THE EMPLOYMENT SITUATION – AUGUST 2010 – BETTER THAN EXPECTED

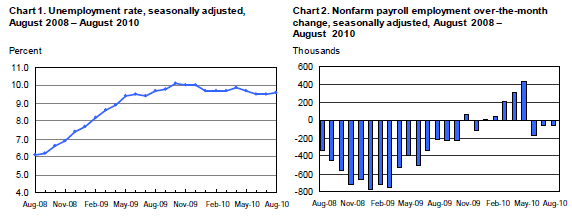

Nonfarm payroll employment changed little (-54,000) in August, and the unemployment rate was about unchanged at 9.6 percent, the U.S. Bureau of Labor Statistics reported today. Government employment fell, as 114,000 temporary workers hired for the decennial census completed their work. Private-sector payroll employment continued to trend up modestly (+67,000).

The number of unemployed persons (14.9 million) and the unemployment rate (9.6 percent) were little changed in August. From May through August, the jobless rate remained in the range of 9.5 to 9.7 percent.

The number of long-term unemployed (those jobless for 27 weeks and over) declined by 323,000 over the month to 6.2 million. In August, 42.0 percent of unemployed persons had been jobless for 27 weeks or more.

In August, the civilian labor force participation rate (64.7 percent) and the employment-population ratio (58.5 percent) were essentially unchanged.

The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) increased by 331,000 over the month to 8.9 million. These individuals were working part time because their hours had been cut back or because they were unable to find a fulltime job.

About 2.4 million persons were marginally attached to the labor force in August, little changed from a year earlier. (The data are not seasonally adjusted.) These individuals were not in the labor force,wanted and were available for work, and had looked for a job sometime in the prior 12 months. They were not counted as unemployed because they had not searched for work in the 4 weeks preceding the survey.

Among the marginally attached, there were 1.1 million discouraged workers in August, an increase of 352,000 from a year earlier. (The data are not seasonally adjusted.) Discouraged workers are persons not currently looking for work because they believe no jobs are available for them. The remaining 1.3 million persons marginally attached to the labor force had not searched for work in the 4 weeks preceding the survey for reasons such as school attendance or family responsibilities.

Over the month, government employment fell by 121,000, largely reflecting the loss of 114,000 temporary workers hired for Census 2010. The number of temporary Census 2010 workers peaked in May at 564,000 but has declined to 82,000 in August.

Construction employment was up (+19,000) in August. This change partially reflected the return to payrolls of 10,000 workers who were on strike in July.

Manufacturing employment declined by 27,000 over the month. A decline in motor vehicles and parts (-22,000) offset a gain of similar magnitude in July as the industry departed somewhat from its usual layoff and recall pattern for annual retooling.

The average workweek for all employees on private nonfarm payrolls was unchanged over the month at 34.2 hours. The manufacturing workweek for all employees increased by 0.1 hour to 40.2 hours, and factory overtime was up by 0.1 hour. The average workweek for production and nonsupervisory employees on private nonfarm payrolls increased by 0.1 hour to 33.5 hours.

Average hourly earnings of all employees on private nonfarm payrolls increased by 6 cents, or 0.3 percent, to $22.66 in August. Over the past 12 months, average hourly earnings have increased by 1.7 percent. In August, average hourly earnings of private-sector production and nonsupervisory employees increased by 3 cents, or 0.2 percent, to $19.08.

The change in total nonfarm payroll employment for June was revised from -221,000 to -175,000, and the change for July was revised from -131,000 to -54,000.

Recap from Reuters....

- RTRS-U.S. AUG NONFARM PAYROLLS -54,000 (CONSENSUS -100,000) VS JULY -54,000 (PREV -131,000), JUNE -175,000 (PREV -221,000)

- RTRS-US AUG PRIVATE SECTOR JOBS +67,000 (CONS +41,000), JULY +107,000 (PREV +71,000); GOVT -121,000, CENSUS JOBS -114,000

- RTRS-U.S. AUG JOBLESS RATE 9.6 PCT (CONS 9.6 PCT) VS JULY 9.5 PCT

- RTRS-U.S. AUG AVERAGE HOURLY EARNINGS ALL PRIVATE WORKERS +0.3 PCT (CONS +0.1 PCT) VS JULY +0.2 PCT, TO $22.66 VS JULY $22.60

- RTRS-U.S. AUG YEAR-ON-YEAR AVERAGE HOURLY EARNINGS ALL PRIVATE WORKERS +1.7 PCT

- RTRS-U.S. AUG AVERAGE WORKWK ALL PRIVATE WORKERS 34.2 HRS (CONS 34.2) VS JULY 34.2 HRS, FACTORY 40.2 VS 40.1, OVERTIME 3.0 VS 2.9

- RTRS-U.S. AUG FACTORY JOBS -27,000 (CONS +10,000) VS JULY +34,000 (PREV +36,000)

- RTRS-U.S. AUG GOODS-PRODUCING JOBS ZERO, CONSTRUCTION +19,000, PRIVATE SERVICE-PROVIDING JOBS +67,000, RETAIL -5,000

- RTRS-U.S. AUG AGGREGATE WEEKLY HOURS INDEX FOR ALL PRIVATE WORKERS UNCH VS JULY +0.4 PCT

Plain and Simple: while 54,000 job losses are no reason to celebrate an economic recovery, there were several upside surprises in this data. Upside surprises include: private industry added 67,000 jobs, Average Hourly Earning rose 0.3%, and significant revisions to June and July numbers which added 123,000 jobs. After an exhausting summer of stagnation and panicky behavior, the market will welcome this better than expected data as a reason to run with a stock market rally and generate returns. This does not change the fact that 42% of the unemployed have been without a job for longer than 27 weeks. This group of workers will continue to drag on the economy for years to come as many of the jobs that were lost in the last two years have likely been lost forever.

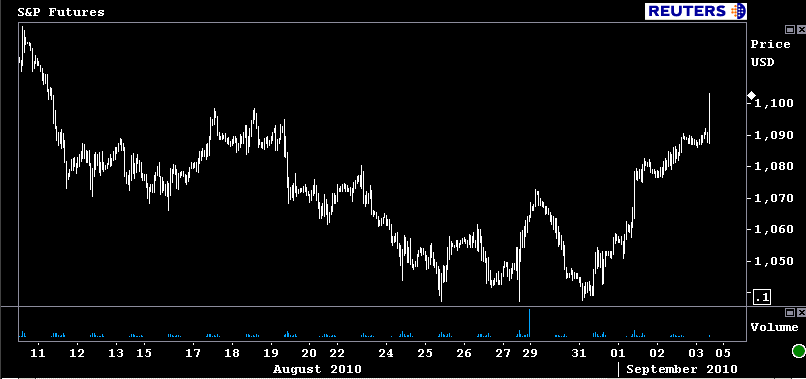

Market Reaction....

Stocks better, bonds worse. Curve bear steepening...

S&P futures are +12.50 at 1102.00

The 10yr note has lost over a full point in price and is 113.2bps higher in yield at 2.757. This move has pushed 10 year yields outside the PANIC ZONE.

The October FNCL 4.0 is -0-13 at 102-12. Yield spreads are tighter. Lock desks were adding pipeline coverage yesterday (selling forward commitments to deliver), but supply wasn't huge so we should see lock desks adding more coverage today (selling forward MBS) as pull-through forecasts just jumped 10-15%.

Rebate will be reduced...

Who wants to catch falling knife heading into a long weekend???