Mortgage lenders continue to see a negative profit outlook for the first quarter of the New Year, the fifth consecutive quarter they have done so. Thirty-eight percent of respondents to Fannie Mae's Fourth Quarter Mortgage Lender Sentiment Survey® expect their profits to decline over the next three months while 46 percent think it will remain essentially the same. While institutions of all sizes and types generally reported an expected net decrease in profit margin, larger institutions were the most likely to do so.

On net, lenders said they view competition from other lenders as their biggest hurdle to profitability. This sentiment, which has driven profit concerns for five consecutive quarters, reached its fourth straight survey high with 75 percent of those with a negative outlook naming this as a reason. Among those expecting profits to improve, increased operating efficiency was cited most often.

Fannie Mae's survey was conducted with representatives of 196 lending institutions including 74 mortgage banks, 77 depository institutions, and 37 credit unions. Fifty-five institutions were classified as mid-sized, with assets between $248.3 million and $1.01 billion; 72 were larger and 69 were smaller. Questions about loans were asked across three loan types; GSE eligible, GSE non-eligible, and government loans.

More lenders reported seeing declining demand for refinancing over the previous three months. This continues a trend that started in the first quarter of 2017. The net share of lenders who expect to see refinancing demand grow in the first quarter of 2018 fell to the lowest reading in a year across all three loan types.

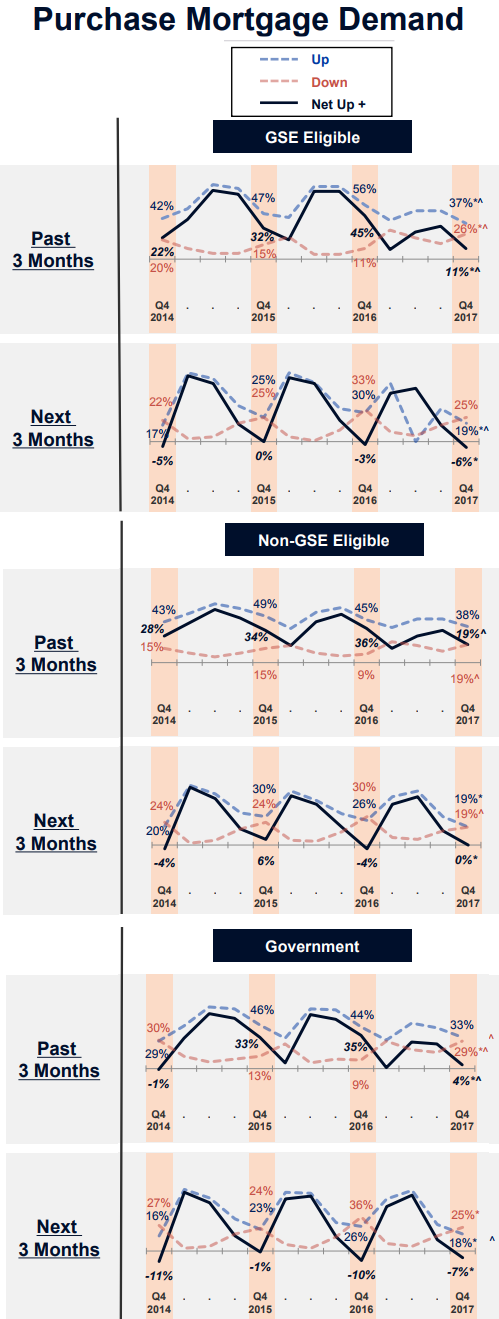

Demand for purchase loans was also lower for all loan types compared to the previous quarter and was the lowest for any fourth quarter over the past three years. The net share of lenders who expect an increase in purchase mortgage demand over the next three months was about the same as it has been for recent fourth quarters.

"Key trends have persisted throughout this year," said Doug Duncan, senior vice president and chief economist at Fannie Mae. "Lenders who see declining profits outweighed those noting improvements in the bottom line for the fifth consecutive quarter. Three-fourths of those seeing deteriorating profits cite competition as the most important reason - a survey high - compared with only about one-third two years ago. This is not surprising given that refinance volume continues to shrink. More lenders reported a pullback in refinance demand from the prior quarter than those who saw an increase, continuing the trend that started at the beginning of the year. This finding is consistent with our forecast for a steady drop in refinance originations this year. With the outlook calling for rising interest rates and continued tight housing inventory constraining home sales, increased competition will likely continue to drive lenders' mortgage business strategies."

Credit standards continue to ease, although modestly. The net share of lenders reporting such easing increased for fourth consecutive quarter, setting new survey highs for the last two. Even if at record levels, the net positive responses remain low, ranging from 18 percent for government loans to 25 percent for GSE-eligible ones. Expectations of credit easing over the next three months declined on net for GSE Eligible loans and did not exceed 10 percent for any loan type.

On net, lenders continue reporting expectations to grow GSE and Ginnie Mae shares over the next 12 months. They also plan to reduce portfolio retention and whole loan sales shares.

Slightly more lenders reported expectations to decrease rather than increase the share of MSR sold and the share of MSR retained and serviced in-house than in recent quarters. The majority also continued to report expectations to maintain their MSR execution strategy.

Fannie Mae's fourth quarter 2017 Mortgage Lender Sentiment Survey was conducted among senior executives of its lending institution customers between November 1, 2017 and November 14, 2017.