I have good news and bad news.

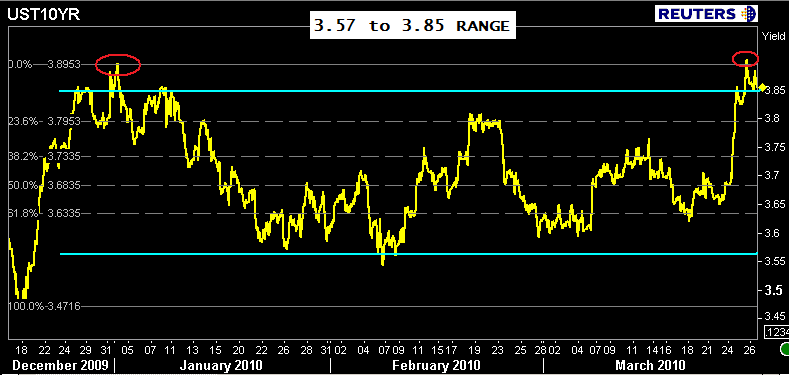

The good news: benchmarks are testing the market's willingness to re-enter the 3.57 to 3.85 range.

The bad news: benchmarks are finding it difficult to re-enter the 3.57 to 3.85 range

The 3.625% coupon bearing 10 year TSY note is +0-06 at 98-03 yielding 3.858%. So close!!!

Here is another look at the 3.57 to 3.85 range. Notice 10s tested the 3.90% level once before....it is encouraging that selling stopped out and real money bargain buying picked up at this same level.

I have nothing but good news for mortgages. "Rate sheet influential" MBS prices are higher, current coupon yield spreads are tighter, and REPRICES FOR THE BETTER ARE ABOUT TO/HAVE HIT YOUR INBOX!!! This should help originators start to refill their empty pipelines (not talking about L.Os, more so big banks). Activity in the TBA MBS market has been slow today.

The FN 4.5 is currently +0-11 at 100-15 yielding 4.451%. The secondary market current coupon is 4.442%. The current coupon yield spread is 58.4 basis points over the 10yr TSY note and 65.4bps over the 10 yr swap.

Stocks are STILL trading higher. The S&P is up 0.13% led by RadioShack, Genworth, and Lennar (homebuilder). The dollar index is weaker...thus oil related stocks are dragging down the overall index.

REPRICES FOR THE BETTER REPORTED