-bottom interest rate on their first position loan."

HELOC originations remain below their peaks in 49 of the 50 major metro areas and in many areas are well below those peaks. Even in Los Angeles, where HELOC originations increased by 55 percent since last year the level of lending is still at only at about 20 percent of its previous peak. The sole metro area which has exceeded its pre-housing crisis peak is Pittsburgh, where HELOC originations increased 13.9 percent year-over-year, bringing the city to a new peak. HELOC originations represent 24.2 percent of all originations in the city thus far in 2014