The net worth of U.S. households worsened during the third quarter of 2011 according to the Federal Reserve's Flow of Funds Summary for the quarter. The figure, which represents the difference between the values of a household's assets and its liabilities, declined about $2.4 trillion to an estimated $57.4 trillion.

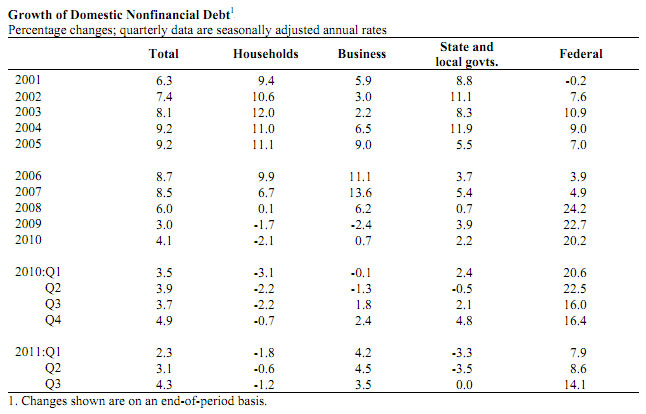

Household debt declined by an annual rate of 1.25 percent, continuing the contraction that began in the third quarter of 2008, almost entirely because of a drop of 1.25 percent (annualized) in mortgage debt, although this rate has lessened since the first half of the year. In contrast, consumer credit rose for the fourth quarter in a row with an annualized rate of increase in the third quarter that was also 1.25 percent.

Nonfinancial business debt was up at a rate of 3.50 percent, a 1 point decrease from the rate in the second quarter. Corporate bonds outstanding and business loans increased while commercial mortgage debt continued to decline although at a more moderate pace than in 2010. Overall domestic nonfinancial sectors expanded at a seasonally adjusted annual rate of 4.25 percent, about 1.25 percentage points faster than in the second quarter.

State and local government debt was unchanged during the quarter while debt held by the federal government increased at an annual rate of 14 percent.

At the end of the third quarter outstanding domestic nonfinancial debt totaled $37.8 trillion, household debt was 13.2 trillion, nonfinancial business debt was $11.5 trillion and total government debt was $13.1 trillion.