The pandemic keeps manifesting itself in the housing market in small but potentially significant ways and there was another data point in Black Knight's new Mortgage Monitor report. The report focuses on delinquencies, price increases, and the continuing inability of servicers to retain customers in the refinancing frenzy. However, it also notes some differences that seem to be developing in pricing, inventory, and delinquencies in the condominium sector.

These may be related to the perceived trend for homebuyers to seek out less dense living situations to protect themselves and their families against exposure to the COVID-19 virus, to want to be able to spend more leisure time outdoors for the same reason, needing more space for working and learning at home, and for commuting time to be of less concern given the acceptance of remote work. While these trends are impacting all types of housing, Black Knight says, "the pandemic has shaped the condominium market in an inverse way."

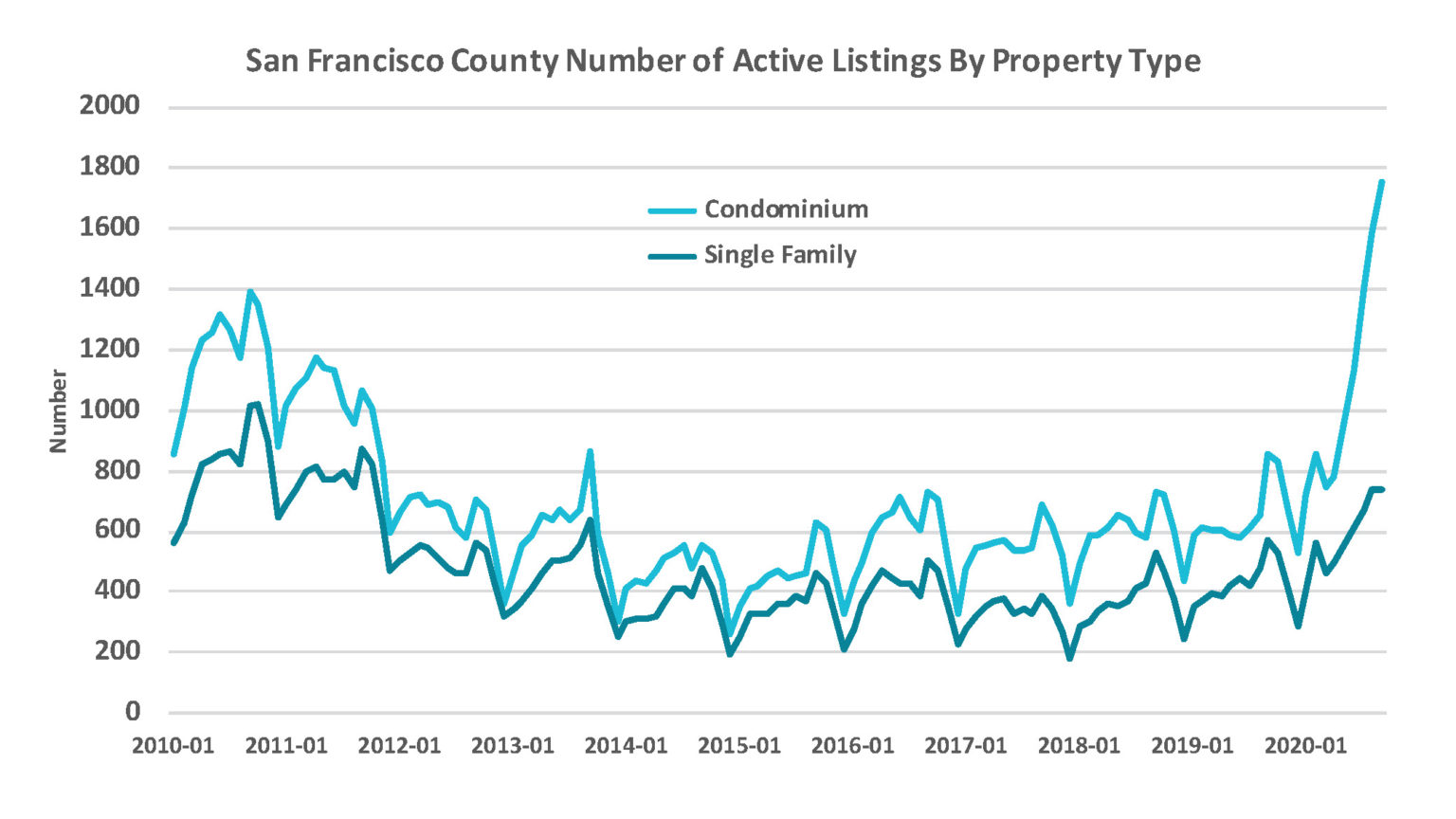

Even as the inventory of available homes is at an all-time low, Black Knight says condos have seen a large increase in availability. This is especially apparent in some of those very cities, such as San Francisco, that homeowners are leaving in droves.

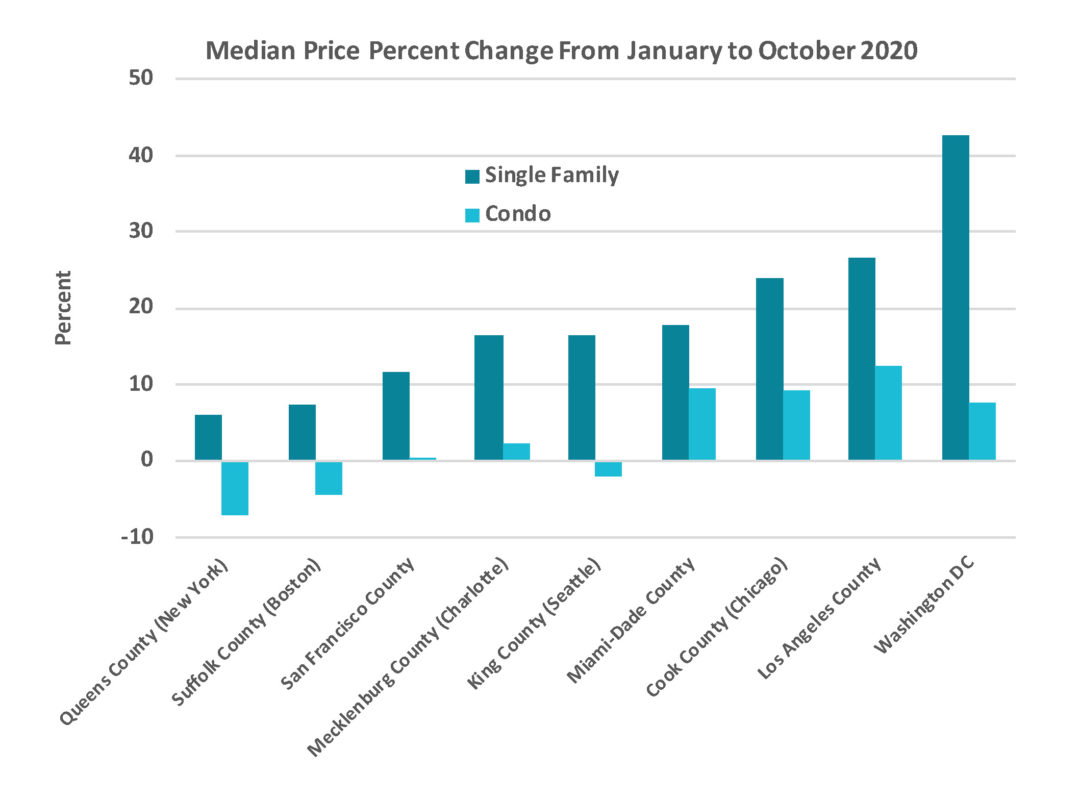

As might be expected, while Black Knight says single family homes prices had increased by 16 percent year-over-year by September, the increased inventory is lowering the average sales prices of condo units as can be seen in some major metro areas.

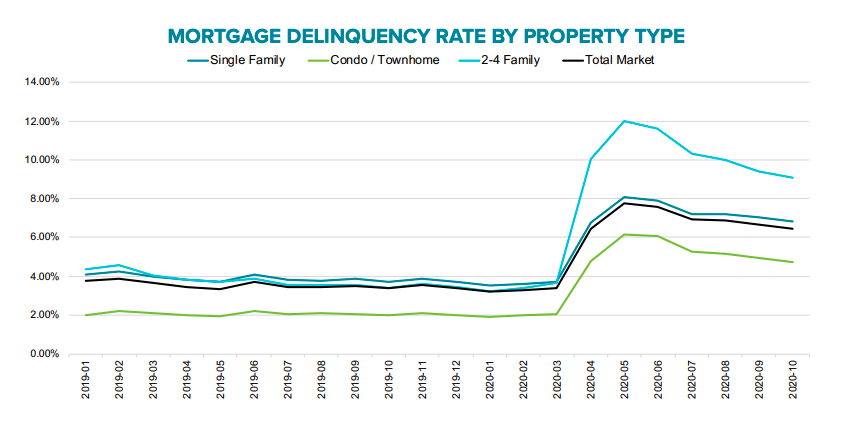

Also, while delinquencies spiked among all housing types in the spring, the gain among condos was more pronounced than for single-family units and the company says the migration away from city centers and the increased inventory of condos and townhomes was probably responsible. However, the delinquency rate for condos is still much lower (4.7 percent in October) than for single families at 6.81 percent. Two-to-four units properties have the highest rate at 9.06 percent, most likely because homeowners are having difficulties with financially distressed tenants.

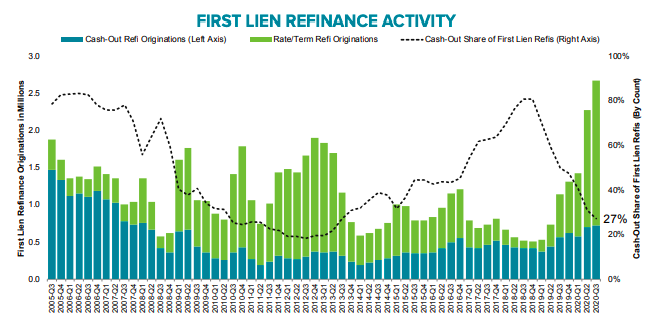

The company also reports that there have been 6.4 million refinanced first mortgages in the first three quarters of 2020. These originations represent about $2 trillion in volume. It used rate lock data last month to project originations would set records in the third quarter which indeed then saw the largest single quarter of purchases ($455 billion), refinances ($867 billion) and total lending ($1.3 trillion) ever recorded.

Data & Analytics President Ben Graboske now says, "As our rate lock data had suggested last month, Q3 2020 originations hit record highs in purchase, refinance and overall lending as record-low mortgage rates and a delay to the normal spring home-buying season spurred both the purchase and refinance markets. Some 2.7 million homeowners refinanced their first-lien mortgages in the third quarter, bringing the total through September 2020 to 6.4 million. What's more, consolidated rate lock data from Black Knight's Compass Analytics and Optimal Blue divisions suggests that number could climb above 9 million by year's end. And, with rates continuing to sit at record lows, refinance incentive remains at historic highs. As of the last week of November, 19.4 million 30-year mortgage holders could likely both qualify for and benefit from a refinance."

Those 9 million 2020 originations will probably represent a volume of nearly $4.4 trillion. This will easily the largest such volume of any year on record.

While cash-out refinances have grown along with the overall numbers, they made up only 27 percent of the total in the third quarter, the lowest share in seven years. The average cash-out amount fell from $63,000 in Q2 to $51,600 representing $37 billion in equity withdrawn.

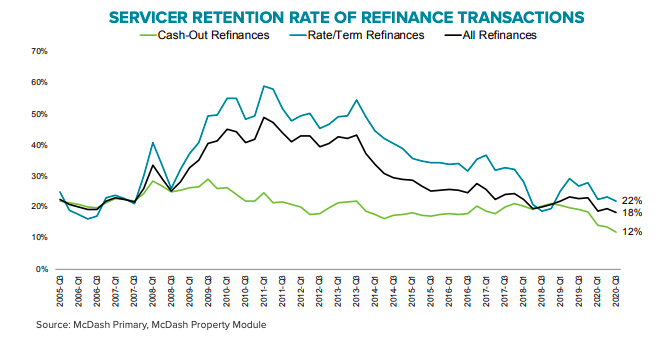

But Black Knight points out that servicers are missing out on the potential benefits of the refinancing boom. Graboske says, "Despite record levels of incentive and lending, mortgage servicers continue to struggle to retain customers, losing the business of more than 80 percent of homeowners who refinance. Pricing appears to be a significant factor in servicers' ability to retain customers, as homeowners who changed lenders received noticeably better rates than those whose business was retained."

The 18 percent of refinancing homeowners who remained with their servicers were the lowest share on record. While 22 percent of rate/term refinancing homeowners were retained, only a record-low 12 percent of cash-out refinance borrowers were retained Pricing (rate offerings) appears to be a key factor in these record-low retention rates. While homeowners who refinanced in Q3 received the lowest interest rates of any group on record, those who "left for greener pastures" received noticeably better rates.

The company looked at borrowers with 720+ credit scores who refinanced into 30-year, fixed-rate, GSE loans. Those who left their current servicer (and likely lender as well) received a more than 1/8th of a percent lower interest rate than those who remained. This was more than twice the spread in Q3. "It stands to reason that rate volatility led to more rate shopping, and in turn, less retention. With that in mind, servicers and lenders alike need to ensure their rate pricing is competitive, especially with the stakes as high as they are right now given record high refinance volumes."

Graboske concluded, "In today's rate environment, and up against fierce competition, lenders need the most precise product and pricing intelligence available. That said, successful retention likely goes beyond pricing to also include a positive customer experience."