Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

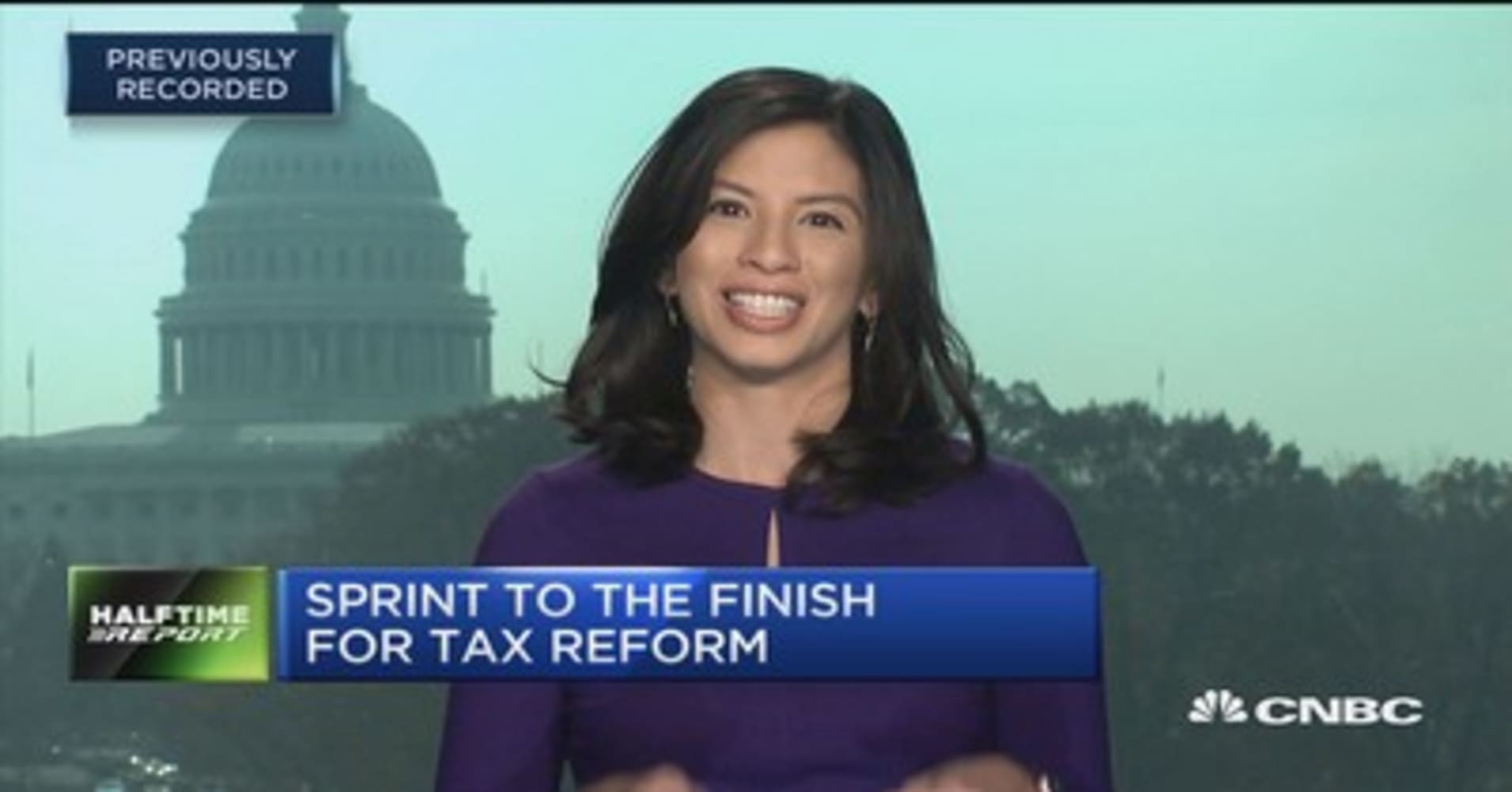

Mortgage rates were distinctly mixed today, with some lenders clearly moving higher while others were effectively unchanged. The deciding factor is both simple and obvious. It has to do with Friday's wild action in the bond market (following the Flynn/Russia news in the morning). That market movement resulted in a handful of lenders reissuing lower rates on Friday afternoon. Those lenders had to move rates back up today because underlying bond markets weren't able to maintain the improvements that resulted in the better rate sheets. Lenders who didn't adjust rates on Friday ended up being in fairly ideal territory for today's bond trading range and thus didn't need to make noticeable adjustments. As for the forces underlying the pull-back in bonds, the Senate's passage of its tax bill likely

|

|