- FN4.5: +0-09 at 102-29. GN4.5: +0-07 at 103-16.

- Secondary Market Current Coupon: --3.2bps to 3.997%

- CC Yield Spreads:+85.1/10yTSY. +74.0/10yIRS. Went Out At Wides. 3m10y Vols: +2 norms

- UST10YR: -6.2bps at 3.146%. +0-17 at 103-00. UST2YR: Least best performer. -1.2bps at 0.718%

- S&P CLOSE: -1.35% at 1050.47. HIGH: 1071.13 LOW: 1050.17

The FN 4.5 MBS coupon closed at a new all-time price high today, breaking the record that was set just last Friday. More importantly the FN 4.0 was bid into the 100 handle, the secondary market current coupon dipped into the 3's for the first time since early December 2009, and lenders were seen offering rebate at 4.375% on C30 loan pricing. Wowwee. Call Guinness!

The FN 4.0 went out +0-09 at 100-05. The FN 4.5 was +0-07 at 102-29. The secondary market current coupon is now 3.997% and we should be seeing more 4.0 MBS supply on screens in the not so distant future. A bit more size was seen in MBS trading flows today. Tradeweb reported electronic trading volume at $282bn today, this is above recent norms but below longer dated averages.

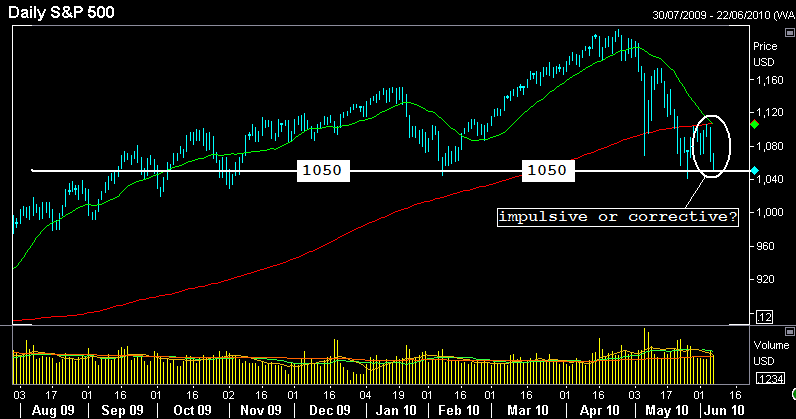

This rally was made possible by a late day stock market sell-off and a flight to safety that sent the UST10YR all the way down to3.146%. This was the first time since May 2009 that 10s closed below 3.18%. Fortunately for equity bulls, selling stopped out before the S&P broke long-standing 1050 support.

Although S&Ps still haven't broken 1050 support, it's hard not to sit back and watch how far this interest rate rally goes. The million dollar MBS question: If the Euro continues its trip toward parity against the US$ and 10yr note yields fall further, will the TBA MBS market be liquid enough to handle a rush of 4.0 MBS supply?

Lest you forget, the 4,0 coupon was primarily supported by Federal Reserve asset purchases when mortgage rates last declined into the 4.50 range. With no Fed funding it will be interesting to see if MBS investors are willing to make a market in this illiquid investment. If there is demand and rates rise, these MBS investors will run like hell to get away from these loans (duration shedding)...too much extension risk embedded! The sad thing is we could probably get a few more refinances done with rates below 4.50%.

Plain and Simple: Only the borrower has the option to pay off their mortgage debt. If a borrower's mortgage rate is below current market, they will be less likely to refinance. If an investor buys a mortgage-backed security with cash flows supported by borrowers who have mortgage rates near current market, and rates unexpectedly rise, that investor will be holding an MBS that is unlikely to prepay because borrowers will have no incentive to refinance (because current market rates are higher). This is called extension risk and the 4.0 coupon has a ton of it!

If stocks and benchmark rates keep falling, the competitive primary mortgage market environment will eventually force most lenders to offer mortgage rates closer to 4.50%. If buyers don't react well to larger amounts of 4.0 loan supply, it would be a sign that mortgage rates are not likely to be offered 4.50% on a widespread basis. Unless stocks rally or loan servicers are cherry picking duration (highly likely!) from the new originations pipeline, this will happen in the days ahead.

Step 1 is having a borrower to lock at these aggressive rates. Do you have a pipeline to lock? Relock? Extend?