According to data reported on Wednesday by CoreLogic, the residential shadow inventory as of October stood at 1.6 million housing units, a supply of 5 months. This was relatively unchanged from figures in July. In October 2010 the inventory was an estimated 1.9 million units, a 7 months' supply. CoreLogic said that the flow of new seriously delinquent loans into the shadow inventory has been offset by the roughly equal sales flow of real estate owned and short sales. Some 3 million distressed homes have sold since January 2009, the point at which prices were falling the fastest, yet the shadow inventory is at essentially the same level as in that initial month.

Shadow inventory includes homes that are seriously delinquent (90 days or more), in foreclosure or already owned by lenders (REO) but are not currently listed by local multiple listing services. This formulation does not include the homes that are typically included in official counts of unsold inventory.

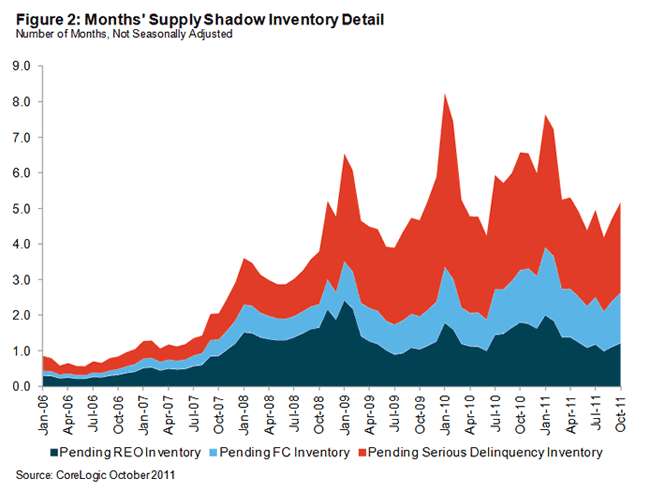

The 1.6 million units in the shadow inventory represent half of the 3 million properties that are currently seriously delinquent, in foreclosure, or in REO. The shadow inventory includes 770,000 units that are seriously delinquent (2.5 months supply), 430,000 are in some stage of foreclosure (1.4 months supply) and 370,000 are already in REO (1.2 months supply.)

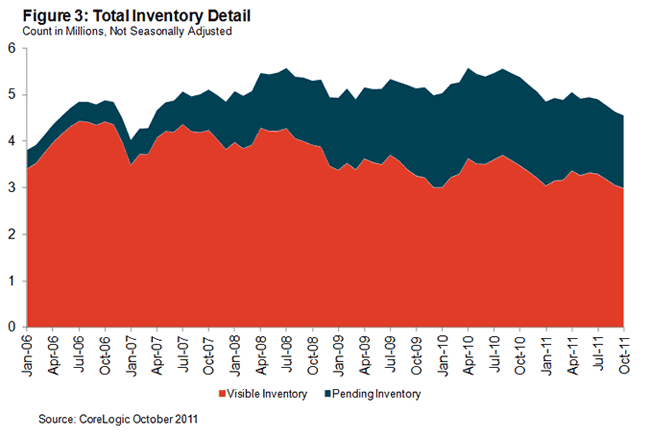

Based on current estimates of the visible inventory (both distressed and non-distressed), the shadow inventory is approximately half of all visible inventory listings. For every two homes available for sale, there is one home in the "shadows"

The inventory is approximately four times as large as at its low point (380,000 properties) at the peak of the housing bubble in mid 2006. According to CoreLogic, a healthy housing market should have less than one-months supply of shadow inventory. This level could be easily absorbed without impacting house prices unless the inventory was geographically concentrated.

The inventory, however, is concentrated to a large extent. Florida, California and Illinois account for more than a third of the shadow inventory. The top six states, which would also include New York, Texas and New Jersey, account for half of the shadow inventory. In addition, the shadow inventory is often located in suburban and exurban submarkets where those properties compete with new home sales. This may be one reason why new homes are currently running at 7 percent of all sales rather than a more typical 12 percent.

"The shadow inventory overhang is a large impediment to the improvement in the housing market because it puts downward pressure on home prices, which hurts home sales and building activity while encouraging strategic defaults," said Mark Fleming, chief economist for CoreLogic.