Did you notice how aggressively lenders were priced this morning?

A few rate sheets were over 50 bps better on 4.625, 4.50, and 4.375% notes! While more than one of the major secondary marketing desks decided to release a portion of the cushion that was baked into loan pricing last week, others were less willing to spread the love. With that in mind...

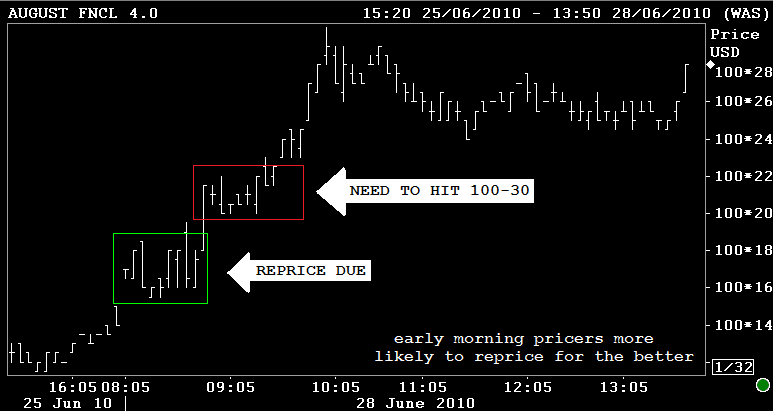

The August FN 4.0 is +0-12 at 100-25 and the August FN 4.5 is +0-08 at 103-07. The secondary market current coupon is 3.3bps lower today and production MBS coupon yields are losing ground against benchmark Treasuries. Here's how I've got 'em marked: the secondary market current coupon is +83bps over the 10yr TSY note yield and +76bps over the 10yr interest rate swap.

If your lender priced early on in the session, you are due a reprice for the better. If your lender took down indications in the mid-morning hours, the August FN 4.0 needs to hit and hold 100-30 before rates are recalled and republished.