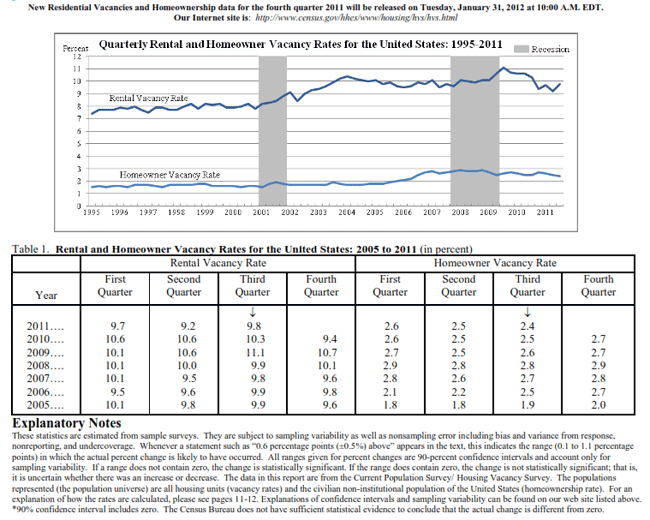

The Homeowner Vacancy Rate declined slightly in the third quarter while vacancies rose in rental housing according to information reported today by the U.S. Census Bureau. Rental vacancies are currently at 9.8 percent, up from 9.2 percent in the second quarter but 0.5 percent lower than one year earlier. Rental vacancies peaked in the third quarter of 2009 at 11.1 percent.

What are termed homeowner vacancies, i.e. the proportion of the homeowner inventory that is vacant for sale, fell to 2.4 percent from 2.5 percent in both the second quarter and Q3 of 2010. This vacancy number has remained relatively stable throughout the housing crises.

There were 132.4 million housing units counted in the third quarter, an increase of 519,000 since Q3 2010. Of that number, 113.5 million were occupied, an increase of 644,000 units. 75.2 million of those units were owner occupied (-244,000) and 38299 were rental units (904,000). A total of 14.2 percent of the housing stock is vacant. 10.9 percent of all properties are vacant year-round properties, 3.2 percent are for rent, 1.4 percent are for sale, and 5.4 percent are being held off of the market.

Rental vacancies are slightly higher in principal cities (10.4 percent) than in the suburbs (9.1 percent) and were lower in the third quarter of 2011 than in the corresponding quarter of 2010 (10.5 percent.) The change in the suburbs was more dramatic with vacancies dropping to 9.1 percent from 10.1 percent year over year. Vacancies inside of MSAs decreased from 10.3 percent to 9.8. Homeowner vacancies ranged from 2.3 percent outside of MSAs to 2.6 percent in principal cities and all rates were slightly lower than the corresponding numbers in Q3 2010.

There was a wide variation among both rental and homeowner vacancies rates on a regional basis, and more definitive rates of change. In the Northeast the rental rate was 8.0 percent, up from 7.4 percent year-over-year and the homeowner rate was 2.2 (compared to 1.6 percent.) The Midwest rental rate was 10.5 percent (down from 11.5 percent) and 2.4 percent for homeowner properties (down from 2.6 percent.) The rental and homeowner rates were 12.2 percent and 2.5 percent in the South compared to 12.9 percent and 2.8 percent in 2010, and in the West the rates were 7.3 percent and 2.3 percent compared to 8.1 percent and 2.6 percent.

The median asking price for vacant rental housing units in the U.S. is $700, up slightly from Q2. Median rents peaked in mid-2009 at around $725. The median asking price for a vacant home for sale is approximately $140,000 down slightly from Q2 but well below the pre-crisis peak of $200,000 in early 2007.

The current homeownership rate is 66.3 percent compared to 65.9 percent in Q2 and 66.9 percent one year earlier. The rate is highest in the Midwest (70.3 percent) and lowest in the West (60.7 percent). Demographically, the rate rises steadily through each age group, from 38.0 percent among those under 35 years to a peak of 81.1 percent among persons 65 years of age and older. Non-Hispanic Whites have a rate of 73.8 percent Blacks 45.6 percent, Hispanics 47.6 percent and all other races 56.4 percent. Not surprisingly, households with a family income equal to or greater than the median have a homeownership rate of 81.3 percent compared to a rate of 51.3 percent among household with less than a median family income.