National delinquency rates continue at 10-year lows, and both early delinquency and transition rates are stable as well. But CoreLogic, in its July Loan Performance Report, points to what it calls some disturbing trends in localized areas.

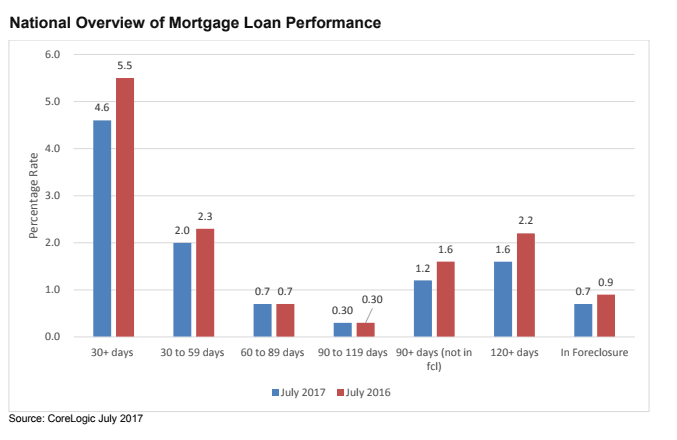

The mortgage delinquency rate was down 0.9 percent year-over-year, to 4.6 percent. The rate includes all loans 30 days or more past due, including those in foreclosure.

The improvement in performance was documented in almost all categories. The rate of early stage delinquencies, loans 30 to 59 days past due, was 2.0 percent, down 0.3 percentage point from the previous July. The foreclosure inventory rate, which measures the share of mortgages in some stage of the foreclosure process, was 0.7 percent, compared to 0.9 percent in July 2016 and the lowest since July 2007 when it was also 0.7 percent.

The serious delinquency rate, loans more than 90 days past due, showed the greatest improvement, dropping from 2.5 percent to 1.9 percent over the 12-month period. It remains near the 10-year low of 1.7 percent set in July 2007. Alaska was the only state in which serious delinquencies increased.

The only metric that didn't improve was the rate of loans that were 60 to 89 days past due. That was unchanged on an annual basis at 0.7 percent.

"While the U.S. foreclosure rate remains at a 10-year low as of July, the rate across the 100 largest metro areas varies from 0.1 percent in Denver to 2.2 percent in New York," said Dr. Frank Nothaft, chief economist for CoreLogic. "Likewise, the national serious delinquency rate remains at 1.9 percent, unchanged from June, and when analyzed across the 100 largest metros, rates vary from 0.6 percent in Denver to 4.1 percent in New York."

Transition rates also improved. CoreLogic found that the share of mortgages moving from current to 30-days past due was 0.9 percent in July 2017, down from 1.1 percent in July 2016. By comparison, in January 2007 just before the start of the financial crisis, the current-to-30-day transition rate was 1.2 percent. It peaked in November 2008 at 2 percent.

The overall delinquency rate is highest in Mississippi at 8.4 percent and Louisiana at 7.8 percent. Other states with elevated rates include New Jersey and New York with rates of 7.1 percent and 7.0 percent respectively, and Alabama at 6.4 percent.

"Even though delinquency rates are lower in most markets compared with a year ago, there are some worrying trends," said Frank Martell, president and CEO of CoreLogic. "For example, markets affected by the decline in oil production or anemic job creation have seen an increase in defaults. We see this in markets such as Anchorage, Baton Rouge and Lafayette, Louisiana where the serious delinquency rate rose over the last year."