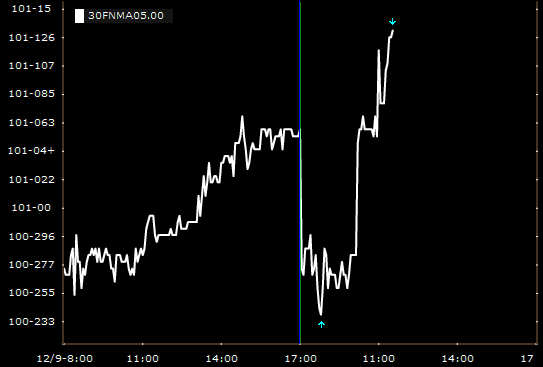

Here is the FN 5.0 Chart from December 1 and December 3...on 12/3 we advised that the intraday high of 101-16 would serve as a strong resistance level going forward

Well here is where we stand currently on the FN 5.0...+12/32 at 101-12. The 5.0 is nearing a cross roads...if we cannot sustain this rally, going sideways is next best thing, but a retracement is due (sell off to test convictions).

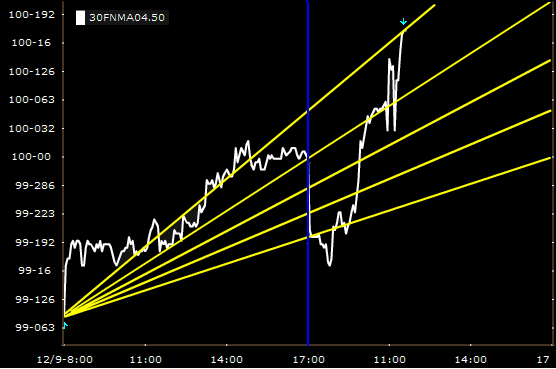

Here are some key retrace levels for the 4.5...these are the price levels which will determine the mood for the rest of the day...if indeed we see selling we need selling not to break through each of these support lines. Each line that is broken signals more bias towards selling and hence reprices for the worse.

If your rate sheets are better than yesterdays late afternoon prices...it is safe to say we are nearing some hard to break price ceilings. Some lenders havent repriced for the better and are due to do so soon but may wait to see if selling continues. If you have a lender who has passed through some gains we advise keeping your finger on the lock trigger in this environment....selling could occur at any time now.