What a rough morning!

It appears my hard drive no longer wants to work. I tried to reach out for help, but no one answered. Then my gf called and reminded me that today is 9.02.10. This explains why Glenn is M.I.A, he's curled up on his couch watching re-runs of 90210! I think his favorite character is Dillon. Enjoy your day off Glenn!

Oh well. I'm up and running again......

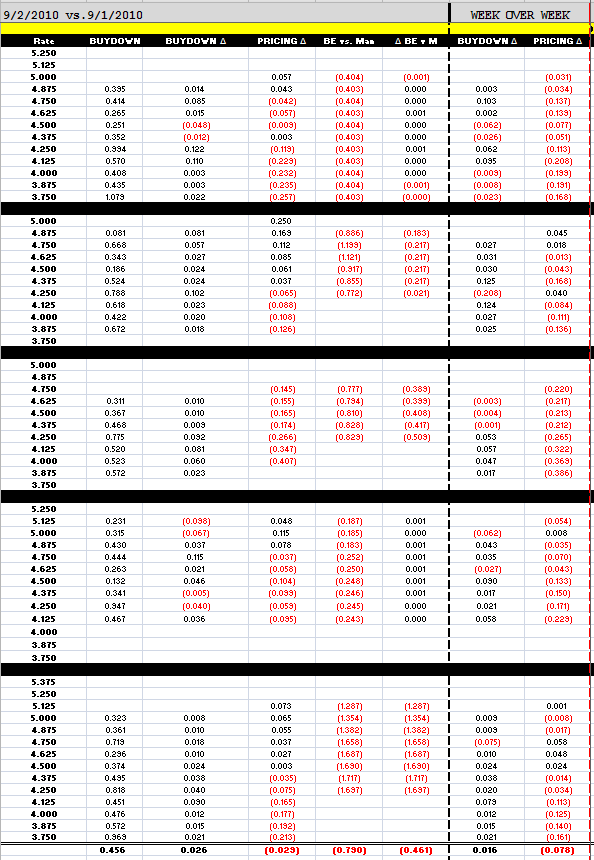

The day has not been so pleasant for originators either. Loan pricing is 2.9bps worse on average today. That doesn't sound too bad, but take a closer look. The largest rebate reductions were applied to the note rates closest to par. These are the rates most borrowers are hoping to be quoted. There is good news though, you can still lock in a rate below 4.25%! It's just gonna cost more at the closing table.

The stock market rally that took place yesterday sure did travel a long distance in a short time frame. That's because there were no sellers to stop stocks from rallying!

This is the explanation I served up yesterday:

While a better than expected read on the manufacturing sector has been cited as the stock market's prime motivation and the bond market's sole source of weakness, we think other factors were at work. Call it exhaustion, blame it on boredom, but it is a new month and market participants took advantage of an opportunity to try something different. The bond market rallied all summer and has been viewed as "overbought" by many investors for the last two weeks. Unfortunately, poor economic data has prevented the bond market from correcting itself. Better than expected manufacturing data, a sector the market views as weak in general, gave investors the chance to let that correction take place today.

Plain and Simple: This was a reallocation trade. Everything seemed to go stagnate in August. When the calendar rolled, money managers made it very clear they were ready to start generating some returns. "Seeking Alpha".

This sets us up for an interesting day tomorrow when the Employment Report prints at 0830. Stocks seem to have already baked in a positive read.

The way I view it, the hoard of $$$ that has gone long Treasuries would just love it if NFP prints worse than expected. Not only could they add to their position at a cheaper price, they could book a profit (reduce losses) when the curve rallies coupon prices higher. On the other hand, if NFP matches expectations or beats, specifically the Private Payrolls portion of the data, we might see the S&P test 1,120 again. An event like that would probably push 10s at least up to 2.75% (potentially 2.85%) and extend duration considerably (the street is hedging FNCL 4.0s against 5yr paper. sounds like a duration shedding event waiting to happen). Although MBS would outperform their benchmark guidance givers into a sell off, rate sheet rebate would still suffer, especially the coupons priced closest to par.

HERE is a more detailed outlook that I feel is especially important to digest.

HERE is a hint of what to expect in the Employment Situation Report. I do not expect this data to be supportive of the stock rally. My two favorite forward looking labor market indicators say the data won't be pretty. I expect more than 100k job losses...

Regardless of how I feel about NFP, if you're floating a loan that needs to be locked in the next 15 days, you're participating in high-stakes gambling.