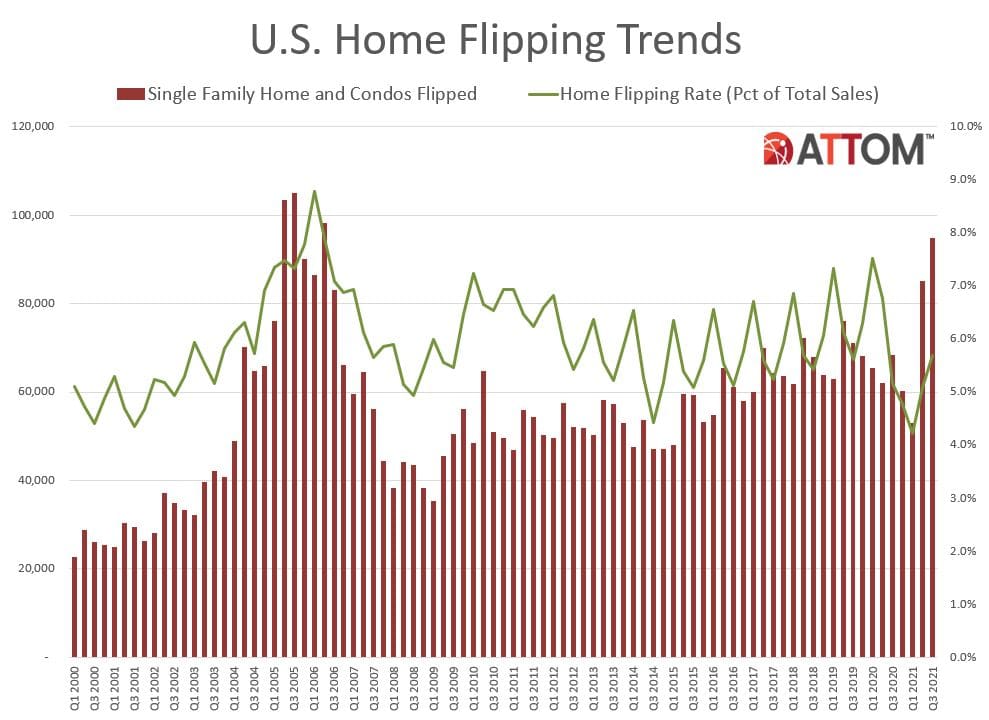

Even as home prices rise into the stratosphere home flipping remains an active endeavor, accounting for just under 6 percent of all home sale transactions in the third quarter of this year. A flip is defined as any arms-length transaction during the quarter within 12 months of a previous arms-length transaction on the same property.

ATTOM says there were 94,766 single-family houses and condominiums flipped during Q3, 1 out of 18 transactions. It was the second quarter in a row that flipping increased after a full year of declines and was a slightly more than a 5 percent increase from both the second quarter of this year and the third quarter of 2020.

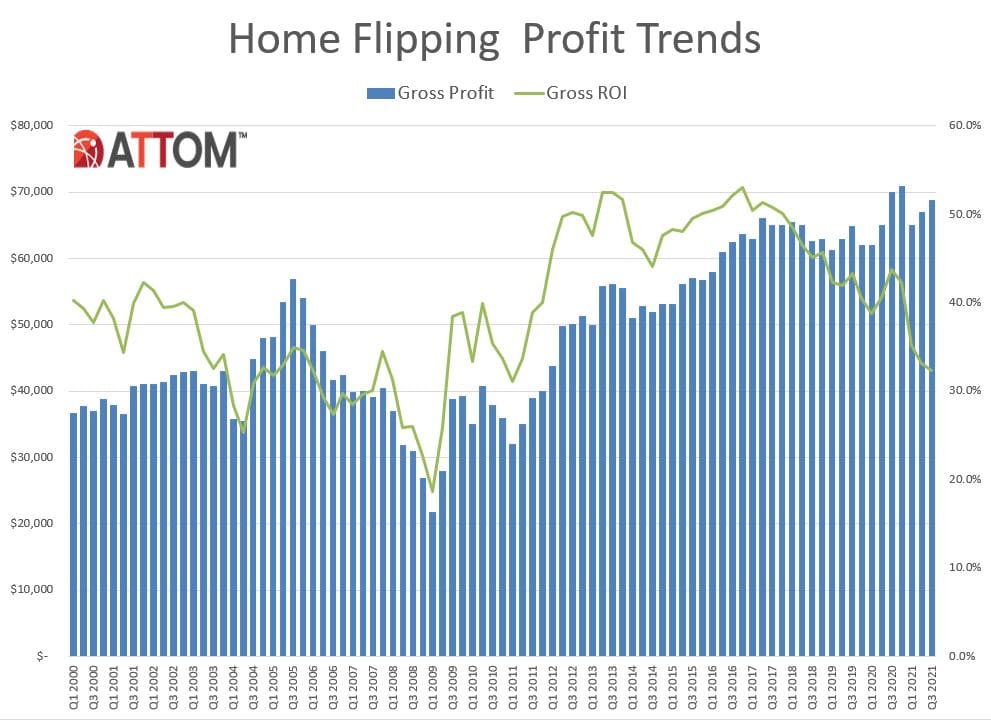

But ATTOM's U.S. Home Flipping Report also shows that typical raw profits remained below where they were a year ago and, more importantly, profit margins dipped to their lowest point since early 2011. The average gross flipping profit is the difference between the purchase price and the flipped price. The calculations do not include rehab costs and other expenses incurred. Flipping veterans estimate those costs typically run between 20 percent and 33 percent of the property's after-repair value. Gross flipping return on investment (ROI) is calculated by dividing the gross flipping profit by the original purchase price.

Among all flips nationwide, the typical gross profit stood at $68,847, up 2.7 percent from $67,008 in the second quarter of 2021. However, it was 1.6 percent less than the $70,000 level recorded in the third quarter of 2020.

Profit margins fell for the fourth quarter in a row. That $68,847 gross profit translated into just a 32.3 percent return on investment compared to the original acquisition price. The national gross-flipping ROI was down from 33.2 percent in the second quarter of 2021 and from 43.8 percent a year earlier, to its lowest point since the first quarter of 2011. ATTOM says that annual decline in the typical profit margin was the largest since early in 2009, when the housing market was crashing from the effects of the Great Recession.

Driving the drop in profit margins was the surge in prices paid for acquisition, a median of $213,000. Resale prices also rose to a median of $281,847, an all-time high. This was up 4.8 percent from $269,000 in the second quarter of 2021 and 22.5 percent from $230,000 a year earlier. That annual increase stood out as the largest for flipped properties since 2005 while the quarterly gain was the second biggest since 2015. However, the gains in resale prices didn't surpass increases that investors were absorbing - 5.4 percent quarterly and 33.1 percent annually - when they bought the homes that were sold in the third quarter of this year.

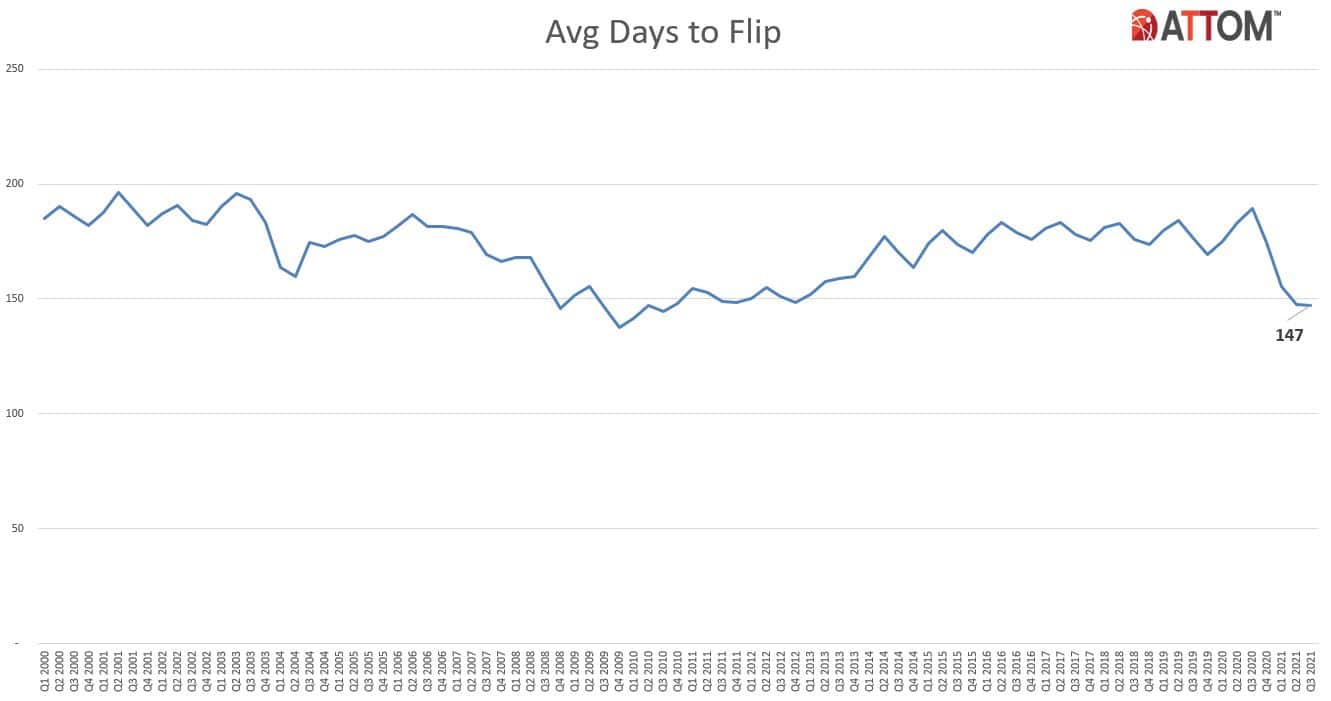

"Home flipping produced another round of competing trends in the third quarter of this year as more investors got in on the action but got less out of it," said Todd Teta, chief product officer at ATTOM. "It's clear that declining fortunes weren't enough to repel investors amid a typical scenario of 32 percent profits before expenses on deals that usually take an average of five months to complete. We will see over the coming months whether the amount they can make on these quick turnarounds will still be enough to keep luring them into the home-flipping business or start pushing them elsewhere."

Flipping increased its share of home sales in the third quarter in 142 of the 195 metropolitan statistical areas analyzed in the report (73 percent) although the increase was generally less than 1 percent. Metro areas with the highest rates of flipping, all in the 9 to 10 percent range, included Ogden, and Salt Lake City, Utah; Phoenix, Arizona; Salisbury, Maryland; and Laredo, Texas.

Home flippers who sold properties in the third quarter of 2021 took an average of 147 days to complete the transactions, the smallest turnaround time since the third quarter of 2010. The latest number was down from an average of 148 in the second quarter of 2021 and 189 in the third quarter of 2020.

The share of flipped homes in the third quarter that were acquired as all-cash purchases increased to 60.4 percent from 59.4 percent the prior quarter and 57.7 percent in the third quarter of 2020.