Following a rather boring day on Monday, volatility picked up a little yesterday as the second quarter officially ended. Mortgage backed securities followed treasuries to higher yields. Most lenders did reprice for the worse increasing consumer borrowing costs by .25 in discount. So far this morning, the downward pressure on MBS and treasuries continues as the benchmark 10 year note has moved to a yield of 3.59 after closing at 3.47 on Monday. Though not always in direct relationship, this upward move in treasury yields is leading MBS in the same direction. We're down .25 in discount so far this AM. Remember, as PRICE falls, YIELD rises. The "price" falling means that investors are requiring higher yields (interest rates). This comparative increase in yield is passed on to you the consumer either in higher rates or higher discount points.

We do have a busy day of economic reports which will set the stage for the most important monthly report, the Employment Situation, which we get tomorrow ( a day early as markets are closed Friday). The first report to hit the wires is the weekly Mortgage Bankers' Association Applications index which tracks the weekly change in mortgage applications at banks. The report has indicated a steep decline in mortgage activity. First, the purchases index registered a 4.5% decline signaling no improvement in purchase activity and the refinance activity dropped a whopping 30%! Many think lower mortgage rates are vital to our economic recovery in order to spur home purchases and increase consumer spending capacity through refinancing. So this report is not the best news for the economy but it isn't a major market mover.

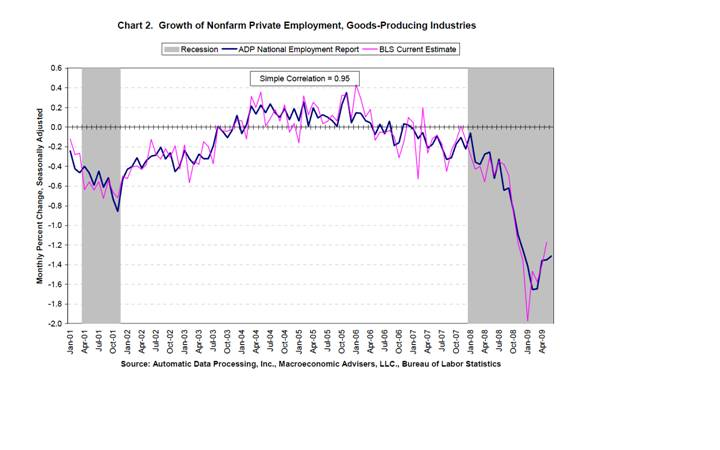

We received a couple reports this morning regarding jobs, but these reports take a back seat to tomorrow's Employment Situation. First out is the Challenger Job-Cut Report which indicated that layoffs at corporations decreased from 111,182 to 74,393, the lowest level since the start of the recession. The second report on jobs is the ADP Employment report which is similar to the official Employment Situation report we get tomorrow but consists of private payrolls (non government, military, etc...). Historically, this report has varied greatly from the official report but it's accuracy is improving and investors are starting to give it a little more attention. Expectations were for ADP to report job losses of 400,000 but the actual report indicated a loss of 473,000 jobs. Here is a graph from Bloomberg that illustrates the difference between the two reports.

Next is the ISM Manufacturing index which gives a measure of the strength of the manufacturing segment of our economy. The Institute of Supply Management surveys more than 300 manufacturers on employment, production, supplier deliveries, and inventories. Readings above 50 indicate that manufacturing is expanding while readings below 50 indicate contraction. The last 3 reports have each come in better than the prior month helping to stoke the fires of the optimist who feels the end of the recession is hear and we are on to economic growth. Last month's report showed an improved reading of 42.8 from April's 40.1 reading. The consensus for June's report is continued improvement with a 45.0 reading, and the actual report has come in basically in line at 44.8.

The U.S Department of Commerce has released their monthly report on construction spending which totals the dollar value of new construction activity. Increasing construction spending would be a positive signal for equities as it would lead to more consumer and business purchases. This report has a 2 month lag, so today's numbers are for the month of May. April's report indicated a much better than expected increase in construction spending, improving by 0.8% following March's 0.4% increase. The release has indicated that construction spending has declined for the month of May by 0.9% which is a larger decline than the expectations of -0.5%.

The last relevant report we get today is the release of Pending Home Sales by the National Association of Realtors(NAR). This report shows whether pending home sales are increasing or decreasing. A pending sale is one in which a contract has been placed on a home but the sale has yet to be completed. Strong demand for housing is a positive signal for our economy, since a consumer has to feel pretty good about their own financial condition and job security to buy a new home. In addition, strong demand for housing will lead to increased purchases of appliances, flooring, furniture, etc.... so the stock market prefers to see a increasing trend. Last month's report indicated a much larger than expected increase of 6.7% leading many to believe that the bottom of housing is near. It will be interesting to see how the recent increase in mortgage rates has affected this report. The NAR just released and pending home sales has posted a small increase of 0.1%.

In what has become a common theme, MBS are continuing to be led by treasuries. Currently the 10 yr note is trading at 3.58 and MBS are down about .125 in discount. For MBS to manage any gains today, they will need treasuries to move lower in yield. If the stock market continues its rally, currently up over 100 points, it will be very difficult for treasuries to gain any momentum.

With the Employment Situation Report due out tomorrow morning, you might want to consider locking your loan today especially if you are closing in the next week or so. A better than expected or a "not as bad as it could be" report will apply a lot of pressure on MBS to move lower. Expectations call for nonfarm payrolls to show a loss of 350,000 and the unemployment rate to hit 9.6%. If you have some inside information, much like Mr. Meeks obtaining a copy of the Orange crop report, and you feel the job losses will be greater, than floating could pay off.

Early reports from fellow mortgage professionals are indicating that the par 30 year fixed rate mortgage has inched higher to a 5.125% to 5.375% range for the best qualified consumers. In order to qualify for a par interest rate you must have a FICO credit score of 740 or higher, a loan to value of 80% or less and pay all closing costs including 1 point loan origination/discount/broker fee.