Key Events in the Week Ahead:

Monday:

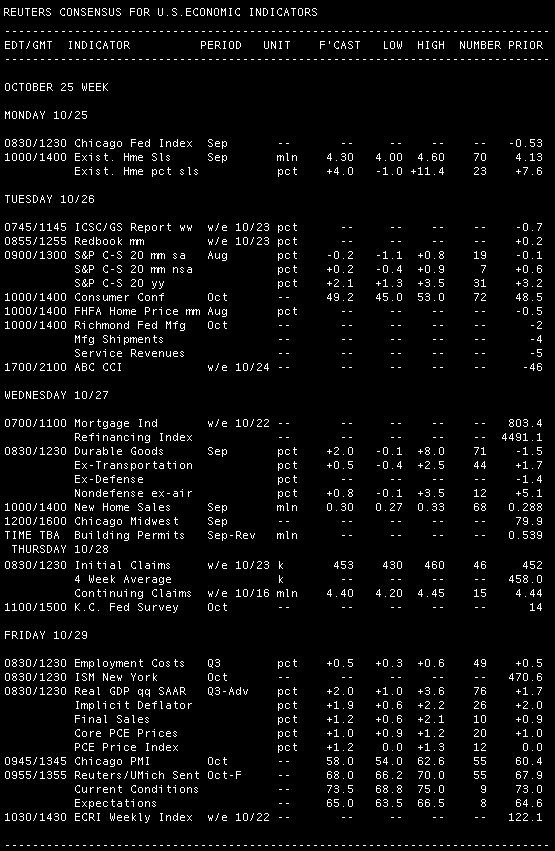

Just before markets open, Federal Reserve Chairman Ben Bernanke delivers opening remarks at the “Mortgages and the Future of Housing Finance” conference co-sponsored by the Fed and the Federal Deposit Insurance Corp.

Besides the Fed/FDIC sponsored mortgage symposium, the MBA will host the 97th Annual Mortgage Bankers Convention in Atlanta Georgia. HERE is the program of events

10:00 ― Existing Home Sales are expected to rise to an annualized pace of 4.30 million in September after the index rose 7.6% to 4.13 million a month before. The anticipated rise indicates that sales hit a bottom in the summer ― sales of single-family homes in July were at their lowest level in 15 years. Exceptionally low mortgage rates could help sales continue to rise, but at the current sales pace it would take 12.5 months just to sell the existing inventory on the market.

“Existing home sales should continue to recover after a severe post-tax credit bust,” said economists at Nomura. “We forecast an increase of about 5% m-o-m to an annualized rate of 4.35 million units. This is broadly in line with recent pending home sales reports, which tend to lead existing home sales by one to two months. While our forecast would put sales up 13% from their recent lows, they would still be down 4% from their low in early 2009.”

4:30 ― William Dudley, president of the New York Fed, speaks on the state of the regional economy at Cornell University in Ithaca. Also, James Bullard, president of the St. Louis Fed, gives the welcome remarks before “The Financial Stability Oversight Council: Can Systemic Risk Be Contained?” conference hosted by the St. Louis Fed.

5:00 ―FDIC Chairwoman Sheila Bair, Rep. Barney Frank and White House economic adviser Paul Volcker assess the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act in Boston.

Treasury Auctions:

- 11:30 ― 3-Month Bills

- 11:30 ― 6-Month Bills

- 11:30 ― 5-Year TIPS

Tuesday:

9:00 ― The S&P Case-Shiller Home Price Index is expected show home prices in the 20 metropolitan areas it covers fell for the third consecutive month in August. In July, monthly prices fell 0.1%, indicating that prices were 3.2% higher than one year ago.

“Looking forward, demand for housing is expected to increase throughout 2011, but at a tepid pace,” said economists at BBVA. “As a result, home prices will appreciate from current levels, but will remain low.”

Economists at Nomura suggest the index has held up well in recent months despite weak sales. “We therefore expect growth in this measure to start to cool. We forecast that Case-Shiller prices rose by 2.1% y-o-y in August, down from 3.2% in July and a peak of 4.6% in May.”

10:00 ― Consumer Confidence is expected to recover to 50.0 in October after shedding almost 5 points to 48.5 a month before ― the lowest score of the calendar year. The best September stock performance in decades should provide a boost, but with unemployment numbers remaining at 9.6%, it’s unlikely consumer expectations will rise much.

“Confidence remains fragile, and is being hurt by a weak labor market and by uncertainty over what will be happening to taxes next year,” said economists at IHS Global Insight, who predict a decline.

Treasury Auctions:

- 11:30 ― 4-Week Bills

- 1:00 ― 2-Year Notes

Wednesday:

7:00 ― MBA Mortgage Applications fell 10.5% in the week ending Oct. 15, erasing most of the 14.6% climb in the week before. Refinancings fell but generally remain high, while purchase applications fell for a second week.

“Mortgage purchase applications started to pick up in late September and early October but have retreated disappointingly over the past two weeks,” said economists at Nomura. “If sustained, the recent reversal would suggest that home sales are likely to remain at today's extremely low levels, at least for the near term.”

8:30 ― New orders for Durable Goods are anticipated to rise 1.6% in September, reversing the 1.5% decline seen in August. A major gain in Aircraft orders should deliver a boost to the index as Boeing took in 257 new orders in the past three months, which economists at Nomura note is the most since April 2008. When transportation is excluded, orders are expected to advance just 0.4%.

Analysts at BBVA remind us that durable goods fell a month previous because transportation equipment dropped 10.2%, equivalent to $5.3 billion.

Economists at IHS Global Insight say the index in unpredictable because of this aircraft volatility. They note that Boeing garnered more than $12 billion of orders in September with 117 orders for planes, including 84 on the last day of the month.

“The main downside risk to the anticipated surge would come if the late-month orders don’t show up in the official statistics until October,” they said. “Outside of aircraft, it should be another lackluster month, with the reversal of some of the positives that blew core capital goods orders up by 5.2% in August.”

10:00 ― New Home Sales are expected to increase 4% to an annualized pace of 300k in September, up from 288k in August. As the effect of the first time homebuyers tax credit expiring wanes, sales are anticipated to inch forward. The NAHB index of homebuilder sentiment also rose 3 points in October, though the overall level was still still dozens of points away from indicating optimism.

Economists at IHS Global Insight note that single-family housing permits, which predict new homes sales, “inched up 0.3% in September after declining for five straight months.”

Treasury Auctions:

- 1:00 ― 5-Year Notes

Thursday:

8:30 ― Initial Jobless Claims have so far averaged 459k each week in October, higher than the 458k average in September or the 487k in August. Economists generally believe weekly claims must come in below 450k consistently to indicate national job growth, so these numbers aren’t quite inspiring.

“Initial jobless claims have been stuck in a tight range of 445-475,000 almost all year,” commented economists at Nomura. “Claims need to break out of these levels to signal any change in labor market conditions. In our view, further declines are more likely than increases.”

Treasury Auctions:

- 1:00 ― 7-Year Notes

Friday:

8:30 ― The first round of GDP results for the third quarter is expected to show the economy grew at a 2% annualized rate the past three months, a bump up from the 1.7% reported in the final reading for Q2, but far below the 3.7% rate from Q1. Housing is a major reason why growth is anemic ― investment in the residential sector could drop 25% in Q3 following a stimulus-backed+25.6% climb in Q2.

“The single largest contributor to growth in Q3 will be consumer spending,” said economists at the Bank of Tokyo Mitsubishi, expecting to see spending rise 2.3% compared with 2.2% in Q2. They said the low growth “reflects continued household restraint in spending as overall jobs were shed over the quarter and households continue to pay down debt, which has held the personal savings rate high.”

Economists at IHS Global Insight predict that foreign trade will once again drag down growth as imports outpace exports.

“The trade drag should be roughly offset by another surge in inventory accumulation, partly reflecting rising imports,” they added. “Overall, the report should show the economy remaining on a sluggish growth path, giving the Fed no reason to change its mind about the quantitative easing that seems on the way on November 3.”

9:45 ― The Chicago Business Barometer, a regional index of manufacturing and services, is expected to continue growing at a fast clip in October, but at levels slower than the prior month. The consensus of economist expectations looks for a 57.6 score, down from 60.0 a month before. Any score above 50 indicates growth.

In contrast to the expected slowdown, the Empire State and Philadelphia Fed indexes improved in October.

“Watch for another increase in the report's prices paid component,” said economists at Nomura. “Higher commodity prices have been lifting these measures, as well as the crude and intermediate PPI indexes.”

10:00 ― The revised reading for the Reuters / U of Michigan’s Consumer Sentiment is expected to be little changed from earlier in the month. The index fell to 67.9 two weeks ago from 68.2 in September, and is now expected at 68.

“We think higher stock prices and reduced downside risks to growth should lead to a moderate boost to the index,” said economists at Nomura. “The Michigan report's measure of inflation expectations remain a key focus. The 5-10 year expectations have been roughly stable.”

Economists at IHS Global Insight say the expected increase is a result of the stock market. They predict current economic conditions will improve slightly while expectations will hold steady.