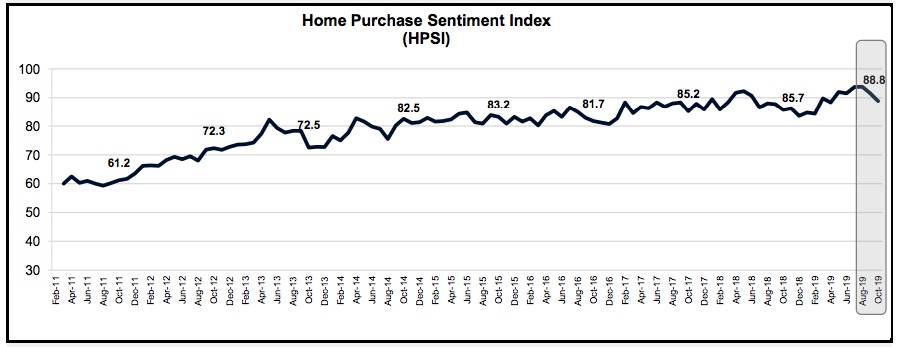

Once again the "Good Time to Buy" component of Fannie Mae's Home Purchase Sentiment Index (HPSI) is on the decline. Net positive answers to that question fell by 7 percentage points in October, helping to drag the entire index lower for the second straight month. The HPSI decreased 2.7 points to 88.8 but remains up 3.1 point compared to October 2018. The Index set an all-time high of 93.8 in September.

The HPSI is constructed from responses to six questions included in Fannie Mae's monthly National Housing Survey (NHS). Five out of six components declined in October.

The Good Time to Buy question elicited net positive responses of 21 percent. Its companion question, whether or not it is a good time to sell, fell 3 percentage points to 41 percent.

Another large decline was in the net share of those who say their household income is significantly higher than it was 12 months ago. It fell 5 percentage points to 16 percent. After dropping by a total of 12 points in August and September, the net share of Americans who say they are not concerned about losing their job regained some ground, rising 3 percentage points to 72 percent. The was the sole increase among the components.

Twenty-seven percent of respondents on net said that home prices will rise. This is 2 points lower than in September and down 10 points year-over-year. The net share of Americans who say mortgage rates will go down over the next 12 months fell 2 percentage points. While still a negative 25 percent, net responses to this question have grown by 32 points in the last 12 months.

"Consumer home purchase sentiment remains robust, with the HPSI still near its survey high despite dipping for a second consecutive month," said Doug Duncan, Senior Vice President and Chief Economist. "The 'good time to buy' component has declined notably, despite low mortgage rates, due in part to the persistent challenge of a lack of affordable housing supply. In turn, the net share of consumers expecting home prices to increase over the next 12 months has fallen to its lowest reading in seven years. Still, low mortgage rates and a strong labor market are supporting the index's overall strength, which is consistent with our expectation for a modest expansion in home purchase activity in the fourth quarter."

The NHS, from which the HPSI is constructed, is conducted monthly by telephone among 1,000 consumers, both homeowners and renters. In addition to the six questions that form the framework of the index, respondents are asked questions about the economy, personal finances, attitudes about getting a mortgage, and questions to track attitudinal shifts. The October 2019 National Housing Survey was conducted between October 1 and October 23, 2019. Most of the data collection occurred during the first two weeks of this period.