We'll get the results of the $13 billion long bond auction in about 20 minutes. Ahead of issuance...

Rate sheet influential MBS coupons are just off their session lows. The October FNCL 4.0 is -0-07 at 104-14.

Benchmark Treasury yields are just off their session highs. The 10-year Treasury note is -0-19 at 99-05 yielding 2.721% (+6.7bps). The long bond is -1-04 at 101-17 yielding 3.79% (+6.2bps).

S&P futures are a few handles off their high print (1112), now +6.75 at 1106.

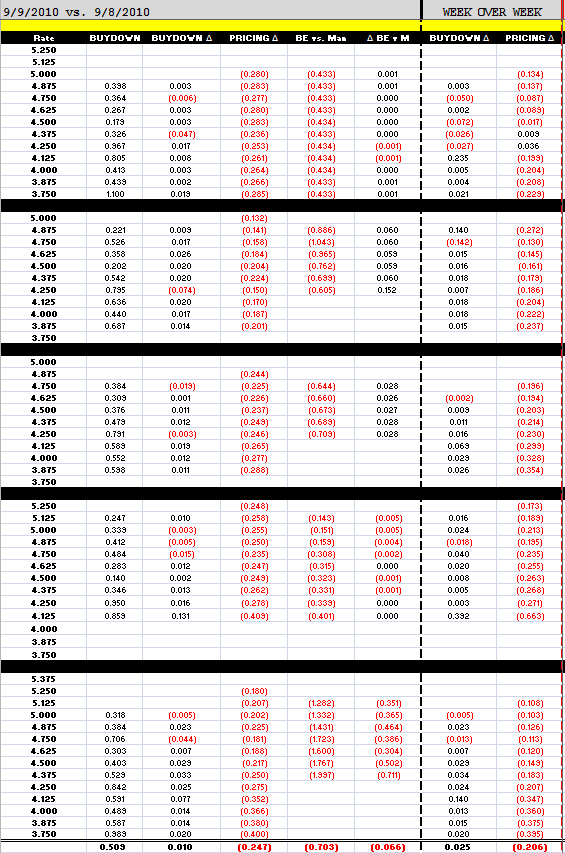

Although production MBS coupon prices are almost 25bps lower, reprices are not an issue at the moment because loan pricing was notably worse on first run releases. On average, rebate was reduced by 24.7bps on the open. Par note rates experienced the largest reductions.

Volume has been light across all markets so far today, we should see some chopatility after the bond auction. Stay tuned....