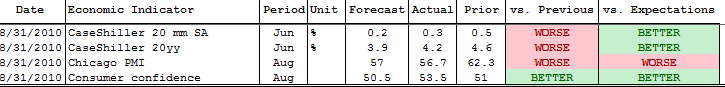

While 2 of the 3 top tier data sets released this morning failed to improve on a month to month basis, 2 of those 3 were better than economists were expecting. Consumer Confidence perked up and beat consensus forecasts while Chicago PMI was a downer all around.

Equity market seem to be focusing on the better than expected headlines vs. the month over month deteriorations, specifically the large uptick in Consumer Confidence. I say that because Consumer Staples and Consumer Discretionaries are leading the broader market higher. I would also point toward technical support at S&P 1040 as a reason to buy. This is where volume accumulated and stocks reversed course after a weak Chicago PMI print at 945am.

S&Ps are currently +6.00 at 1051. Trading volume has already surpassed yesterday's extremely low total, but flows have been thin since 10am data...

The modest rally in stocks has done little to ward off price appreciations in TSYs. The long end of the curve has fully recovered from the Friday sell off. In the chart below I called attention to a 4bp range between 2.47% and 2.51%. This tight range seems to be the base for all directional moves. Break downs of 2.51% support have led to tests of 2.55% (top-side of the PANIC ZONE) and we all know what happened after 2.55% support failed...the knife started falling at a faster pace.

The 2.625% coupon bearing 10 year Treasury note is +0-11 at 101-06 yielding 2.491% (-3.9bps). The 2s/10s curve is 3bps flatter at 200bps where bull flattening has simply ceased. Trading volume is below average and flows have thinned out since 10s found their way back into their comfort zone (TY rejected higher prices). Month-end buying is still ahead so yields may move lower in after hours trading.

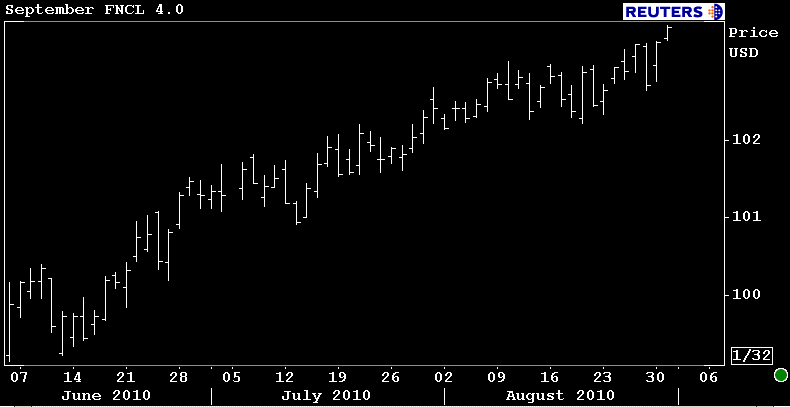

Rate sheet influential MBS coupon prices are being pulled higher by duration adjusted benchmarks. The September delivery FNCL 4.0 hit a new record price high of 103-15 this morning....

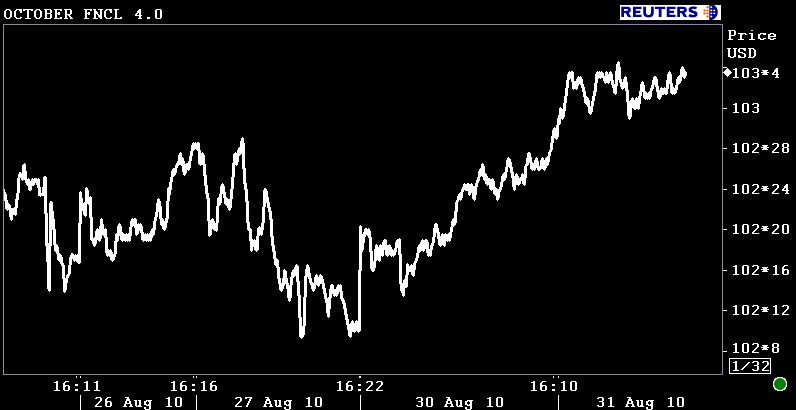

In terms of the coupons that are used to build loan pricing, the October FNCL 4.0 is +0-04 at 103-02. The TBA market did not offer much action in the first half of the session. Yield spreads are generally unchanged vs. TSYs and swaps. Loan supply has been slow but there have been reports of a little more activity in 3.5s. This aligns with reports from lock desks who are cautiously meddling in 3.5s and would explain why rebate is so much better today in the lowest note rates.

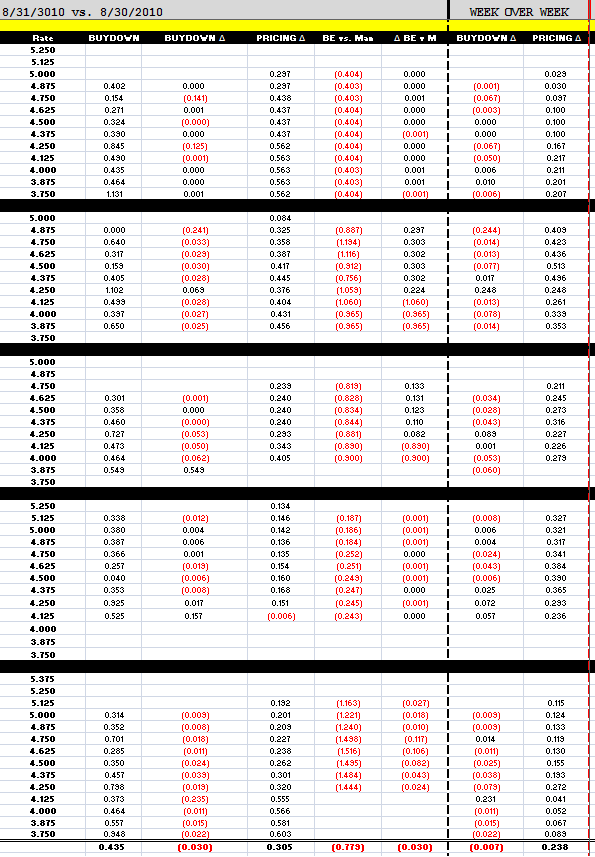

Have you seen loan pricing today?

When we took down indications and updated our model with offers from the majors, our first reaction was: THERE IS AN ERROR SOMEWHERE!

On average, loan pricing is 30.2 basis points better vs. yesterday. Just to confirm these rebate improvements I called around to a few desks and double checked our model for errors. Nope. Loan pricing is really that much better today. The bulk of bps boosts have been awarded in note rates that would be sold forward into 3.5 MBS.

Don't get overly excited yet...we've seen days in the past where lenders got uber aggressive and it never lasted. I'm not saying it won't last this time because it actually could! Especially with 4.0s trading in the 103 handle and negative convexity becoming a legitimate concern as 90 day refi's reapply for another refi....duration needs are high.

FOMC Minutes at 2pm...