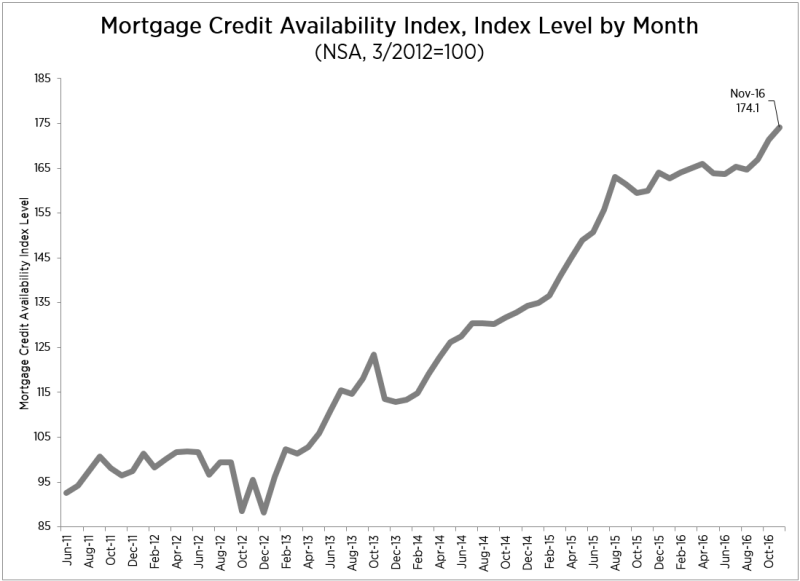

Access to mortgage credit continued its recent upward trend in November. The Mortgage Bankers Association said on Monday that its Mortgage Credit Availability Index (MCAI), increased by 1.6 percent from October to 174.1. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

Lynn Fisher, MBA's Vice President of Research and Economics said of the index, "Mortgage credit availability increased for the third consecutive month in November, driven by increased availability of conventional low down payment and streamlined refinance loan programs."

Of the four component indices, the Conforming MCAI saw the greatest increase in availability over the month (up 2.2 percent), followed by the Government MCAI (up 1.8 percent), the Conventional MCAI (up 1.5 percent), and the Jumbo MCAI (up 0.8 percent).

The MCAI analyzes data from Ellie Mae's AllRegs® Market Clarity® business information tool. The index was benchmarked to 100 in March 2012. The Conforming and Jumbo indices have the same "base" level as the MCAI and now stand at approximately* 93 and 220 respectively. MBA says it used that same date to calibrate the other two indices "to better represent where each index might fall in 2012" and set those bases at 73.5 for Conventional loans and 183.5 for Government loans. The indices for those are now at 95 and 425 respectively.

*MBA does not provide absolute numbers for the sub-indices. Approximations of their current levels are derived from graphs in its press release.