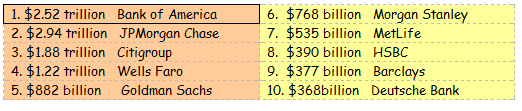

With all the moving and shifting, here are the most recent numbers on

the largest banks ranked by assets:

A few others you know are: #12 U.S. Bancorp ($265 billion), #17 BB&T ($165 billion), #23 Fifth Third ($110 billion), #33 Comerica ($59 billion), #82 Sterling Financial, Spokane ($11.9 billion).

Top bank research firm Keefe, Bruyette has identified 21 distinct periods of bank performance starting in the early 1960s. Outperformance periods averaged 34 months in length, during which bank stocks outperformed the market by an average of 20.8% annualized. The under-performance cycles averaged 23 months, during which bank stocks lagged the market by 20% per year, on average. Our view is that an outperformance for small cps banks is just around the corner.

A good example of how much access banks have to non-deposit funding sources is Bank of America. Although they have $2.52 trillion in assets, they have only $976 billion in deposits.From 1961 through 2010 year-to-date, bank stocks rose slightly less than the S&P 500, 5.6% versus 6.2% per year based purely on stock price appreciation. Once we consider dividends, on a total return basis, large-cap bank stocks have returned 9.9% annually versus 9.6% for the S&P since 1961.

In the last six months we helped nine different banks start up Warehouse Lending operations. All are extremely small banks lending only in their own back yard, but what’s really pleased us is that five of them are already funding loans and a sixth will start next week. Two are still a month or two away from going live, and one has it hold due to regulatory issues. We can’t wait to get to see their six month numbers. The two who’ve been doing it the longest have shown us their metrics, and they’re generating an ROA in excess of 2% so far

Let’s pretend you’re a bank and you’re funding mortgages today with

Fed Funds. Fed Funds will cost you 16 bps, and let’s say you’re closing

5% loans. Your spread while you hold them in warehouse is 4.84%, and

let’s assume you’ll hold these loans for 15 days before they’re

purchased. On a $250,000 loan, that comes to $33.15 per day, which

comes to $497 in net interest income for the 15 days. That’s an extra 20

bps, just from the cheaper funds. If you do $50 million a month in

volume, you’ll make an extra $100,000 that month. Realistically, you’re

not going to fund all your loans with Fed Funds, but you get the point.

Let’s

instead look at the same numbers above and assume you fund your

mortgages with deposits costing 1.25%. You’re picking up 15 bps during

those 15 days, and on the $50 million that funds that month, you’d make

an extra $77,000 by holding them 15 days. Want to make an extra $5,000

to put to the Christmas Party? Just ship your loans on the 16th day

instead of the 15th day.

The Mandatory/Best Efforts Spread in February averaged 38 bps with a peak of 48 bps and a low of 33 bps. We also tracked it the last 11 days, and it was 41 bps. There are many, many companies that should stick to best efforts delivery, maybe most companies, but for those capable of hedging, tracking and of being disciplined, this pick-up can be a big contributor to earnings.

We know we sound like a broken record, but don’t be fooled by how many dollars your company made last year. Look at your pre-tax earnings and divide that by your total volume. If you made less than 65 bps, you were below average. If you’re okay with being average, God bless you. If you want to do better, we can probably help.

Last Wednesday Wall Street Journal was chockfull of items meant to assist those involved in business and finance. On page D-3 we learned that *** augmentation beat out liposuction, 311,957 to 283,735 as the most popular surgical procedure for the second year in row. Interestingly, buttock augmentations beat out buttocks lifts, 4,996 to 3,024. And no, we don’t have any idea what a buttock augmentation is or why someone would want one.

Have you noticed that the music on TV ads isn’t what it used to be? We can remember the 1812 Overture for Quaker Oats Puffed Rice (the part where the cannons explode). The Loan Ranger had The William Tell Overture, and Malto Meal had that classical piece, maybe Berlioz, with the words added about how “Winners……. wake up with Malto-Meal.” Can anyone remember any others?

Here are some selected prices, today and a year ago. We don’t know if there is any deep meaning in these numbers, but it sure looks like there may be some inflation heating up. By the way, we don’t bother to describe all the details of the type or unit of measurement. For instance, there’s Wheat, hard, Kansas City and there’s Wheat, No. 1 soft white, Portland, Oregon. We have no idea what this means so we just chose whatever seemed logical. Notice how, except for wheat, everything’s really gotten more expensive.

How about all those new licensing regs? Probably a good thing to get the sleaze balls out of the industry, but it sure is bitter medicine, isn’t it?