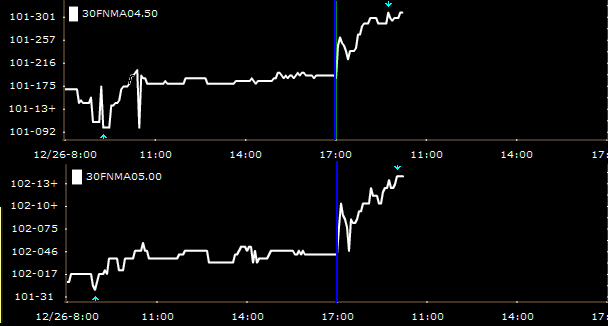

Variable trading conditions continue...to our benefit for now. Here is a snap shot of the stack:

FN 4.5: +0-12+ at 102-00 GN 4.5: +0-10+ at 102-12

FN 5.0: +0-10+ at 102-15 GN 5.0: +0-11 at 102-30

FN 5.5: +0-08 at 102-20 GN 5.5: +0-08+ at 103-03

FN 6.0: +0-07 at 102-28 GN 6.0: +0-08 at 103-03

Since the onslaught of supply was gifted upon mortgage markets last Monday, MBS spreads have looked attractive which has drawn a few short term bargain buyers. Light supply combined with just enough relative value bids has helped to narrow the MBS spread over the yield curve and swaps. As Matt described this morning this illiquid backdrop increases the probability of larger than usual intraday bid ranges. Although we have seen consecutive down in coupon rallies we need to remind all that trading will continue to be governed by these illiquid conditions.....

Rate sheets are slowly filtering in now, pricing looks to be 20-30bps stronger at this point. Stay tuned for alerts....