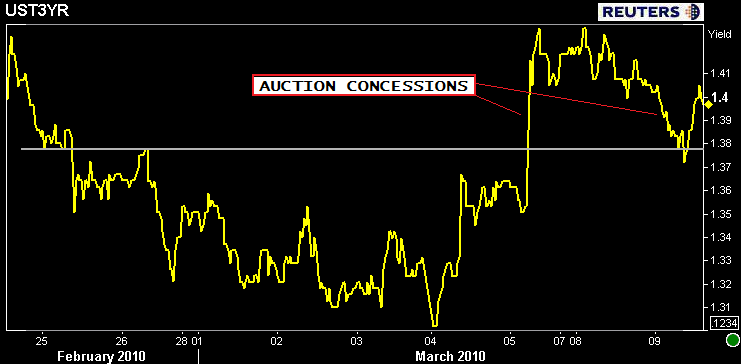

Immediately following the 3yr Treasury Note auction, treasuries weakened while MBS held steady. Since then, MBS have lost a few ticks, but the 4.5 remains positive on the day, up 1 tick at 101-07. The 10yr note is also up a tick leaving the yield just under 3.72. The 10yr's post auction selling turned the corner very much in line with yesterday's high yields suggesting a shift of guidance to tomorrow's auction.

MBS is building a case for support just over 101-06, but as volume remains fairly light, again, the emphasis is even more squarely on tomorrow's auction than it already was. Until/Unless 101-06 breaks down in a significant way, the chances of reprices for the worse remain limited to "knee-jerk only," but we're not seeing justification for that.

In 10yr notes, the bearish preparations for tomorrow's auction are apparent in that yields rose over 3.71 following the auction and have since been unwilling to come back below. In contrast, MBS are right in the same pre-auction range. A break below 3.71 yields in the 10yr would provide further reassurance on the day whereas weakness past 3.72 on the topside would be cause for concern that MBS might be forced to follow.

Here is AQs recap of auction results:

-----------------------------------------------------------------------------------------

The Treasury has successfully auctioned $40 billion 3 year notes. This is the fifth consecutive offering at this size.

The bid to cover ratio, a measure of auction demand, was 3.13 bids submitted for every one accepted by the Treasury. This is above recent averages and the second highest 3yr note subscription in the last fifteen auctions--- only the November 9, 2009 refunding saw greater demand.

Bidding stopped out at a high yield of 1.437%. This is slightly below the 1pm "when issued" bid (that's good!).

Primary Dealers, aka the street, took 37.7% of the issue. This is above the five auction average of 35.5% of the total auction award but below the ten auction average of 39.1%. While dealer participation was higher relative to recent auctions, the need for the dealer backstop bid continues to fall. This is a positive...we do not want the street taking down higher percentages of the auction because they will need to get rid of unexpected supply...and they will not do it at cost.

Direct bidders, aka domestic fund managers like Vanguard and PIMCO, were awarded 10.3% of the issue. This is above the ten auction average of 8.95% but below the five auction average of 10.9% of total auction.

Indirect bidders, aka ferners (foreigners), were awarded 51.6% of the auction. This is below both the five and ten auction averages of 51.9% and 53.5% respectively.

This was an above average auction. Not great. Not bad. The fact that demand was firm and the high yield was lower than the 1pm "when issued" yield implies traders were comfortable with the concession that was priced in prior to the auction.

$40 BILLION 3-YEAR NOTES

YIELDS

High 1.437 pct

Median 1.403 pct

Low 1.340 pct

PRICE/ACCEPTANCES

Price 99.818589

Accepted at high 15.66 pct

Bid-to-cover ratio 3.13

AMOUNTS TENDERED AND ACCEPTED (dollars)

Total accepted 40,000,016,000

Total public bids tendered 125,069,178,000

Competitive bids accepted 39,829,538,000

Noncompetitive bids accepted 70,478,000

Fed add-ons 473,243,300

Primary Dealer Tendered 84,038,000,000

Primary Dealer Accepted 15,060,338,000

Primary Dealer Hit Rate 17.9% of what they bid on

Primary Dealer Total Award 37.7% of total auction

Direct Bidder Tendered 13,571,000,000

Direct Bidder Accepted 4,119,000,000

Direct Bidder Hit Rate 30.4% of what they bid on

Direct Bidder Total Award 10.3% of total auction

Indirect Bidder Tendered 27,289,700,000

Indirect Bidder Accepted 20,650,200,000

Indirect Bidder Hit Rate 75.7% of what they bid on

Indirect Bidder Total Award 51.6% of total auction

I must remind you that this sector of the yield curve has minimal bearing on the "rate sheet influential" side. To that end, we have $21 billion 10s tomorrow and $13 billion 30s on Thursday. The true strength of the 3.57 to 3.71 range in 10s will be put to the test over the next two days.

I am not saying to expect all out armageddon today, more or less I am telling you to be defensive with your floats over the next three days. If you have suitable rebate and need to lock before Friday....it makes sense to do so before traders go to work beating up the long end of the yield curve...the same way they baked in an auction concession to the 3 yr note.