Daily Newsletter - FREE

Delivered to over 70,000+ industry professionals

each day, the Daily Newsletter is the definitive recap of the day's most

relevant mortgage and real estate news and data. View the latest Newsletter below.

Most Recent VIEW ALL »

Newsletter Preview

View our most recent newsletter below, or use the date selector to view past newsletters.

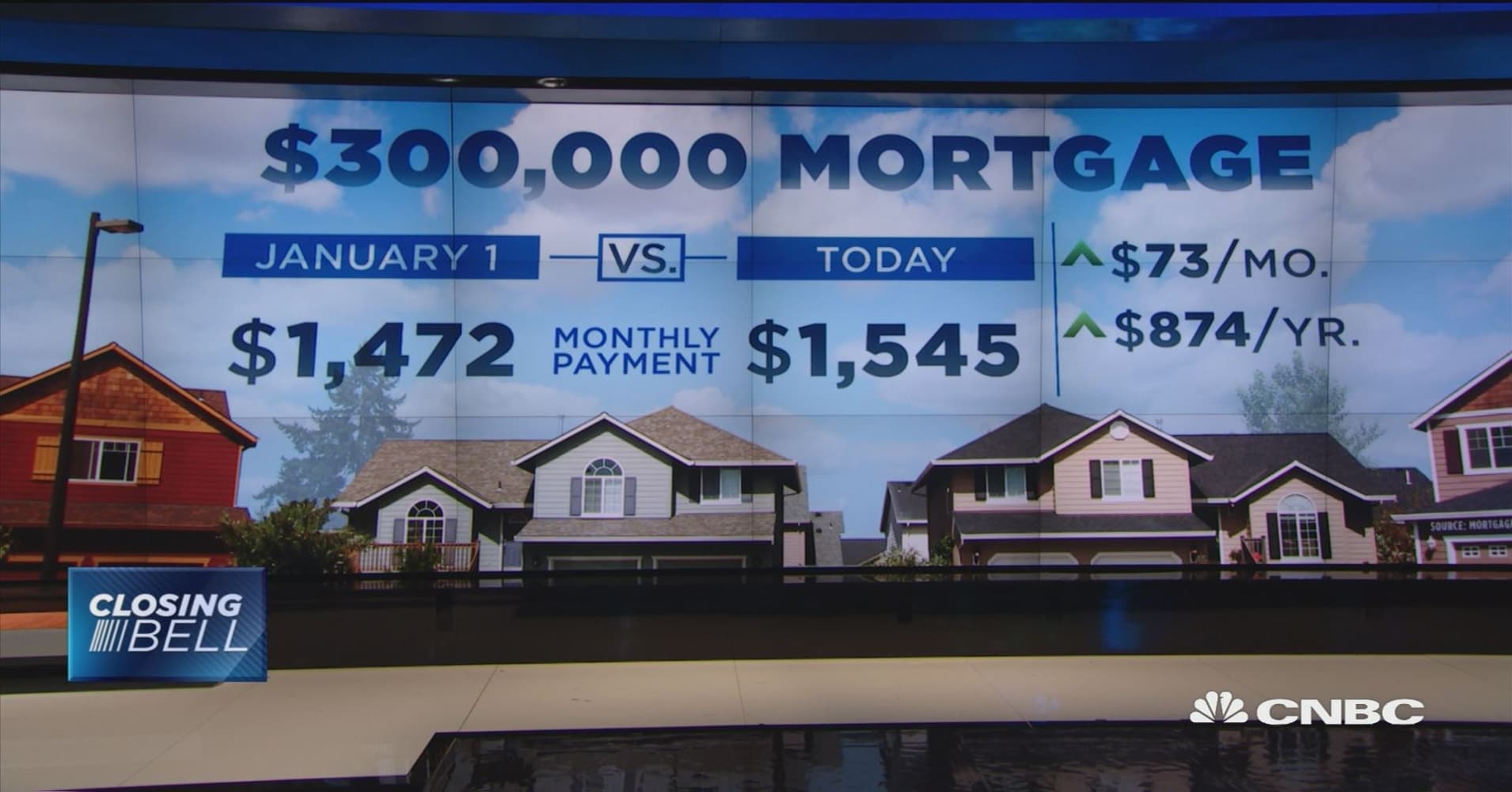

Although the company said it was regular January phenomenon, last month's surge in refinancing also feels a little like borrowers "headed for the last roundup." Ellie Mae's Origination Insight Report noted that the share of refinancing originations shot up by 5 percentage points in January, accounting for 45 percent of all closed loans. The surge coincided with a jump in the average interest rate of closed loans, from 4.28 percent in December to 4.33 percent, making for a 13-basis point increase since October. It was the highest share for refinancing, which dipped to less than a third of closed loans in early summer, since January. The December 2016 to January 2017 increase was 1 point. "As we ring in 2018, we see refinances rise as a percent of overall loan volume, something that we have seen

|

|