Nearly half of the homes sold so far this year in California went for more than their asking price. Such sales usually result from so-called "bidding wars" when multiple sellers submit competing offers. The California Association of Realtors® (C.A.R.) reports that the 49.5 percent of homes that sold over list in 2013 is almost double the number of such sales in 2012 (25.9 percent) and triple the 16.6 percent share in 2011. The 20-year average for above-list price sales is an 18 percent share.

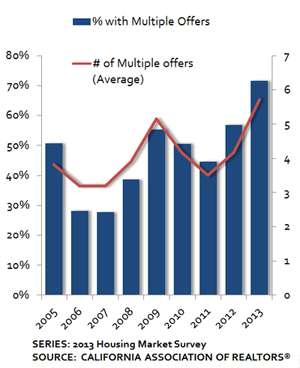

C.A.R's released this and other data from its 2013 Annual Housing Market Survey. The Survey also found that the tight inventories in the state led to multiple officers in more than 72 percent of sales compared to 57 percent in 2012. This was the highest incidence of multiple officers in at least 15 years and for each home that sold at a higher amount there were an average of 5.7 offers compared to 4.2 offers last year and 3.5 in 2011.

The survey also found that an increasing number of home sellers, nearly half of those responding, planned on purchasing another home in the future. This was the third consecutive year that statistic has increased.

"Sellers are more upbeat about the housing market and are more comfortable with their financial situation. As the real estate industry and the economy continue to recover, many sellers regained confidence in owning a home since the Great Recession," said C.A.R. President Don Faught. "The number of home sellers planning on repurchasing, in fact, increased to the highest level since 2007, which suggests that repeat buyers could be the driving force in the housing market in 2014."

Distressed homes continued to make up the most competitive part of the market. Ninety-one percent of owned real estate (REO) properties attracted multiple offers, up from 71 percent last year. Three-quarters of short sales received more than one offer compared to two-thirds last year. Close to seven of 10 equity sales attracted more than one bid in 2013, a surge from 51 percent in 2012.

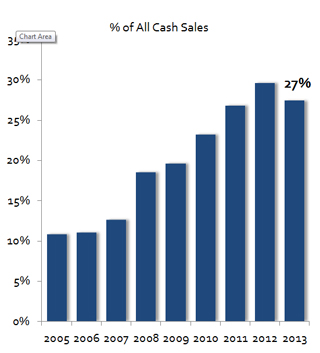

The percentage of cash sales decreased for the first time in eight years. More than 25 percent of buyers paid with cash, down from about 30 percent last year but triple the 8.8 percent rate in 2001 The Mortgage Bankers Association projected a decline in cash sales yesterday as part of its 2014 projections.

Investors remain an active component of the California market, accounting for 19 percent of sales, up from 16 percent the previous year and more than double the investor market at the beginning of the last decade. At the same time the share of first time buyers fell to 28 percent from 36 percent. It was the third decline in the last four years.

The share of international buyers purchasing in the state increased for the third straight year to 8 percent from 5.8 percent in 2012 and 5.7 percent in 2011 with more than half buying a home as a primary residence. Buyers from China, Mexico, and Canada made up the vast majority of international buyers at 34 percent, 15 percent, and 10 percent, respectively.